ABC-Costing for practical use. ABC costing (differentiated costing method) ABC cost accounting and costing method

Key concepts:

- A cost object is any unit of account (department, contract, distribution channel, type of product, etc.) for which costs need to be determined separately.

- Cost driver - a parameter proportional to which costs are transferred to the cost of resources.

- Resource driver is a parameter proportional to which the cost of the resource is transferred to the cost of the operation.

- Activity driver is a parameter that proportionally transfers the cost of activities to cost objects.

Activity Based Costing consists in cost accounting for work (functions). The enterprise is considered as a set of work operations, in the course of which it is necessary to expend resources.

The cost of indirect costs in the enterprise is transferred to resources in proportion to the selected cost drivers. Then the structure of operations necessary to create products (works, services) is developed. The calculated resource cost is then transferred to operations in proportion to the selected resource drivers. As a result, the cost of operations is included by cost objects in proportion to the drivers of operations. The result is the calculated cost of products, works or services.

The essence of the method is to study the relationship between costs and various production processes.

According to the methodology, a complete list and sequence of operations (functions) are determined with simultaneous calculation of the resource requirements for each operation.

There are 4 types of operations according to the way they participate in the production of products:

- piece work (output of a unit of production)

- batch work (issue of an order, set)

- product work (production as such)

- general business work

Resources are classified by highlighting 2 groups:

- delivered at the time of consumption (e.g. piecework wages)

- delivered in advance (for example, salaries)

Through the system of cost drivers, the amount of resources spent per product output is determined.

The disadvantage of the method is the high complexity of implementation. However, ABC is one of the most accurate ways to estimate costs.

The Activity Based Costing (or ABC) method has become widespread in European and American enterprises. Literally, this method means activity cost accounting (functional cost accounting).

It arose as a result of changes taking place in the economic structure of costs, in particular, views on the methodology of cost accounting and calculation of production costs have changed, since traditional systems Production costing was created at a time when most companies produced a limited range of products and mainly included in production costs the cost of basic materials, the cost of wages of the main production workers. The costs of production maintenance and management, which are mostly overhead, were small, so the distortion of production costs due to their distribution in proportion to the wages of production or the amount of material costs for products was insignificant. The cost of information processing, on the contrary, was quite high.

The search for new methods for obtaining objective information about costs has led to the emergence of the ABC method, or "AB-costing", according to which the enterprise is considered as a set of work operations that determine its specifics. In the process of work, resources (materials, information, equipment) are consumed, some result appears. Accordingly, the initial stage of applying the AB-costing method is the determination of the list and sequence of work in the enterprise by decomposing complex work operations into simple components in parallel with the calculation of resource consumption.

The costing system under consideration is a new direction for domestic accounting, and the approach to costing by type of activity is due to the awareness of the inadequacy of reflection by traditional methods of distributing the costs of modern complex production processes. Calculation by type of activity is especially relevant for organizations that perform educational services. The ABC method is one of the directions for the distribution of overhead (indirect) costs. The application of the AB-costing method provides for a slightly different terminology than in the domestic accounting system. 1)

A cost allocation group is a detailed group of indirect costs that can be identified with specific activities.

For example, the salary of a safety engineer is 28,800 rubles. per month. During this period, he performs four types of work: briefing - 100 hours, checking the preparation of workplaces - 14 hours, drawing up a report - 8 hours, dismantling emergency situations - 22 hours. A total of 144 hours of work. Indirect costs, or cost distribution group, are salaries with accruals. 2)

An operation is an event, task, or unit of work that has a specific purpose. ABC uses the cost of these operations as an intermediate step for attributing the costs of products (works, services) and as information that has independent value. In our example, the operation is briefing 100 hours, checking the preparation of workplaces - 14 hours, etc. 3)

Operation Center - a group of operations united by some technological or organizational feature.

Operations centers can be activities related to the operation of equipment, its current repairs etc. After the inclusion of operations in the accounting system, the resources consumed by each individual operation (center of operations) during the reporting period are established. In our example, the operations center equals operations.

The degree of detail (grouping) in each case depends both on the specifics of the technology and the organization of production and management, and on the presence of technical, informational, time and other restrictions. The test of effectiveness will be decisive, i.e. the benefit of detailing information, as in any other system of calculation, must exceed the cost of it. 4)

A cost driver, or cost allocation base, is the link between a group of overhead costs and an operation. For example, the costs associated with the work of a safety engineer can be related to the performance of the scope of duties through the amount of time spent on types of work. 5)

The rate of the cost carrier, or the distribution coefficient of the first stage - the ratio of the group of distributed costs to the value of the cost carrier. If we continue the previous example, then the distribution coefficient of the first stage will be equal to the ratio of the costs associated with the work of a safety engineer to the total amount of time worked by him, i.e. 144 hours. The distribution coefficient is 200 * 28,800 rubles: 144 hours = = 200 rubles. 6)

The cost of the operation is the total amount of expenses aimed at the implementation of homogeneous operations. In the part of the salary of the safety engineer, it will be equal to the distribution factor of the first stage, multiplied by the value of the distribution base related to this operation.

In our example, the cost of the instruction operation is equal to

200 rub. 100 hours \u003d 20 LLC rubles;

the cost of preparing jobs -

200 rub. 14 hours = 2800 rubles;

the cost of dismantling emergency situations -

200 rub. 22 hours = 4400 rubles;

cost of reporting

200 rub. 8 hours = 1600 rubles 7)

The carrier of an operation, or the cost allocation base of an operation, is a quantitative measure of the workload of an operation. In our example, the carrier of the operation is expressed by the number of briefings - 40 units. and the preparation of seven jobs.

The rate of the carrier of the operation, called "preparation of jobs" (or coefficient), will be:

K2 = = 400 rubles. 8)

The rate of the operation carrier, or the distribution coefficient of the second stage - the ratio of the cost of the operation for the period to the total value of the operation carrier for the same period. In this case, the specific indicator of the cost of the briefings carried out is calculated. The coefficient will be:

K, \u003d -- \u003d 500 rubles.

The ABC system provides for a two-stage distribution of costs and, accordingly, there are two calculation objects - intermediate - operation; final - production. Let's say that the products (lamps) are made by 20 workers. The share of the salary of a safety engineer attributable to the production of fixtures is equal to the cost of the operation performed (500 rubles) multiplied by the quantitative expression of the distribution base (20 people). In our example, the cost per month for the briefing operation performed by the safety engineer and related directly to the manufacture of fixtures is 10,000 rubles, or

500 rub. 20 people = 10,000 rubles.

The cost of the operation "preparation of three jobs assigned to the production of lamps" will be:

400 rub. 3 work places = 1200 rubles.

Examining the activities of the organization, Ronald Coase (Nobel laureate in economics) concluded that the effectiveness of work depends on the ratio of costs for similar business operations within the company and in the free market. If the costs of an operation inside the enterprise are less than those outside it, it makes sense to keep the staff in the structure, to invest resources within the enterprise. If the need for the work of individual specialists is small, it is more profitable to pay for an external service. Simply put, the economics of transaction costs allows you to understand why firms are created and why their management is based on a particular organizational structure.

The ABC method is used in combination with cost accounting and product costing methods. different levels. In Russia, it is still only being used. Abroad, in the management of firms, information is used that is obtained by applying the AB-costing method for current management and strategic decisions.

In many organizations, the ABC method is considered not as an accounting method, but as a management tool. Cost management in the context of individual operations, not products or even cost centers provides new opportunities for effective planning and cost control and reduction.

It is generally accepted that ABC information can be used both for current management and for making strategic decisions. At the level of tactical management, this information can be used to determine ways to increase profits and improve the efficiency of the organization, at the strategic level - in making decisions regarding the reorganization of the enterprise, changing the range of products and services, entering new markets, diversifying, etc.

The application of the ABC method is also known in inventory management. This method classifies inventories according to some specific indicator of importance, usually according to the annual volume of use of this type of inventory: raw materials, materials, semi-finished products in monetary terms. Depending on the significance of reserves and size working capital, used for their acquisition, activities for control and management of stocks are distributed among managers.

The ABC method is used to improve the performance of enterprises in the most various fields activities. One of its main uses is in the service industry, where the manager focuses on the most important aspects services, dividing them into the most important, important and not very important. The point is not to overvalue the non-essential aspects of service at the expense of the really important ones.

The ABC accounting system has the following advantages:

provides more accurate unit costing in case of significant specific gravity indirect costs not directly related to the objects of calculation;

substantiates managerial decisions on pricing, the choice of a production program;

provides the calculation of the cost of business processes, especially when performing services as new costing objects.

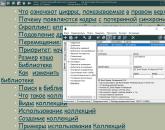

So, with the ABC method, unlike the traditional method, the cost accounting object is the operation, and the calculation object is the operation and the usual object: a product or a group of products, a service or a group of services, work performed (Fig. 8.1).

Consider circuit diagram distribution of indirect costs, i.e. the cost of maintaining a safety engineer for the operations performed and the allocation of costs to certain types products (Fig. 8.2).

Using the ABC method, not all costs are distributed, but only those for which it is possible and economically feasible to isolate cost groups by operations and find adequate drivers of costs and operations. The remaining indirect costs are allocated using the traditional method.

The allocation of overhead costs can be complex and even controversial, but overhead costs are an important cost element for many organizations, and their treatment has a significant impact on unit cost results, inventory costs, profit estimates, and possibly sales prices.

In practice management accounting There are two possible approaches to the distribution of overhead costs: "traditional" and by type of activity (ABC method). The procedures used by each of these approaches are shown in Fig. 8.3.

Traditional method ABC method

Rice. 8.3. Traditional and ABC method of allocation of overhead costs 232

Allocation (and redistribution) bases should be determined, if possible, in terms of the overhead cost carrier, i.e. underlying cause of their occurrence.

The ideal basis for the implementation of the AB-costing system is scientific and educational activities. Based on this method, it is possible with a high degree of reliability to assess the quality of education, the level of programs and instrumental systems used, and the timeliness of the technologies used in the field of educational services.

“No one should believe in anyone like the Lord God or his prophet.

It’s enough just to listen to a person who makes you think.”

Peter Oppenheimer, English economist

Janus - the two-faced god in Roman mythology - was considered the patron of doors, entrances and exits, as well as all beginnings in time. It was he who, before the advent of the cult of Jupiter, was the deity of the sky and sunlight, opened the heavenly gates in the morning, releasing the sun into heaven, and closed them at night. The Romans believed that Janus taught people chronology, crafts and agriculture. It is known that one face of Janus was young and the other old. He was both good and bad at the same time. But let's move from Roman mythology to finance and management accounting.

There are two costing concepts in management accounting: the absorption costing method and the costing method. variable costs(variable costing), which, like the two-faced Janus, do not allow one to unequivocally relate to the issues of cost and pricing. ABC costing (Activity Based Costing) has the greatest duality in management accounting, since it can be designed both on the principle of greater absorption of costs, and on a method that will be closer to the calculation of variable costs. In such a situation, the question arises: is functional cost accounting a tribute to fashion or time?

ABC costing is spoken about in different ways. Some admire him and are convinced that any management accounting system should be broken down into small processes, on the basis of which the cost is determined. But there is also an opposite opinion: ABC costing is too complicated, so it makes no sense to describe the processes in detail. Some are sure that the essence of ABC costing is that “Nadezhda Petrovna’s run along the corridor with an invoice costs 7 hryvnia 55 kopecks and should be attributed to one or another batch of products.” That is why he, like Janus, has two faces.

Let's see how management accounting treats the use of ABC costing, but first, let's remember what types of costing exist (Figure 1).

Evolution of costs (from absorption to ABC costing)

At first, the financiers were convinced that all the costs of the enterprise, one way or another, should be included in the cost price. This method was called cost absorption (cost absorption) and is still used in accounting (some are trying to use it in management accounting).

From the early 1940s to the late 1980s, the variable cost method became popular, according to which only variable costs are taken into account in the cost of products. At the same time, it does not matter what these costs were: part of the cost of production or, for example, part of overhead costs, like sellers' commissions - in any case, they were considered variable and included in the cost. In addition, there is nothing to hide, it is the method of calculating variable costs that is the system on the basis of which the most objective decisions are made.

The next in the period 1980-1990. was the concept of the so-called ABC-costing. Thanks to the development of IT, it has become possible to see the individual processes of the company, analyze them and understand how much they cost. The cost of processes, which cannot be dispensed with in the production and sale of products, clings to the cost of goods.

Another newfangled concept that became popular in the 1990s was target costing, sometimes referred to as the market standards paradigm. In this case, everything is generally turned upside down, if only because the financiers are trying to achieve a certain target cost.

Let's look at the price formation process in each of the above paradigms. The first paradigm of the era of the industrial revolution was valid until the 1940s. During this period, the commodity filling in the world was not yet so large, so the likelihood that all the goods would be bought was high. In those years, when calculating the cost, direct material and labor costs were used, overhead production and non-production costs clung with a certain coefficient. As a result, the total cost was formed, which already included both management costs and cost costs. The desired profit was sometimes added to this, and so the price was formed, based entirely on costs (table 1).

The absorption paradigm, despite the fact that it persists in accounting, could not survive on the market for a long time: an expensive product cannot compete in the market with cheaper ones. To what level can the price be reduced? The cost absorption paradigm did not provide an answer to this question.

Financiers began to conduct calculations differently. The variable component of all costs began to be correlated and calculated separately, including direct material and labor costs, the variable part of overhead non-production costs. This is how the variable cost was determined (Table 2). In theory, the company should not set the price below 125 monetary units. But selling a product at a price higher than 125 makes a profit. Under these conditions, all fixed costs are summed up separately and the product margin should cover them. Table 2 shows that the margin is: $203 - 125 = 78. As long as the product has a positive margin, it should be left in the product portfolio and continue to work with it. It should be noted that the variable cost calculation method has become a step forward compared to the absorption of expenses, and it has begun to be actively used in management accounting.

After the variable cost paradigm, which, in general, everyone was satisfied, came new paradigm- ABC. It turned out that many companies have problems with fixed costs: the margin seems to be very high (variable costs are low and the price is high), but the bulk of the costs are actually fixed. At this stage, the calculation of variable costs began to slip. The owners of the company were hardly satisfied with the results when it was noted in the income statement that with fixed costs of several million, margins were also several million. In this case, it is not clear whether this or that product needs fixed costs or not. Thus, the need for ABC costing arose, which made it possible to resolve issues regarding which processes the company uses to manufacture and sell products, how much they cost, and what costs accumulated within these processes can be used for cost.

In ABC costing, not all costs are variable. A significant part of them is fixed, but they can be variable in proportion to some processes associated with business activity factors.

As shown in Table 3, the overhead costs accumulated at the unit level depend on the number of hours spent on the production of the product. Costs at the level of a complex of products (batch or order) can be the costs of a company that purchases several products in one batch. There are also costs accumulated at the level of product diversification (product range), for example, the costs of developing anti-crisis products should be attributed specifically to them. In addition, there are costs accumulated at the level of the complex of clients and customers. When a company is going to, say, celebrate the holidays with its biggest customers, that expense will be part of the customer-level cost.

How do companies get to this point?

At one time, when absorbing costs, everything was simple: fixed costs were collected together, divided into the number of machine hours and, on the basis of this, were “smeared” between products. However, there was a lack of precision.

Then the financiers decided, they say, we won't think like that anymore. You need to be smarter and try to distribute costs depending on the characteristics of the operating unit. For example, protection costs will depend on the number of square meters that are protected. As a result, a system was created in which not only single overhead costs with a certain coefficient fell on the product, but also marketing costs with their own coefficient, expenses financial department- with his own, HR expenses - with his own. This is how the norms of individual centers arose, according to which overhead costs were distributed.

It soon became clear that centers are organizational units within which certain processes take place. By the way, some of the processes can be considered useful, creating added value, and some can not. On this stage it was decided to isolate them separately, to characterize as business activity and transfer overhead depending on part of this activity. They began to analyze different types of activity and determine their cost in order to cling to products. For this reason, ABC costing requires considerable detail and understanding of all processes occurring in each department.

When is ABC costing needed?

The functional cost system is used when the company is characterized by:

- a large number of products;

- many supporting processes;

- standardized process;

- periodic allocation base;

- frequency of changes in costs.

Let's turn to tables 4 and 5. Each company produces three products - Alpha, Beta and Gamma. Both of them are unprofitable at the level of $100030. Company A has a fixed cost of $133,080. Margin data for each segment of this enterprise does not provide an answer to the question of what processes are used.

Company B is also unprofitable at $100,030, but its marginal profit in each of the directions, as well as fixed costs, is much higher than that of company A.

Based on the data in the table, it is easy to determine that company B needs ABC costing more, since its fixed costs are much higher and it is difficult to understand which of them make up the cost structure. To do this, you need to divide $269,080 between the company's processes and analyze who is the client of certain processes and who uses them. By the way, an indicator that may indicate the need for ABC is the operational leverage (OL), which is calculated as the ratio contribution margin to net and reflects a measure of the company's operational risk. So, for company A, this figure is:

OLA = 33050 / (-100030) = -0.3304;

for company B it is equal to:

OLV = 169050 / (-100030) = -1.6899.

The need for ABC costing increases as the module of this indicator increases.

ABC costing technology

The first question that arises when using ABC costing is: with what coefficient should the costs be distributed? There are several options. For example, with coefficients between which there is an obvious physical connection - the more materials a department uses, the greater its purchase costs and the higher the wages of the people who are engaged in these purchases.

Therefore, purchasing costs can be carried forward depending on the cost of materials. In addition, there are also objective and investigative factors: if more people work in the department, then HRs have more work. Why not transfer HR costs by man-hours?

There are also some points that the company sets itself. For example, a certain decision is made, on the basis of which standards are determined. Thus, advertising costs are distributed based on the percentage of sales for each center. financial reporting. In addition, complex overhead cost transfer coefficients are sometimes constructed, which depend on complex formulas that take into account the values of several factors at once.

In addition, there is an arbitrary relationship, say, uniform distribution means fairness. And why not transfer the marketing costs equally to all the products that the company has, so that no one is offended. True, in this case, products with low margins will suffer.

Nor should the importance of the strategic allocation of overhead costs be underestimated when they are treated as required by the strategy. Moreover, in this case, justice should be forgotten.

Cost drivers

The list of cost drivers can be endless. Among other things, it may include, for example, the number of flowers on the windowsill, etc. People have come up with quite different cost drivers, but the most common and classic ones are:

- number of machine hours;

- number of man-hours;

- Cost of materials;

- the number of pieces of manufactured products;

- the number of square (or cubic) meters in the room;

- the total volume or part of the income received from the sale of products of a certain type;

- the number of operations performed in connection with the production of the product;

- specific specifications product;

- the part of the marginal profit that this product brings in the total marginal profit.

Building an ABC costing system

To build an ABC system, you first need to analyze all types of company activities. To do this, it is necessary, at least in general terms, to present a list of processes that occur with a certain periodicity. Then you should determine what costs the company incurs and whether they can be linked to the list of processes. After that, set the result for each activity. Their costs will form cost pools. After implementing all these actions, it will be possible to link costs to results.

Consider how this happens, say, in a company that is engaged in the general distribution of goods from one manufacturer through a centralized warehouse and a network of regional warehouses to branded end points of sale. How will this delivery take place? First, a large batch of products will go from the factory to a centralized warehouse (for example, in Kiev), then, after reloading into smaller batches, it will be distributed to regional warehouses, and from there, after the next reorganization, they will be transported in small batches to the end stores of the region (Figure 2) .

The task seems to be simple: to deliver the goods, but this process includes a huge number of service sub-processes. To calculate the cost of delivery based on ABC costing, you need to understand which costs are present during transportation, and which are in warehouses. As for delivery, the main costs at this stage will include drivers' wages, vehicle depreciation and fuel. Expenses in warehouses - wages of all personnel, depreciation of lifting and transport mechanisms, etc. After different pools of expenses have been identified (delivery pool to the central warehouse, to stores, pools of warehouse terminals), the question arises of what indicators can be used to identify each type of activity (all expenses should be tied to different types activities). The next stage is the definition of an indicator that would indicate the quality of work performance. It turns out that on the route this indicator will be ton-kilometers, in the warehouse - overloaded tons. If you know the number of tons and ton-kilometers at each stage of delivery, as well as the unit cost of these indicators, then, knowing the weight of the goods and the distance to which it should be delivered, you can determine the cost of delivery services.

To organize accounting for pools, it will be necessary for each of them to open an account similar to a regular overhead account. On the debit of such accounts, the costs attributed to this pool will accumulate, and on the credit, these costs will be transferred with a coefficient that characterizes the pool’s business activity for the cost price (in our case, transportation). You will have to open a pool for each route and several pools for each individual warehouse. You can immediately foresee the "joy" of those accountants who will have to do all this work.

Benefits and pitfalls of ABC costing

Analyzing the benefits of cost-benefit analysis of costs, it should be remembered that within such a system:

- the company pays attention exclusively to the main processes;

- all costs are considered as components of the cost;

- the company abandons the short-term division of costs into fixed and variable and focuses on what processes are needed to create a product;

- it becomes possible to identify high-cost activities, as well as those that do not create value.

The following circumstances act as peculiar pitfalls:

- ABC costing requires fairly heavy cost absorption—spreading out a large amount of fixed costs;

- additional finance department resources are needed;

- this system can be implemented in different ways: you can make every effort and paint all the pools of expenses very accurately, or you can do it not very diligently;

- the result obtained, most likely, will not show to what level the price of the product can be reduced;

- a company can get an accurate result, but it happens that too much effort is spent on it;

- the use of ABC costing does not require a concentration on individualized products that are produced for the client, but forces you to follow the principle: "Produce a mass product." But will it be compatible with marketing strategy companies?

Of course, it is almost impossible to overestimate the role of the cost-benefit system of cost analysis: in some cases, it is simply indispensable to do without it. Therefore, companies should use not only variable costing, but also ABC consulting, and also determine cost pools. In addition, it is necessary to allocate all costs by pools and stop in time when detailing ABC costing, because ABC costing, like Janus, is twofold and ambiguous.

Since this is not all that can be said about ABC costing, the authors plan to return to this topic in the future.

- Mikhailo Kolisnyk, teacher of Kyiv-Mohyla Business School

Alexander Rizenko, project editor

Continuing lighting innovative methods management accounting, this article will outline the basic principles of Activity Based Costing (or ABC) - a method that has become widespread in European and American enterprises of various profiles.

The name Activity Based Costing would be best translated into Russian as “work cost accounting”. The emergence and development of ABC corresponded to certain changes taking place in the economic structure, namely, a change in views on the methodology of cost accounting and the calculation of the cost of production. Previously, the calculation of the cost was carried out taking into account the constants (absorption costing) and variable costs(direct costing). In the first case, fixed costs are allocated to the cost of production, which thus reflects the full production costs. In the second, fixed costs are not included in the cost of production, but are written off as costs for the period. The cost of production in this case is equal to marginal costs. However, in practice, the activity of an enterprise inevitably requires a long-term attraction of resources in production, marketing, sales, and service. Therefore, despite the fact that, according to the calculations, the equality of marginal costs and income brings the maximum income, the use of the direct costing method is effective only under certain conditions. First, direct costs in the enterprise account for most of the costs; secondly, it must produce a narrow list of products (one or two types), each of which requires almost equal fixed costs. If the enterprise does not meet such requirements, cost indicators will inevitably be distorted.

Among the typical results of these distortions are such as underestimation of margins for small-scale products and overestimation - for large-scale ones, lower income indicators in financial accounting compared to managerial accounting, the apparent high profitability of technologically complex and innovative products compared to simple ones. Therefore, in order to solve the main tasks of management accounting - cost accounting and cost calculation, indicators of constant and variable costs were not very suitable.

The search for new methods for obtaining objective and reflective information about costs has led to the emergence of the ABC method.

In Activity Based Costing, an enterprise is viewed as a set of work activities. Jobs define the specifics of the enterprise. Works consume resources (materials, information, equipment) and have some result. Accordingly, the initial stage of ABC application is the definition of the list and sequence of work in the enterprise. This is usually done by decomposing complex work operations into their simplest components, in parallel with the calculation of their resource consumption. Within the framework of the ABC, three types of work are distinguished according to the way they participate in the release of products: Unit Level (or piece work), Batch Level (batch work) and Product Level (product work). Such a classification of costs (works) in ABC systems is based on the experimental observation of the relationship between the behavior of costs and various production events: the release of a unit of production, the release of an order (package), the production of a product as such. At the same time, another important category of costs is omitted, which does not depend on production events - costs that ensure the functioning of the enterprise as a whole. To account for such costs, a fourth type of work is introduced - Facility Level (general business work). The first three categories of work, or rather, the costs of them, can be directly attributed to a specific product. The results of general economic work cannot be accurately assigned to one or another product, therefore, various algorithms have to be proposed for their distribution.

Accordingly, in order to achieve an optimal analysis, resources are also classified in the ABC: they are divided into those supplied at the time of consumption and supplied in advance. The former include piecework wages: workers are paid for the number of work operations that they have already completed; to the second - fixed wages, which is negotiated in advance and is not tied to a specific number of tasks. This division of resources makes it possible to organize a simple system for periodic reports on costs and income, solving both financial and managerial tasks.

All resources spent on a work operation constitute its cost. At the end of the first stage of the analysis, all the work of the enterprise must be accurately correlated with the resources necessary for their implementation. Let us give an example (for simplicity of explanation, we will consider the cost item as the equivalent of a resource). In some cases, the cost item clearly corresponds to some kind of work.

“Salary of the Procurement Department” is included in the cost of the “Procurement” work operation. But, for example, “Rent office space” should be distributed in proportion to the consumption of the work “Supply”, “Production”, “Marketing”, etc. It often happens that a resource cannot be correlated with a work operation and, therefore, is wasted.

However, a simple calculation of the cost of certain works is not enough to calculate the cost of the final product. According to ABC, the work operation must have an index-measurement of the output result - the cost driver. For example, the cost driver for the “Supply” cost item would be “Number of purchases”; for the article “Settings” – “Number of adjustments”. The second stage of application of the ABC is to calculate the cost drivers and indicators of their consumption of each resource. This consumption figure is multiplied by the cost per unit output of the work. As a result, we get the amount of consumption of a particular work by a particular product. The sum of consumption by a product of all works is its cost price. These calculations constitute the third stage practical application ABC methods.

Presenting an enterprise as a set of work operations opens up wide opportunities for improving its functioning, allowing for a qualitative assessment of activities in such areas as investment, personal accounting, personnel management, etc.

Corporate strategy implies a set of goals that an organization wants to achieve. The goals of the organization are achieved by the performance of its work. Building a work model, determining their relationships and execution conditions ensures the reconfiguration of the business process of the enterprise for the implementation of the corporate strategy. ABC, ultimately, increases the competitiveness of the enterprise, providing accessible and operational information to managers at all levels of the organization.

An even greater effect in cost optimization can be achieved by using ABC in combination with another methodology, namely Life Cycle Costing, the concept of cost accounting. life cycle(or, in the Russian equivalent, the concept of life cycle cost accounting). This approach was first applied in the framework of government projects in the defense industry. The cost of the entire life cycle of a product, from design to retirement, was the most important indicator for government agencies, since the project was funded based on the full cost of the contract or program, and not on the cost of a particular product. New production technologies have provoked the transfer of LCC methods to the private sector. There are three main reasons for this transition: a sharp reduction in the life cycle of products; increase in the cost of preparation and launch into production; almost complete definition financial indicators(costs and revenues) at the design stage.

Technological advances have shortened the life cycle of many products.

For example, in computer technology the time of production of products became comparable with the time of development. High technical complexity products leads to the fact that up to 90% of production costs are determined precisely at the R&D stage. The most important principle of LCC, therefore, can be defined as “forecasting and controlling the costs of manufacturing a product at the design stage”.

This approach clearly illustrates the commonality of approaches in various sections of cost management. For example, if the LCC mandates that costs be managed at a given stage production cycle taking into account the following, then the strategic cost analysis with the same goals considers not just the value chain within the enterprise, but the complete industry value chain (DSP). Relatively strategic analysis costs, examples were given, revealing the need complex analysis DSP. For LCC, the situation can be illustrated as follows.

The plant produces three types of products: A, B, C. At the stage of designing a complex technical product A, the issue of the volume and level of detail is decided. technical description. Let's assume that the development detailed instructions maintenance will cost 250 million rubles. Plus, the publication for each set of equipment is another 7 thousand rubles. Moreover, the presence or absence of instructions will not affect the sale price (1 million rubles) in any way, since warranty obligations include service with a visit to the customer. That is, the consumer will not be very interested in the accompanying documentation because of the confidence in technical support. The service department of the enterprise works on a salary basis and the cost of maintaining it is 50 million rubles per month.

It follows from the condition that the product life cycle at our enterprise consists of the following stages:

Design;

Production - estimated circulation of 10,000 items in two years;

The use of traditional management accounting methods - marginal analysis - prescribes to refuse to issue maintenance instructions, as this will lead to an increase in marginal income by 7,000 rubles per unit of output. If we include development costs in the cost price, then the effect will increase by 250,000,000/10,000 = 25,000 rubles.

The application of cost management methods prescribes to analyze the impact of issuing / not issuing instructions on costs throughout the life cycle of the product. Regarding our example, it is necessary to consider the service maintenance stage, that is, to evaluate the impact management decision design stage to service stage costs. This is where the fundamental difference between simple cost accounting and cost management comes into play.

In the marginal analysis, we took service costs as a constant value and did not include it in consideration because of its insignificance in relation to the decision being made. In terms of cost management, this is a serious omission. Accepted into the analytical scheme service maintenance will require the solution of the following tasks: determination of factors affecting service costs (cost drivers); allocation of service costs to the cost of the product life cycle in proportion to the consumption of the cost driver; calculation and analysis of the costs of the life cycle of the product, taking into account changes in its design (the appearance of instructions).

The volume of tasks shows the need for a comprehensive application of cost management methods. In this case, to use LCC analysis, it is necessary to rebuild the cost accounting technique - to apply ABC.

Let the cost driver for the activity of the service department be the number of calls per month. average cost one call is 40 thousand rubles (average transportation costs plus hourly staff rate multiplied by the average call time). The average number of calls is 1000 per month and they are distributed as follows:

product A (issue without service instructions) - 600; item B and C, 200 each (with instructions).

The difference of 50,000,000 - 40,000 * 10,000 = 10,000,000 rubles between actual and estimated costs is a reserve: the maintenance of an additional 2 managers for emergency cases. By allocating the variable component of service costs to the cost of products in proportion to the use of the cost driver (and not to the volume of output or the size of direct production costs), we get an increase in the cost of product A by 40,000 * 600 = 24 million rubles per month. Using the ABC accounting technique, one can estimate the impact of the preparation of instructions on the total amount of costs.

From the experience of manufacturing and servicing products B and C, it follows that the release of operating instructions will reduce the number of calls from 600 to 200 per month, that is, it will lead to a reduction in service costs by 400 * 40,000 = 16 million rubles per month. The life cycle of product A is 2 years, so service costs will decrease for the entire cycle by 16 * 24 = 384 million rubles. The total additional costs at the design and production stage will amount to 250,000,000 + 7,000 * 10,000 = 320 million rubles, which is 384 - 320 = 64 million rubles lower than the savings on service. Thus, the joint application of the LCC and ABC methods revealed the need and effectiveness of issuing operating instructions.

Successful work in the conditions of global competition requires not only constant updating of the range and quality of products, but also a thorough analysis of the enterprise's activities to reduce unnecessary or duplicated functions (works). Often, enterprises, pursuing the goal of reducing costs, adopt a policy of total cost cutting. Such a solution is the worst, since under such a policy, all work is subject to reduction, regardless of its usefulness. A general reduction can reduce the performance of essential work, leading to a deterioration overall quality and performance of the enterprise. A drop in productivity will lead to another wave of layoffs, which will once again reduce the efficiency of the enterprise. Attempts to get out of this vicious circle will force the enterprise to raise costs above the initial level. The ABC methodology, combined with value chain analysis, allows an enterprise not only to reduce costs line by line, but to identify excess resource consumption and redistribute them in order to increase productivity.

Activity based costing (“accounting by type of activity” or “calculation of costs based on business processes”) - calculation of cost by volume of economic activity.

Activity Based Costing or ABC Method , widely used in European and American enterprises of various profiles.

In the literal sense, this method means "accounting for costs by work", i.e. functional cost accounting.

In Activity Based Costing, an enterprise is viewed as a set of work activities. The initial stage of applying ABC is to determine the list and sequence of work in the enterprise, which is usually carried out by decomposing complex work operations into their simplest components, in parallel with the calculation of their resource consumption. Within the framework of the ABC, three types of work are distinguished according to the way they participate in the production of products: Unit Level (piece work), Batch Level (batch work) and Product Level (product work). Such (work) in ABC systems is based on the experimental observation of the relationship between the behavior of costs and various production events: the release of a unit of production, the release of an order (package), the production of a product as such. At the same time, another important category of costs is omitted, which does not depend on production events - costs that ensure the functioning of the enterprise as a whole. To account for such costs, a fourth type of work is introduced - Facility Level (general business work). The first three categories of work, or rather, the costs of them, can be directly attributed to a specific product. The results of general economic work cannot be accurately assigned to one or another product, therefore, various algorithms have to be proposed for their distribution.

Accordingly, in order to achieve an optimal analysis, resources are also classified in the ABC: they are divided into those supplied at the time of consumption and supplied in advance. The former include piecework wages: workers are paid for the number of work operations that they have already completed; the second - a fixed salary, which is negotiated in advance and is not tied to a specific number of tasks. This division of resources makes it possible to organize a simple system for periodic reports on costs and income, solving both financial and managerial tasks.

All resources spent on a work operation constitute its cost. At the end of the first stage of the analysis, all the work of the enterprise must be accurately correlated with the resources necessary for their implementation. In some cases, the cost item clearly corresponds to some kind of work.

However, a simple calculation of the cost of certain works is not enough to calculate the cost of the final product. According to ABC, the work operation must have an index-measurement of the output result - the cost driver. For example, the cost driver for the “Supply” cost item will be “Number of purchases.

The second stage of application of the ABC is to calculate the cost drivers and indicators of their consumption of each resource. This consumption figure is multiplied by the cost per unit output of the work. As a result, we get the amount of consumption of a particular work by a particular product. The sum of consumption by a product of all works is its cost price. These calculations constitute the 3rd stage of the practical application of the ABC methodology.

I note that the presentation of the enterprise as a set of work operations opens up wide opportunities for improving its functioning, allowing quality assessment activities in areas such as investment, personal accounting, personnel management, etc.

Corporate strategy implies a set of goals that an organization wants to achieve. The goals of the organization are achieved by the performance of its work. Building a work model, determining their relationships and execution conditions provide a reconfiguration of the business process of the enterprise to implement the corporate strategy. ABC, ultimately, increases the competitiveness of the enterprise, providing accessible and operational information to managers at all levels of the organization.

An even greater effect in cost optimization can be achieved by using ABC in combination with another technique, namely - the concept of life cycle costing (Life Cycle Costing - LCC).

This approach was first applied in the framework of government projects in the defense industry. The cost of the entire life cycle of a product, from design to retirement, was the most important indicator for government agencies, since the project was funded based on the full cost of the contract or program, and not on the cost of a particular product. New production technologies have provoked the transfer of LCC methods to the private sector. There are three main reasons for this transition: a sharp reduction in the life cycle of products; increase in the cost of preparation and launch into production; almost complete definition of financial indicators (costs and incomes) at the design stage.

Technological advances have shortened the life cycle of many products. For example, in computer technology, the time of production of products has become comparable to the time of development. The high technical complexity of the product leads to the fact that up to 90% of production costs are determined precisely at the R&D stage. The most important principle of the concept of life cycle costing (LCC), thus, can be defined as "forecasting and managing the costs of manufacturing a product at the design stage".

Successful work in the conditions of global competition requires not only constant updating of the range and quality of products, but also a thorough analysis of the enterprise's activities to reduce unnecessary or duplicated functions (works). Often, an organization, in pursuit of cost reduction goals, adopts a policy of total cost reduction. Such a solution is the worst, since under such a policy, all work is subject to reduction, regardless of its usefulness. A general reduction can reduce the performance of essential work, which will lead to a deterioration in the overall quality and productivity of the enterprise. The drop in productivity, in turn, will lead to another wave of layoffs, which will once again reduce the efficiency of the organization. Attempts to get out of this vicious circle will force the company to raise costs above the initial level.

The ABC methodology allows the enterprise not only to reduce costs line by line, but to identify excess resource consumption and redistribute them in order to increase productivity.

Thus, this method has a number of advantages:

1. It allows you to analyze overheads in detail, which has great importance for management accounting.

2. The ABC method makes it possible to more accurately determine the cost of unused capacity for periodic write-off to the profit and loss account. The cost of a unit of production, estimated using this method, is the best financial assessment resources consumed, as it takes into account complex alternative ways of defining relationships between production and resource use.

3. The ABC method allows you to indirectly assess the level of labor productivity: a deviation from the amount of resources consumed, and therefore from the release or comparison of the actual level of cost sharing with the volume that could be possible with real resource provision.

4. The ABC method not only delivers new information about costs, but also generates a number of non-financial indicators, mainly measuring the volume of production and determining the production capacity of the enterprise.

Based on the foregoing, we note that introduction of the ABC system into work practice Russian enterprises would provide a reliable calculation of the cost of specific products, which will significantly increase the objectivity of assessing the profitability of products. Ultimately, the use of ABC will increase the competitiveness of the enterprise, since it provides access to operational information at all levels.

Popular

- Photo Print Pilot - print photos at home

- Epson Easy Photo Print - photo printing application

- How to behave in a job interview

- What is the difference between a supermarket and a hypermarket?

- Feathered evil: what happens in the nest where the cuckoo threw her egg

- Eagle owls and owls How to determine the sex of a long-eared owl

- What year did the Internet appear

- Owl as a pet How to distinguish the gender of an owl

- Birds of the Moscow Region (photo and description): large predators and small birds A bird that makes different sounds

- The Board of Directors of the PIK group of companies re-elected the board of the company Aleksey Kozlov Pik