Balanced Scorecard: an assessment tool or a way to implement a strategy? BSC (Balanced Scorecard) and Business Studio Use holistically defining scorecards.

This method is especially significant in the analysis of financial economic activity enterprises. The fact is that a more or less objective judgment about an enterprise can only be made on the basis of certain indicators. It is no coincidence that any annual report big company begins with the section "Main indicators" (in the English literature for the name of this section the term "highlights" is used, which can be translated as "brightly lit, protruding spot"), which provides key financial indicators that comprehensively characterize financial position and performance of the company.

Of course, the selection of indicators is usually carried out purposefully (in other words, biased), although some of them may be universal. So, one of the main characteristics of the company's success is the indicator "revenue (profit) per share", therefore, in the annual report of any large company, this indicator is given in dynamics. On the contrary, due to the ambiguous interpretation of the concept of "efficiency", one can choose those performance indicators that most favorably characterize the activities of a given enterprise.

Since it is usually impossible to get a complete picture of the enterprise from one indicator, no matter how good it is, it is recommended to work with a scorecard. Imagine a situation where an analyst is tasked with giving comprehensive assessment activities of an economic entity. Since this activity is multifaceted, the problem of selecting indicators inevitably arises. This problem becomes more complicated when other factors are taken into account: the purpose of the analysis, the available Information Support, time limit, the presence or absence of relevant technical means etc. However, even if the target setting is of a general nature, the complexity of the assessment can be achieved only when it is possible to form a system of indicators.

The term "scorecard" is widely used in economic research. It is the complexity of the analysis that involves the use of certain sets, sets of indicators in the work. The analyst, in accordance with the criteria defined by him, tries to select indicators, forms a system from them, and analyzes it. Can any set of indicators be considered a system? Of course no. Compared with individual indicators or some set of them, the system is a qualitatively new formation and is always more significant than the sum of its individual parts, since in addition to information about individual aspects of the described phenomenon (process, object), it carries certain information about the new that appears in the result of the interaction of these individual parties, ie, information about the development of the phenomenon as a whole.

The construction of a detailed system of indicators is based on a clear understanding of two points: what is the system and what basic requirements it must meet. The definition of the concept of "system of indicators" is given in the scientific and educational literature - under the system of indicators that characterizes a certain economic entity or a phenomenon, is understood as a set of interrelated quantities that comprehensively reflect the state and development of a given subject or phenomenon. Such a definition is very general. Therefore, for practical use in the scientific literature, a number of requirements have been developed that a system of indicators must satisfy. The most important of them, which have methodological significance, are: a) the necessary breadth of coverage by the indicators of the system of all aspects of the subject or phenomenon under study; b) the relationship of these indicators; c) verifiability.

Note that the second requirement provides for the presence, first of all, of content, i.e. internal, interconnection of the components of the system. This can be understood as follows: in order to recognize a set of indicators as a system, it must have some kind of “organizing principle”, i.e. something in common that unites indicators. The establishment of this "organizing beginning" is a fundamental step in the process of building a system of indicators. An important place should also be given to the establishment of formal relationships. Professor V. E. Adamov noted: “no matter how many particular indicators ... of any economic phenomenon or process we define, they will remain a set, and not a system of indicators until meaningful and formal relationships between them are established” [Statistical study..., p. 124].

The importance of the verifiability requirement, i.e. verifiability. In theoretical manuals on analysis, one can often find indicators for which both the calculation algorithm and information support are unclear. The cognitive value of such indicators is highly questionable. It is no coincidence that in annual reports Western companies often separate a section describing the algorithms for calculating key indicators.

In addition to the three requirements noted, when building indicator systems, it is necessary to be guided by a number of principles. It cannot be said that they are of secondary importance, but in practice their implementation is hindered by a number of circumstances.

We list the most important of these principles.

The principle of the tree structure of the system of indicators.

It assumes that most often in the system there should be private and generalizing indicators, and the most optimal is to ensure the logical deployment of private indicators into generalizing ones. Such logic is not something fundamentally new. In particular, the resources of the enterprise can be summarized in three groups - material, labor and financial; moreover, the ratio between these types of resources, firstly, may depend on the type of activity (for example, in companies operating in the field of high technology, the significance of the costs associated with labor resources, may be relatively smaller; V financial companies high importance financial resources etc.) and, secondly, unconditionally controllable. The effectiveness of each type of resource is evaluated by its own indicators (capital productivity, labor productivity, turnover), which play the role of private indicators of the system; at the same time, these indicators can quite logically be supplemented by a small number of generalizing indicators, for example, resource productivity. This approach is widely used in financial analysis.

Visibility principle

Assumes the presence of a certain set of indicators that is optimal for a given enterprise. As a result of a qualitative analysis, it is necessary to build a system that would cover all the essential aspects of the phenomenon under study. At the same time, the indicators of the system should complement each other, and not duplicate each other, be significant and, if possible, slightly correlated with each other. The latter, in addition, means that the system of indicators must also comply with the principle of acceptable multicollinearity. Failure to comply with this principle leads to information overload of the selected set of indicators, since correlating indicators behave in the same way in dynamics, and therefore the usefulness of their simultaneous inclusion in the system may be doubtful. Of course, we are not talking about the fact that, when forming a set of indicators, it is always necessary to calculate the correlation coefficients; this circumstance should simply be kept in mind and, if possible, taken into account.

The principle of a reasonable combination of absolute and relative indicators

It is that the main purpose of any system

indicators consists in comparing and analyzing some characteristics in the spatio-temporal context. Relative values are most suitable for this purpose; with their help, it is possible to identify and evaluate the influence of extensive and intensive factors in the development of a phenomenon, to eliminate the spatio-temporal incompatibility of indicators due to such reasons as inflation, economies of scale, organizational changes, etc. For example, profit, being an absolute indicator, cannot always serve a criterion for comparative evaluation of the efficiency of enterprises; Another thing is profitability indicators. Thus, the prevalence of relative and specific indicators is due to the fact that they have certain advantages over absolute ones - they allow comparing objects that are not comparable in absolute values, make it possible to eliminate the influence of certain general economic factors (for example, inflation), are more stable in space and time, t .e. characterize more homogeneous variational series, allow “improving” the statistical properties of indicators (in the sense that they belong to a distribution law close to normal), which is an important factor for correct data processing using statistical methods, etc.

Without dwelling in detail on the principles of construction and types relative indicators, we only note that the relative indicator is most often calculated by comparing two absolute indicators; it is recommended to control their logical comparability. In particular, if one of the compared indicators is a momentary (interval) value, then the other should be the same. Thus, the return on assets is the ratio of turnover (volume of sales) to the value of fixed assets; since turnover is, by definition, an interval indicator, and fixed assets can be characterized by both interval and moment indicators, it is more reasonable to use the average (for the corresponding period) cost of fixed assets when calculating the return on assets.

The principle of informality.

This means that the system should have the maximum degree of analyticity, provide the ability to evaluate current state enterprise and the prospects for its development, as well as be suitable for making managerial decisions. Compliance with this principle is achieved by: a) the predominant inclusion in the system of indicators used in traditional analysis; b) providing uniquely interpreted algorithms for their calculation; c) predominant use as information base accounting and reporting data.

In conclusion, we note that the development of a system of indicators for the purposes of a specific analysis is always creative.

All objects of analysis of economic activity are reflected in the system of indicators of the plan, accounting, reporting and other sources of information.

Indicators are elementary models that describe the quantitative and qualitative characteristics of certain processes in the economic activity of an enterprise. At the same time, each indicator reveals only a part of the real activity, and a significant number of indicators are needed to characterize the activity of the enterprise as a whole.

A system of indicators characterizing a certain economic object or phenomenon is understood as a set of interrelated values that comprehensively reflect the state and development of this object or phenomenon.

The most important requirements that the system of indicators must satisfy are: the necessary breadth of coverage by the indicators of the system of all aspects of the object or phenomenon under study, the relationship of these indicators, the logical deployment of some indicators from others.

Any system of indicators consists of two types of values: economic indicators (volume of production and sales, financial results etc.) and statistical indicators (growth rates, coefficients, etc.).

The system of indicators characterizing the performance of the enterprise should perform the following main functions:

1) accurately reflect the objective economic essence of the phenomena and processes under study;

2) take into account the organizational and specific features of the industry in which the enterprise operates;

3) fully reflect the activities of the enterprise as a whole and take into account the characteristics of each structural unit;

4) be a reliable tool complex analysis economic activity of the enterprise and its management;

5) be comparable in dynamics and commensurate with accounting data, ensure in accounting feedback;

6) act as a tool for identifying on-farm reserves and developing a further strategy for the development of the enterprise.

Since the analysis uses a large number of indicators of different quality, it is necessary to group and systematize them. By properties of reflected phenomena indicators are divided into quantitative and qualitative. Quantitative indicators are used to express absolute and relative values that characterize various areas of the enterprise's activities and can be expressed in natural, conditionally natural and cost meters. Qualitative indicators are used to evaluate manufactured products in terms of their conformity established requirements(standards, specifications, samples), for evaluation economic efficiency use of the resources available in the enterprise.

Some indicators are used in the analysis of the activities of all sectors of the national economy, others - only in certain sectors. On this basis, indicators are divided into general and specific. The general indicators include indicators of manufactured and sold products, labor productivity, profit, cost, etc. An example of specific indicators can be crop yields, livestock productivity, calorie content hard coal, peat moisture, etc.

According to the degree of synthesis, the indicators used in the analysis are divided into generalizing, particular and auxiliary, or indirect.

Generalizing indicators are used for generalized characteristics of complex economic phenomena. Private indicators reflect individual aspects, elements of the studied phenomena and processes. For example, generalizing indicators of labor productivity are the average annual, average daily, average hourly output of products by one worker. Particular indicators of labor productivity include the cost of working time for the production of a unit of output of a certain type or the amount of output per unit of working time. Auxiliary (indirect) indicators are used to more fully characterize a particular object of analysis. For example, when analyzing labor productivity, this is the amount of working time spent per unit of work performed, the production rate.

Analytical indicators are divided into absolute and relative. Absolute indicators are expressed in monetary and physical units. Relative indicators show the ratio of any two absolute indicators and are defined as percentages, coefficients or indices.

Absolute indicators, in turn, are divided into natural and value. Cost indicators are currently among the most common. The most important cost indicators are indicators of the volume of manufactured and sold products. Also, in monetary terms, the costs of production, profit, etc. are expressed.

Natural indicators are used in the planning and accounting and analytical activities of the enterprise. Along with natural indicators in analytical practice, their variety is also used - conditionally natural indicators.

In the study of cause-and-effect relationships, indicators are divided into factor and result. If one or another indicator is considered as the result of the impact of one or more causes and acts as an object of study, then when studying the relationships, it is called effective.

Indicators that determine the behavior of the effective indicator and act as the reasons for changing its value are called factorial.

According to the method of formation, indicators are distinguished: normative (fuel consumption rate, energy, depreciation, prices, etc.); planned (plan data); accounting (accounting, statistical and operational reporting data); analytical (evaluative), which are calculated during the analysis to evaluate the results and efficiency of the enterprise.

Each of the indicators discussed above has its own specific meaning and significance for monitoring and analysis. If these indicators are considered separately, it turns out that some of them suffer from a certain limitation. Analysis involves a comprehensive, systematic use of indicators. Only under this condition is it possible to comprehensively and objectively investigate the economic activity of an enterprise in a particular area and, moreover, the activity of an enterprise as a whole.

A comprehensive study of the activities of the enterprise provides for the systematization of indicators.

In the system of indicators of complex analysis, the following subsystems can be distinguished, presented in Figure 3.1.

The completeness and integrity of any analysis that has an economic focus is largely determined by the validity of the set of criteria used. As a rule, this set includes qualitative and quantitative assessments, and its basis is usually calculated indicators that have a clear interpretation and, if possible, some guidelines (limits, standards, trends).

Definition of an indicator and classification of indicators.

Indicators are elementary models that describe the quantitative and qualitative characteristics of certain processes in economic activity. Each indicator characterizes only a part of real activity. To fully disclose the activities of the enterprise, you need a huge number of indicators.

In the process of economic analysis of economic and financial activities, one constantly has to deal with a system of indicators, dividing according to certain criteria:

- a) cost and natural - depending on the underlying meters;

- b) quantitative and qualitative - depending on which side of the phenomena, operations and processes is measured;

- c) volumetric and specific - depending on the use of individual indicators or their ratios.

Cost indicators are among the most common. The use of value indicators follows from the presence in the economy of commodity production and commodity circulation, commodity-money relations. Naturally, wholesale and retail sales, distribution costs, and profits are expressed in monetary terms. The monetary (value) meter follows from economic essence the listed categories.

Natural indicators are used in the planning and accounting and analytical practice of organizations in all industries. They are especially necessary to control the safety of property, the rational use of material and labor resources.

In organizations, goods are taken into account and analyzed not only in value terms, but also in physical terms (according to the assortment in accordance with the established nomenclature). In natural terms, control is also carried out over the fulfillment by manufacturers of contracts for the supply of goods.

Quantitative indicators in the analysis are those that express quantification and can be obtained by direct accounting. Quantitative indicators are used to express absolute and relative values that characterize the volume of production and sales of products, its structure and other aspects of the work of organizations. Quantitative indicators can be expressed both in cost and natural units of measure. Thus, quantitative indicators are the volume of products sold in rubles; output in kilograms, meters; liters, etc.

Qualitative indicators determine the internal qualities, signs and characteristics of the phenomena being studied. Qualitative indicators are used to evaluate manufactured products in terms of their compliance with established requirements (standards, specifications, samples), to assess the economic efficiency of labor and material costs, as well as financial investments.

Indicators that characterize the quality of the work of organizations are now acquiring great importance. Organizational performance indicators include:

indicators characterizing the rhythm of sales;

implementation of the sales plan for a given structure of goods (taking into account the intra-group assortment);

full satisfaction of consumer demand (no cases of unsatisfied demand);

study of demand and its forecasting (in connection with the phenomena of seasonality, changes in consumer tastes, fashion changes, the offer of new products by manufacturers, design and modeling organizations);

continuous or selective acceptance of goods in terms of quality, which prevents the sale of incomplete, low-grade and low-quality goods (absence of claims from buyers for the low quality of the goods sold);

compliance with the requirements of sanitary supervision (especially in trade food products) and etc.

Economic phenomena and processes usually contain both quantitative and qualitative factors. The main task is to determine the influence of both.

An increase in the output of goods can occur, for example, by increasing the number of workers (quantitative indicator) and by increasing labor productivity (qualitative indicator). The volume of marketable output may increase as a result of both an increase in the output of the number of products, and an increase in the proportion of products of the highest grade in them.

Volumetric indicators are the primary reflection of the studied economic phenomena and processes in terms of their volume, composition, etc. Wholesale and retail sales, working capital, distribution costs, income - all these are volumetric indicators.

Economic phenomena and processes are usually expressed in absolute and relative terms. The absolute indicator characterizes the quantitative dimensions of the phenomenon, regardless of the size of other phenomena. Relative indicators reflect the ratio of the magnitude of the phenomenon under study with the magnitude of other phenomena or with the magnitude of this phenomenon, but taken for a different period of time. Relative values are the quotient of dividing one absolute number by another. If we divide the current value of the indicator by the base, we get a simple ratio, often called a coefficient, which shows how many times the first number is greater than the second. Multiplying the quotient by 100, we get the percentage.

Specific indicators are relative, derived from the corresponding volumetric indicators. Specific indicators can be considered: output per employee, inventory in days of turnover, the level of costs per ruble of sales, etc. Widely used in economic calculations and other relative values that characterize the implementation of the plan, structure, dynamics, intensity of development.

Structure index ( specific gravity) - shows the relative share constituent element in total.

Absolute growth is the difference between the subsequent and previous values of the indicator (chain) or the initial value (basic). A chain absolute increase characterizes a consistent change in indicators, and a basic absolute increase characterizes a change on an accrual basis. The absolute increase shows how many absolute units the given level has changed compared to:

- a) with the previous level in the chain method;

- b) with the initial level with the basic method.

There is a relationship between the chain and basic absolute growth - the sum of the chain gives the corresponding basic absolute growth. For the entire period described next, the absolute increase will be expressed as the difference between the last and the first level of the series. Absolute growth can be both positive and negative and must have units of measure and dimensions.

Relative indicators are also the rates of growth and growth, which characterize the dynamics of the change in the indicator.

The growth rate is the ratio of the subsequent value of the indicator to the previous one (chain growth rates) or constant, taken as the base of comparison (basic growth rates):

The chain method characterizes a sequential change, and the basic method characterizes a change on an accrual basis. There is a relationship between chain and base growth rates - the product of chain growth rates gives the corresponding base growth rate. The growth rate can be expressed in terms of ratios or percentages.

The growth rate shows how many percent this level changes compared to:

- a) with the previous level of the series in the chain method,

- b) with the basic, initial level of the series with the basic method.

The growth rate is usually expressed as a percentage and shows by how many percent the current level has increased (+) or decreased (-) compared to the previous (basic) level.

An important relative indicator is also the relative value of coordination - the ratio of the parts of the whole to each other. An example is the ratio in the liabilities side of the organization's own and borrowed capital.

In addition to absolute and relative values, average values are used in the analysis of economic activity. They are used for a generalized characteristic of a group of homogeneous phenomena in terms of a quantitative attribute, that is, they characterize the entire group of objects with one number.

Average values should be used only in the study and generalization of mass, qualitatively homogeneous aggregates. If the qualitative homogeneity of the studied population is violated, it is impossible to operate with average values, since they may hide significant shortcomings in the work of the organization. Therefore, along with the use of average values, it is necessary to analyze the indicators from which they are added.

Each of the indicators discussed above has a certain meaning and its own significance for monitoring and analysis. The indicators cannot be considered separately, because they do not give a complete picture of activity. But economic analysis involves a complex, systematic use of indicators. Only under this condition is it possible to comprehensively and objectively investigate the economic activity of an organization in a particular area, and even more so the work of the organization as a whole.

2. Principles of building a system of indicators

When selecting indicators, it is necessary to formulate the logic of their combination into a given set. It is necessary to make sure that the role of each of them is visible, and it does not give the impression that some aspect has remained uncovered or, on the contrary, does not fit into the scheme under consideration. In other words, the scorecard should have a framework or plan that explains the logic behind its construction.

The term "scorecard" is widely used in economic research. During the analysis, criteria are selected for evaluating activities, which are reduced to a certain system of indicators. The complexity of the analysis requires the use of entire systems, rather than individual indicators.

The most important requirements that the system of indicators must satisfy are: the necessary completeness of coverage by the indicators of the system of all aspects of the object or phenomenon under study, the relationship of these indicators, the logical following of some indicators from others.

In addition, when building scorecards, the following principles should be followed:

- - the principle of the tree structure of the system of indicators. It assumes the presence in the system of particular and generalized indicators of varying degrees of integration, and the particular and generalizing indicators must be connected both logically and formally by a relationship, i.e. a set of private indicators, by means of some simple mathematical operations, should be reduced (integrated) into one or more generalizing indicators;

- - the principle of visibility implies the presence of a certain set of indicators that is optimal for a given enterprise and covers all the essential aspects of the phenomenon under study. At the same time, the indicators of the system should complement each other, and not duplicate each other, be significant and slightly interconnected. The latter means that the system of indicators must also comply with the principle of permissible parallelism;

- - the principle of a reasonable combination of absolute and relative indicators involves the use in systems, along with absolute values, of a sufficiently large number of relative and specific values;

- - the system of indicators should ensure the adequacy of analytical information to the current state of affairs in the enterprise;

- - the indicators of the system should be informal, i.e. the system should have the maximum degree of analyticity, and the indicators of the system should be unambiguously calculable.

There are four types of links between indicators: logical, semantic, functional and stochastic.

The system of performance indicators of an enterprise (organization) should perform the following main functions:

- - Reliably reflect the objective economic essence;

- - take into account the organizational and specific features of the industry;

- - fully reflect the activities of the enterprise as a whole and take into account the characteristics of each economic level;

- - serve as a reliable tool for comprehensive study financial and economic activities of the enterprise and its management;

- - act as a tool for opening reserves and developing a further strategy for the development of the enterprise;

- - be comparable in dynamics and commensurate with accounting data, provide feedback in accounting.

- 3. Relationship between the processes of developing a system of indicators and the formation of an information base for economic analysis

To create a full-fledged information base for economic analysis, it is important to investigate the degree of information analyticity, i.e. its adequacy to the requirements, tasks of economic analysis.

The analyticity of information can be characterized using indicators such as:

- - The completeness of the coverage of the information necessary for the analysis or the degree of availability of information.

- - The degree of repeatability of similar indicators in different reporting forms.

- - Flexibility as the ability to make timely adjustments and at the same time sufficient resistance to change. The flexibility of indicators depends on the ratio of primary and derived information, since any changes in the primary indicator entail deviations in the derivatives.

- - redundancy coefficient, which determines how information meets modern requirements and forms the basis of future behavior of retrospective analysis;

- - The degree of readiness for mechanized processing. It depends on the state of the document itself, the degree of its preparedness - unification, typification, the complexity of the settlement operations provided for in it.

- - the complexity of filling and processing, ease of collection;

- - degree of mutual correspondence various kinds information (planned, accounting, etc.);

- - degree of reliability (logical and mathematical);

- - comparability of information, i.e. the possibility of using various types of information without additional processing.

It has been established that the subsequent analysis is provided to the greatest extent with information with a higher level of analyticity.

Knowing the information that is available and can be obtained, you can choose the right methods of analysis and determine the appropriateness of using a particular methodology and program.

In other words, as mentioned in the previous section, in order to form an information base for economic analysis, it is necessary to develop such a system of indicators that would fully meet the requirements, i.e. would cover precisely those criteria that are most important to us in this moment. Also, the chosen system of indicators should most fully describe the aspects of the economic activity of the organization that are of interest to us, so that the information received meets the requirements for the formation of an information base. The composition, content and quality of the information base on which an analytical study is carried out determine its effectiveness.

4. Technical, economic, production and financial indicators. Indicators of efficiency in the use of resources, costs and performance of economic activity. Indicators of extensive and intensive development of the organization. Indicators financial condition organizations

The economic activity of the enterprise is characterized certain system technical economic indicators.

All technical and economic indicators are closely interconnected, and each of them characterizes a certain aspect of the activity of an enterprise or a separate unit.

The main technical and economic indicators include:

- 1. the volume of production and sales of products in physical and value terms;

- 2. general fund wages;

- 3. current production costs (cost) per unit of output and annual production;

- 4. gross and net profit;

- 5. deductions to the budget;

- 6. profitability of production and products;

- 7. the level of competitiveness of production and products;

- 8. indicators reflecting the need for raw materials, materials, equipment and one-time costs ( capital investments or investment).

The volume of production is estimated by the following indicators:

- 1. gross output - monetary expression of the total volume of output produced for a certain period (month, quarter, year).

- 2. marketable output - a monetary expression of the total volume of manufactured products, with the exception of the value of the remains of work in progress, semi-finished products, special tools and devices of own production.

Indicators of the use of means of production include an assessment of the use of buildings and structures, machinery, equipment and other labor tools (OPF), raw materials, materials, energy resources and other objects of labor (working capital).

1. Profitability - a general indicator of the use of fixed assets, working capital and current production costs, i.e. this is the profitability, profitability of the enterprise, an indicator of the economic efficiency of production, reflecting the results of economic activity.

P \u003d balance sheet profit / OPF + working capital, or

P = Profit balance. - taxes / OPF + working capital.

2. Capital productivity - output per 1 rub. average annual cost of OPF. This indicator is necessary to assess the use of fixed capital.

Fo \u003d V / OPF,

V - Volume of output

3. Capital intensity - average annual cost OPF per 1 rub. manufactured products. This indicator is used to determine the prospective need for OPF.

Fe = OPF / V /

- 4. Development of marketable and gross output per worker and worker.

- 5. Labor intensity - the cost of working time for the manufacture of a unit of production or unit of work.

- 6. Machine capacity - the time of processing the product on the machine in accordance with the technological conditions.

- 7. Profit is a converted form of surplus value. It is calculated as the difference between the wholesale price and the cost price.

- 8. Wholesale price of the enterprise - the price of goods at which current costs are reimbursed and profit is ensured.

- 9. The cost of production - the current costs of the enterprise for the production and sale of products, expressed in monetary terms.

- 10. Demand - economic category, characteristic of commodity production and reflecting the total social need for various goods, taking into account the solvency of buyers.

- 11. Offer - a range of products presented on the market of goods for sale at an established or contractual price.

- 12. Competitiveness of products - a set of technical and economic indicators that can more effectively meet the needs of customers than similar products

- 13. Competitiveness of production - assessment of the technical and economic possibilities of production to ensure consistency between the interests of the manufacturer and the buyer.

Production indicators in monetary terms include sales volume, income, sales, marketable and gross output, net and conditionally net output, standard net output, gross and intra-production turnover, standard cost of processing.

Generalizing indicator production program enterprise is sold products (RP), or proceeds from the sale of products, works, services.

Marketable output (TP) is the cost finished products resulting from production activities enterprises, performed works and services intended for sale on the side.

Gross output (VP) characterizes the entire volume of work performed by the enterprise for a certain period of time (month, quarter, year). The composition of gross output includes both finished and unfinished products, i.e. work in progress (WIP).

VP \u003d TP-WIP at the beginning of the period + WIP at the end of the period.

Sold products are equal to marketable products if the balances of finished products in the warehouse at the beginning and end of the period remained unchanged. With an increase in stock balances, sales will be less than marketable products; with a decrease in balances, the volume of sales will be more than marketable products by the amount of the decrease in stocks of finished products.

RP \u003d TP + balances of finished products at the beginning of the year - balances of finished products at the end of the year.

Net product (NP) is the newly created value at the enterprise. It includes wages paid in the form of wages and not paid, but included in the cost of goods in the form of taxes and various charges, as well as profit. IN clean production does not include the transferred value created at other enterprises (payment for raw materials, materials, energy, fuel, depreciation).

PV = Sales Volume - Material Costs - Depreciation

Conditionally net production (CPP) is a newly created value, but taking into account depreciation.

PHR = Sales Volume - Material Costs.

Standard-net is a part of the price of the product, includes the basic and additional salary of personnel with deductions for social needs and standard profit.

Gross turnover is the sum of the value of the gross output of all divisions of the enterprise.

Below is a list of the most commonly used metrics. These indicators are divided into five groups, reflecting various aspects of the financial condition of the enterprise:

Liquidity ratios

Capital structure indicators (sustainability ratios)

Profitability ratios

Business activity ratios

Investment Criteria

For some indicators, recommended ranges of values are also given. The most frequently mentioned values are taken as such ranges. Russian experts. However, the allowable values of indicators can differ significantly not only for different industries, but also for different enterprises one industry and a complete picture of the company's financial condition can only be obtained by analyzing the entire set of financial indicators, taking into account the characteristics of its activities. Therefore, the given values of the indicators are purely informational in nature and cannot be used as a guide to action. The only thing that can be noticed is that if the values of the indicators differ from the recommended ones, then it is desirable to find out the reason for such deviations.

1. Liquidity indicators

The ability of an enterprise to pay its short-term obligations is called liquidity. An enterprise is considered liquid if it is able to meet its short-term obligations by selling current assets. Fixed assets, if they are not acquired for the purpose of further resale, in most cases cannot be sources of repayment of the current debt of the enterprise

1. Current ratio / Current liquidity ratio

Reflects the extent to which the company's short-term liabilities are covered by current assets, i.e. characterizes the company's resistance to short-term fluctuations in the market.

2. Quick ratio

Reflects the extent to which a company's short-term liabilities can be paid from assets that are either already cash or may turn into cash in the near future. Unlike CR, this indicator does not consider that reserves can be used to pay liabilities, because stocks do not always have liquidity and can be turned into money.

3. Cash ratio / Absolute liquidity ratio

Shows what share of short-term debt obligations can be covered by Money and their equivalents in the form of marketable securities and deposits, i.e. almost completely liquid assets.

4. Defensive interval ratio / Self-financing period

Reflects the number of days a company is backed by funds held in its current assets. This indicator characterizes how stable funding can be provided. current operations in case of short-term failures in sales.

5. Net working capital / Net working capital

difference between current assets company and its short-term liabilities. Net working capital is required to maintain financial stability enterprise, since the excess of working capital over short-term liabilities means that the enterprise can not only pay off its short-term liabilities, but also has reserves for expanding activities.

Irina Loshchilina

Consultant GC " Modern technologies management"

The article discusses the methodology for building and implementing a balanced scorecard (BSC). The article is intended for business analysts, BSC implementation consultants and IT professionals.

Assessment of the need to build a company strategy

Today, in order to succeed in a dynamic environment, companies need to be able to quickly adapt to changing market conditions and outperform their competitors in terms of quality, speed of service, breadth of product range and price of products.

Only prompt receipt of information about the company's activities will help the management to make a decision in a timely manner. At the same time, the operational actions of the company must be coordinated and aimed at achieving certain long-term goals, otherwise there is a risk of remaining in place. To do this, the company must be able to correctly identify its strategy and mobilize all resources to achieve its strategic goals.

A lot in the development of the company can depend on a correctly and clearly formulated strategy. It is important to understand that a well-designed strategy is only half the battle. It still needs to be successfully implemented.

What does the strategy look like? Formal representations of different companies about the strategy differ. View options range from one slide to five keywords to an impressive document full of various tables and entitled "Long Term Planning".

Many believe that the content of the strategy plays a key role, and the form of presentation is secondary. Gradually, managers are abandoning this point of view, as they understand that strategies can only be successfully implemented when they are understood by the company's employees. By describing the strategy in a more or less ordered form, we increase the likelihood of its successful implementation.

One of the tools for presenting the strategy implementation process in an understandable form is a balanced scorecard (Balanced ScoreCard, BSC).

Balanced system indicators is a system strategic management company on the basis of measuring and evaluating its effectiveness on a set of optimally selected indicators that reflect all aspects of the organization's activities, both financial and non-financial. The name of the system reflects the balance that is maintained between short-term and long-term goals, financial and non-financial indicators, main and auxiliary parameters, as well as external and internal factors activities.

Currently, there are not many examples of successful application of the balanced scorecard in practice, because when implementing the Balanced ScoreCard, one has to face various problems. The most serious problems most often relate to the incorrect interpretation of the methodology or organizational issues. The labor intensity of developing a balanced scorecard and the lack of inexpensive and effective software products are also problems that one has to face in the practical implementation of BSC.

The effectiveness of a balanced scorecard depends on the quality of its implementation. The introduction of a balanced scorecard is carried out in four stages:

- Preparation for building BSC;

- Building a BSC;

- BSC cascading;

- Monitoring the implementation of the strategy.

Implementation of strategy implementation methodology today is continuously connected with automation. Implementing a Balanced ScoreCard, for example with Microsoft Excel, or without any information support at all, is possible only at the initial stages of BSC implementation or in small organizations. If a company aims to implement a system balanced scorecard for several structural divisions and periodically refine and adjust them, then without taking advantage of information technologies not enough.

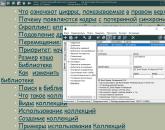

The following software products are currently available to BSC developers: ARIS 7.0, Microsoft office Business Score Card Manager 2005, business studio 2.0.

Let's consider in more detail the methodology for developing and implementing a balanced scorecard. To illustrate the main stages of building a Balanced ScoreCard, we will use the Business Studio 2.0 software product.

Preparing to build a balanced scorecard

At the stage of preparation for building a BSC, it is necessary to develop a strategy, determine the prospects and decide for which organizational units and levels a balanced scorecard should be developed.

It is important to always remember that BSC is a concept of implementing existing strategies, not developing fundamentally new strategies. You must first complete the development of the strategy, and then proceed to create a balanced scorecard.

When determining the departments for which the Balanced ScoreCard will be developed, the following should be taken into account: the more departments of the enterprise are strategically managed using one BSC, the better it is possible to cascade (decompose, transfer) important goals from the upper level to the lower ones.

One of the important activities in preparing for the development of a balanced scorecard is the choice of perspectives.

Any strategy development model can only claim to be complete if it provides answers to questions about different areas company activities.

Setting only financial goals when implementing a balanced scorecard is not enough if it is not clear how these goals will be achieved. In the same way, it will not be entirely correct to set goals isolated from each other. In this case, the relationships between individual goals and their influence on each other remain unaffected. This implies the need to take into account all important aspects enterprise activities.

Consideration of various perspectives in the formation and implementation of the strategy is feature concept of the balanced scorecard and its key element. The formulation of strategic goals, the selection of indicators and the development of strategic actions in several perspectives are designed to provide a comprehensive review of the company's activities.

Rice. 1. Perspectives of BSC

Companies that formulate their strategy too one-sidedly do not necessarily veer toward finance alone. There are companies that are too customer-oriented and forget about their financial purposes. Some companies may be overly process oriented and do not pay attention to market aspects. The introduction of a balanced scorecard, in turn, provides an equal consideration of several perspectives and helps to avoid such a bias.

Based on their empirical research, Robert Kaplan and David Norton proved that successful companies their BSCs take into account at least four perspectives (Figure 1):

- Finance;

- Clients;

- Internal business processes;

- Education and development.

These four perspectives should provide answers to different questions, namely:

- Finance Perspective: What image of ourselves do we need to create with our shareholders in order to achieve financial success?;

- Customer Perspective: What kind of self-image do we need to create with our customers in order to realize our vision of the future?;

- “Internal Business Processes” Perspective: In which business processes do we need to excel in order to meet the needs of our shareholders and customers?;

- Learning and Development Perspective: How should we maintain the ability to change and improve in order to realize our vision of the future?

Simplicity and the presence of clear logical relationships between BSC perspectives make it possible to achieve an understanding of the processes taking place in the company at the level of all performers.

Building a balanced scorecard

At the first stage of building a Balanced ScoreCard, a balanced scorecard is developed for one organizational unit. It can be a company as a whole, a division or a department.

In this case, the construction of BSC is carried out by performing the following steps:

- Specification of strategic goals;

- Linking strategic goals with causal chains - building a strategic map;

- Selection of indicators and determination of their target values;

- Development of strategic measures.

Specification of the strategic goals of the balanced scorecard

Rice. 2. Strategic goals of BSC

In general terms, a goal is a description of the desired state of something in the future. This state can be expressed in the words: "to supply customers with our products within a short period of time." You can specify the wording with the help of indicators and their target values: "delivery time less than 36 hours."

To build a strategic management system, it is necessary to decompose (break down, structure) the company's strategy into specific strategic goals that reflect various strategic aspects in detail. By integrating individual goals, cause-and-effect relationships between them can be established so that the full set of goals reflects the company's strategy.

Each strategic goal is associated with one of the prospects for the development of the organization (Fig. 2).

Too many strategic goals should not be defined for top level organizations. A maximum of 25 targets will suffice. Too many goals in a scorecard indicates the inability of the organization to focus on the main thing, and also means that the formulated goals are not strategic for the organizational level at which the scorecard is being developed. The development of tactical and operational goals should be given attention in the systems of indicators of subdivisions of the lower levels of the organizational structure.

Building a strategic map of a balanced scorecard

Determining and documenting causal relationships between individual strategic goals is one of the main elements of BSC.

Established cause-and-effect relationships reflect the presence of dependencies between individual goals. Strategic goals are not independent and isolated from each other, on the contrary, they are closely related to each other and influence each other. The achievement of one goal serves the achievement of another, and so on, up to the main goal of the organization. Links between different goals are clearly visible due to the causal chain (Fig. 3). Those that do not contribute to the realization of the main goal are excluded from consideration.

The causal chain is a handy tool for bringing the BSC down to the lower organizational levels.

A strategic map is used to graphically display the relationship between strategic goals and prospects.

Rice. 3. Causal relationships of strategic goals

Choice of indicators of the degree of achievement of strategic goals

The BSC scores (boxes in Figure 3) are target meters. Indicators (Fig. 4) are a means of assessing progress towards the implementation of the strategic goal.

The use of indicators is intended to concretize the strategic planning goal system and make the developed goals measurable. Indicators can only be identified when there is clarity about the targets. Choosing the right metrics is a secondary issue, because even the best metrics won't help a company succeed if the goals are wrong. It is recommended that no more than two or three indicators be used for each of the strategic objectives.

Without targets, indicators designed to measure strategic goals are meaningless. Determination of target values of management indicators causes difficulties not only in the development of BSC. The fundamental difficulty in determining the target value of a particular indicator is to find a realistically achievable level.

As a rule, a balanced scorecard is developed for a period corresponding to the long-term period of strategic planning (3-5 years). At the same time, long-term target values are determined for delayed indicators (indicators that indicate ultimate goals corporate strategy). Since the implementation of the strategy is also carried out in the current year, target values are also set for the medium term (1 year) period - for leading indicators (indicators that change over time over a short period of time). Thus, a balance of the system of indicators for long-term and short-term goals is achieved.

In the Business Studio 2.0 system, the content of short-term plans is detailed by periods (quarters, months, weeks, days) and expressed as planned values of indicators. Indicators and their target values (values that are planned to be achieved) provide management with timely signals based on deviations of the actual state of affairs from the planned one, i.e. the actual quantitative results obtained are compared with the planned ones.

So, the indicator is a meter showing the degree of achievement of the goal. However, it is also a tool for evaluating the effectiveness and efficiency of a business process. Indicators serve both to assess the effectiveness of processes and to assess the degree of achievement of the goal at the same time.

Rice. 4 BSC indicators

Strategic activities to achieve strategic goals

Achieving strategic goals involves the implementation of relevant strategic measures. "Strategic measures" general concept for all activities, projects, programs and initiatives that are implemented to achieve the strategic goals.

The distribution of the company's projects according to the goals of the balanced system creates clarity in understanding what contribution this or that project makes to the achievement of strategic goals. If projects do not make a significant contribution to the achievement of the strategic objectives, they should be reviewed to see how they contribute to the achievement of the basic objectives. If a particular strategic measure does not contribute significant contribution in achieving basic goals, the need for its implementation is extremely doubtful.

Cascading Balanced Scorecard

Cascading leads to an improvement in the quality of strategic management in organizational units involved in building a balanced scorecard, since goals and strategic activities from higher units can be sequentially transferred to the BSC of lower organizational units - this is vertical integration of goals.

When cascading, the strategy specified in the corporate Balanced ScoreCard applies to all levels of management. The strategic goals, metrics, targets, and improvement actions are then fleshed out and tailored across departments and teams. That is, the corporate balanced scorecard should be linked to the BSC of subdivisions, departments and individual work plans of employees. Based on the BSC of their division, each department develops its own BSC, which must be consistent with the corporate BSC. Then, with the participation of the head of the department, each employee develops his own individual work plan. This plan focuses more on delivering real results in the workplace rather than tasks or improvement actions.

Thus, when cascading, a bridge is established between successive levels of the hierarchy, along which the corporate strategy sequentially descends.

Monitoring the implementation of the strategy

To improve the balanced scorecard, top management and those responsible must constantly review and evaluate the organization's performance.

Strategic objectives are characterized by a high degree of relevance to the company, and this relevance should be assessed at least annually. In doing so, it is necessary to evaluate:

- Are the selected indicators suitable for assessing the degree of achievement of the developed goals?;

- How easy is it to calculate indicator values?;

- Has the structural subdivision reached the target values of the developed indicators?;

- Have the target values of indicators of higher units been achieved?;

- What contribution does the structural unit in question contribute to the achievement of the goals of the upper levels?

The evaluation of indicators is primarily to understand the possibility of calculating the actual value of the indicator based on the data of the reporting period. In addition, it is necessary to compare the plan-fact on the values of the developed indicators with the clarification of the causes of deviations. Such an analysis is accompanied by either an adjustment of the target value of the indicator, or the development of corrective measures aimed at achieving the previously set target value.

The lower level BSC should always be evaluated to help achieve the higher level goals.

In addition, it is advisable to predict the target values of indicators for a long period of time.

What does the company get as a result of the implementation of a balanced scorecard?

Let's sum up some intermediate results. What does the enterprise get as a result of the description of the strategy and its consistent implementation using the Balanced ScoreCard methodology? The first and most important is the concentration of efforts on strategically important areas for the company. Defined the main objective company, the means to achieve it (strategic goals) are outlined, the goals are cascaded by departments. The second result, respectively, is the presence of strategic goals for each division - that is, everyone understands what needs to be done. The third result is the possibility of a clear understanding of the effectiveness of actions. The presence of indicators for each goal to achieve it allows each participant in the process to understand their role in the implementation of the company's strategy. And, finally, the fourth result is the control and manageability of the process of implementing the strategy from the top down. The company, in the hands of its leaders, becomes effective tool achieving the set goal.

Advantages of a computer over pencil and paper

All of the above is quite achievable without the use of any automation. Moreover, a number of successful enterprises used similar methods at the end of the 19th century, when computer technology was not as advanced as it is today. Another question is whether it is convenient to work with pencil and paper, will automation at some stage increase the efficiency of implementing the strategy? Of course, pencil and paper is only a symbol. The collection and some processing of indicators is quite feasible using at least the same Microsoft Excel. However, goals can change, the significance of some indicators after the test of time will be overestimated, some elements that we considered unimportant will begin to play a strong role ... The leader must be able to respond to changes and make changes to his plan as quickly as possible - after all, every step, done in the wrong direction takes us away from the goal.

As a rule, the main problem faced by enterprises that have decided to implement this strategy implementation methodology is not how to automate the creation of a tree of goals and indicators or the construction of a strategy map, but how to automatically constantly provide BSC with fresh data and keep it in working order. Without this, operational control over the implementation of the strategy is impossible. For example, you can use the mechanism for collecting indicator values using mailings, implemented in software product Business Studio 2.0 (Fig. 5). A means of collecting indicator values that are not contained in information system, are Microsoft Excel files that are automatically distributed to performers and then imported into the system.

For each individual responsible for entering the values of indicators into the system, a dynamic letter is generated with instructions for filling out the reporting table. Business system Studio 2.0 finds all indicators for a given individual and generates a Microsoft Excel file containing a table with indicators for which this individual is responsible for entering the values. This file is attached to the letter, and then these letters with files are sent to the electronic address (E-mail) of an individual stored in the system directory.

Rice. 5. Mechanism for collecting indicator values using mailing lists

Further individuals fill in the files with the actual values of the indicators and place them in a specific folder on the file server or send them to the system administrator. The system automatically reads the files from the folder and uploads them to its database.

At this stage, the collection of indicator values ends.

A balanced scorecard, like any other management tool, should be adjusted as the company develops and the external environment changes. The environment in which the enterprise operates is usually very dynamic, which leads to the adjustment of strategic goals. And this, in turn, requires constant updating of indicators for achieving these goals. However, in most cases this does not happen, which makes the balanced scorecard of performance unworkable at best, if not downright harmful.

The collected indicator values should be made available to stakeholders for analysis. To do this, the system contains a set of pre-configured reports, which, if necessary, can be changed or supplemented with new ones. Planned and actual values of individual indicators are presented in BSC reports in dynamics for several periods. The analysis period can be selected by the user in the Business Studio 2.0 system settings.

Fierce competition, in which modern enterprises live and operate, dictates the need to improve the efficiency of each aspect of the enterprise. Management is no exception. The manager needs tools for his work just like any other employee. The technique described by us is not as complicated as it is effective, and the availability of software tools for its implementation allows you to perform this work in real time.

Any company is the object of close attention of a wide range of stakeholders: shareholders, managers, employees, creditors, suppliers, consumers, partners. Based on their specific interests, each party approaches the issue of evaluating the company's activities in its own way, identifies factors and aspects of activity that are important for it and which it will evaluate. The object of evaluation is the company's activities aimed at maintaining relations with the main stakeholders. This approach defines the internal structure of the balanced scorecard…

The balanced scorecard (BSC) is considered primarily as a system for evaluating the performance of companies (organizations, enterprises). We will try to identify the prerequisites that led to its appearance.

First of all, this is a change in the structure of companies' assets and the nature of their activities. The main resources for which there was a struggle at the dawn of civilization were land and Natural resources. With the development of industry, the emphasis in competition shifts to the area of fixed assets and capital. An increasing role is played by intangible assets in the form of licenses and patents, knowledge and skills of personnel, trademarks and brands. However, unlike land and oil, buildings, structures and equipment, intangible assets are difficult to “touch” and just as difficult to value in monetary terms. As a result, the importance of non-financial instruments in assessing the activities of companies is increasing.

In addition, the need for a systematic approach to relations with stakeholders and the activities of the company as a whole can be considered a prerequisite for the emergence of the BSC. This is due to the increase in the speed of changes in the external environment: in a competitive environment, in politics and economics.

Consideration of the balanced scorecard will begin with several issues related to performance evaluation, namely:

- why evaluate?

- what to evaluate?

- how to evaluate?

The answer to the first question, it would seem, is obvious - to accept managerial decision. However, not all so simple.

Any company is the object of close attention of a wide range of stakeholders ( stakeholders). Here is an incomplete list of them: shareholders, managers, employees, creditors, suppliers, consumers, partners. In this case, each of the parties pursues its own specific interests ( rice. 1).

Rice. 1. Stakeholders and their interests

Based on the interests, each party approaches the issue of evaluating the company's activities in its own way, identifies factors and aspects of activity that are important for it and which it will evaluate. This raises the next question: “What to evaluate?”

The balanced scorecard is not intended to assess the company as a whole, although it may include financial indicators that characterize, among other things, the value of the company (the value of its net assets, revenue, profit, etc.).

The object of evaluation is the company's activities aimed at maintaining relations with the main stakeholders. This approach determines the internal structure of the BSC. In this connection, we move on to the next question: “How to evaluate?”

American "business gurus" Robert Kaplan ( Robert Kaplan) and David Norton ( David Northon), the authors of the system, propose to consider four main aspects of evaluating a company's performance:

- finance - success is assessed in terms of meeting the interests of shareholders;

- consumer relations - it is estimated how successful the company is in its relations with consumers;

- internal business processes - it is assessed how reasonably managers manage internal processes in the company, how optimally these processes are organized;

- innovation and personnel - it is assessed how much the company cares about its own development and, in particular, about the development of such a resource as personnel.

The composition of the assessment aspects is determined by the specifics of the activities of each specific organization, and when designing the system, special attention should be paid to the selection of the most appropriate aspects. At the same time, it should be noted that all aspects of assessment are considered to be interconnected by a coherent logic of cause-and-effect relationships. This logic, depending on the relationship of the company with various stakeholder groups, may vary.

Description of the balanced scorecard

Building logic

Consider the internal logic behind the balanced scorecard. As mentioned above, each of the aspects of evaluation is associated with activities that affect the interests of one of the parties (shareholders, consumers, managers, employees). The choice of specific aspects of assessment is determined by the specifics of the organization's activities and depends on the strategies and priorities it implements. For example, the aspect of "innovation and people" can also cover the areas of development and training. IN table 1 examples of possible areas of assessment for different types of commercial and non-profit organizations are given.

Table 1. Aspects of evaluating the company's performance

Organization | Parties concerned | Aspects of assessment |

| Oil company | Shareholders Consumers Managers Environmental organizations Employees | Finance Consumers Business processes Ecology Staff |

| Political Party | Sponsors Voters Party members Apparatus workers | Finance Consumers Ideology Staff |

| Commercial research organization | Shareholders Customers Managers Scientific workers | Finance Consumers Innovation Staff |

| Hospital | Insurance companies Ministry of Health Patients Managers Doctors and medical staff | Finance Policy Consumers Business processes Staff |

Selecting assessment metrics

In each aspect of assessment, the company uses a set of indicators that best characterize its progress towards achieving long-term goals. At the same time, it is the long-term goals and strategies of the company that determine the choice of the most appropriate indicators for evaluating the company's performance.

Here I would like to draw attention to the fact that an indicator is understood as a sign that in some way characterizes the activity, a kind of “symptom” by which one can judge the causes of what is happening. At the same time, each indicator is assigned a standard value that the company would like to achieve (sales of more than 2 million hryvnia per year) or would not want to achieve (the number of accidents at work is not more than five per year). In the course of carrying out its activities, the company measures the actual values and compares them with the normative ones: the actual sales volume is 1.8 million UAH. per year, and the number of accidents is one. As a result of such a comparison, the company decides to change (or not change) its activities, determine new normative values indicators or changes in the composition of indicators. IN table 2 examples of indicators for each of the aspects of assessment are presented. The list of indicators is open. The choice of specific indicators and the establishment of standard values is determined by the field of activity of the company and depends on its strategic goals, as well as on the selected aspects of evaluation.

Table 2. Indicators for evaluating the company's performance

Aspect | Indicators |

| Finance | Return on invested capital, % Return on assets, % Sales revenue Profit Amount of costs Other indicators |

| Consumers | Number of consumers Market share, % Number of visits to consumers Consumer satisfaction index, % Other indicators |

| Business processes | Share of administrative expenses, % Production cycle time Equipment performance Labor productivity growth, % Other indicators |

| Staff | Personnel development expenses Number of teaching hours per year Employee satisfaction index, % Other indicators |

Internal relationships between aspects of assessment

A significant innovation introduced by the BSC and distinguishing this system from other approaches to assessing the performance of an organization is the construction of clear cause-and-effect relationships that are established both between individual indicators and between aspects of assessment as a whole. For example, the company Halifax* (Halifax) developed the so-called Z-model, which allows linking the four aspects of evaluating this company ( rice. 2).

Rice. 2. Halifax Z-model

According to the Z-model, there is a causal relationship between the aspects of evaluation, which can be expressed by the following phrase: “If we have selected competent personnel and do business correctly, then our consumers will be satisfied, and we will expand our business.” This means that Halifax considers its people to be the foundation for building efficient business processes, which in turn are driven by customer satisfaction, leading to superior financial results.

Similar to the links established between various aspects of evaluation, cause-and-effect relationships are also established between the individual indicators of the system. Moreover, the links between the indicators are established both within each of the assessment areas, and between the indicators that are in various fields. As a result, the so-called system balance is achieved. However, the balance sheet is not limited to the harmonization of indicators.

The relationship of goals, indicators, tasks and actions

An important factor in the balance of the system is the relationship between the goals, indicators, tasks and actions of the company. To build such a system, it is very important to understand the specifics and purpose of each of these components.

Goals in the context of the BSC should be understood as a description of the future state of the company, preferably after a sufficiently long period of time, for example, 3–5 years. Indicators - those signs by which in the future it will be possible to determine whether the goal has been achieved. Tasks determine the ways to achieve goals, set directions for action. Well, the actual actions: what exactly should be done to solve problems, to achieve the standard values of indicators, and, in the end, to achieve goals.

All these components make up a coherent system of cause-and-effect relationships and cover both all functional areas of the company's activities and all levels of the management hierarchy. It is the vertical and horizontal consistency of goals, indicators, tasks and actions that makes the implementation of the company's strategy a manageable process. In this regard, it is necessary to pay attention to the fact that it is the strategies implemented by the company that set the requirements for the structure and content of the BSC.

Linking the Balanced Scorecard to Strategy

Mission statement and long-term goal setting

Building a balanced scorecard is impossible without a clear understanding of the company's mission, requirements and restrictions on activities that determine possible and impossible directions for its development, long-term goals and strategies that are acceptable for it.

The mission can be thought of as a combination of four components:

- purpose Why does the company exist?

- strategy - competitive position and distinctive competence of the company;

- values What does the company believe in?

- standards of conduct - the policies and behavioral models that underlie the distinctive competence and value system.

These components determine the nature of the long-term goals that a company can set for itself. Graphically, the mission can be represented as a range in which both the company's goals and strategies for achieving them fit ( rice. 3).

Rice. 3. Constraints imposed by the mission on the strategies of the company

Long-term goals can be formulated as “doubling the value of the company by the end of the third year of operation” or “ensuring a 20% share in the European market household appliances after 5 years". At the same time, the deadline for achieving the goal and the value of the indicator, which will indicate the achievement or non-achievement of the goal (two-fold growth of the company or 20 percent market share), are clearly indicated.

Strategy formation

To achieve its long-term goals, the company implements strategies, regardless of whether they were clearly spelled out and communicated to managers and employees or arose spontaneously, due to changing circumstances in the external environment. It is important that the company implements only those strategies that fit within the mission, without violating the integrity of its image in the eyes of the stakeholders with whom it maintains relations at the moment and plans to maintain in the future.

Strategies here refer to the course of action that an organization follows in order to achieve its long-term goals. The actions themselves are selected based on the tasks that determine what, in fact, should be done.

Thus, a balanced system appears in a more expanded form, when each of the aspects of the assessment covers both goals and indicators, as well as tasks and actions that need to be taken to implement the company's strategy.

Here you can give an example of building cause-and-effect relationships from goals to indicators, tasks and actions. Let's say the goal in terms of customer relations is "increased customer loyalty", and the indicator is "repeat sales at the level of 38%". In this case, the task may be “improving the quality of customer service”, then the action is “introducing customer service standards” or “training staff to develop communication skills”. If you look closely at the actions, then "introducing standards" can be attributed to the aspect of "business processes", and "conducting training" to the aspect of "staff". It is the construction of a chain of cause-and-effect relationships between goals, indicators and actions within and between various aspects of assessment that makes it possible to make the system balanced. An important role is played by the so-called strategic maps - graphical interpretation of the identified cause-and-effect relationships, both between indicators and between actions taken by the company.

Implementation of a balanced scorecard

- How is the process of implementation of the SSP organized? First of all - this individual activity company, in which top managers, directors, managers should be directly involved key divisions and departments. There are several main stages of the implementation of the BSC:

- Context analysis. At this stage, the company's competitive environment is analyzed and the company's mission is formed or revised.

- Strategic analysis. Identification in progress key aspects evaluation, specification of the mission for these aspects, setting strategic goals.

- Corporate strategy cards. Sources are determined competitive advantage companies, a system of indicators is developed, causal relationships are identified, long-term and short-term goals are agreed, strategic maps are drawn up.

- Strategic maps of divisions. The stage is devoted to the detailing of strategic maps to the level of units. In fact, this is a repetition of stage 3 at the lower management level, the identification of responsible executors, the setting of specific operational goals and objectives of the activity.

- System implementation. Planning activities for the implementation of the system, building a monitoring system for the implementation and operation of the BSC and implementation itself.

However, there are many obstacles and traps on the way to the implementation of the BSC that make it difficult, slow down, and often make it impossible to implement a balanced scorecard in organizations.

Traps and obstacles

Organization's unpreparedness for implementation