How to make a business plan for an airline. How to open your own airline from scratch? Organization of financial planning

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Posted on http://www.allbest.ru/

COURSE WORK

BUSINESS PLAN FOR THE PRODUCTION OF A MULTI-PURPOSE FOUR-SEAT AIRCRAFT

1.3 Products - four-seater aircraft "Farmer"

3. Production plan

Bibliography

The main goal of this project is the development and organization of production of a multi-purpose four-seat aircraft "Farmer" for aviation chemical work (ACH).

An objective prerequisite for the implementation of this project, firstly, is that today in Russian Federation there is a tendency towards the rapid development of the sector of private and corporate aircraft and small class helicopters - 4-6 seaters. It is these aircraft that make up 65% of the world's aircraft fleet. Demand in the country is significant, but there is no serious offer in the domestic aviation industry today.

Secondly, similar foreign-made aircraft cost from 230,000 to 560,000 euros, while an aircraft of our production will cost from 160,000 euros.

Thirdly, the specifics of Russia (poorly developed networks of well-equipped airfields) make the use of imported equipment limited.

1. General characteristics and sectoral features of the functioning of the organization

Deltaclub KuAI occupied in the 70s and 80s. of the last century, leading positions in the field of hang gliding, development and production of hang gliding equipment not only in the Volga region, but also in the then USSR. There were also sporting achievements, and the well-known family of wings "Vector", but by the 95-96s the institute began to lack money, and then the place for the club and the people left for free bread, having spent more than one year trying to defend their native the basement of dormitory No. 3 of the institute, which was equipped with their own hands from scratch. The great battle with the firefighters, plumbers, safety inspectors and the administration of the Institute was lost.

A nomadic gypsy life began in garages, basements, children's clubs of amateur technical creativity, which ended on the street. Potapova, house 2, owned by the well-known designer of flying boats "CHE" in Russia, Boris Chernov. Here they found a fairly reliable haven for many years.

Once again, "out of habit", having improved the premises and the adjacent territory (which took about a year), the company began to eliminate its backlog from our colleagues in Russia, who did not waste time all these years.

By this time, the hang glider in agriculture has already ceased to be considered a curiosity and has proved its ability to earn money, and odd jobs on “rides”, aerial photography, and training did not make a difference in finances. Formed its own concept of a chemical trike. Two seasons in the fields and 25,000 ha. behind the back - it meant something back then. And although I was always more drawn to the operation of aircraft (that is, to "pure" flights), the diploma of the Aviation Institute and the rich past of the KuAI hang-club required the use of forces in the field of development and production. This is one reason, and most importantly - there was not enough money to buy decent equipment. (Yes, and every decent designer considers only his own to be a "decent" technique). This is how the hang glider "Agropatrol-04" was born.

Now the company has many thousands of hectares behind it, there are a dozen aircraft, even more experienced chemical pilots.

The company "Aviaspektr" manufactures and sells hang gliders, as well as components: training and chemical trolleys, used and new, used Strem and Stranger wings, ROTAX 447, 462, 503 engines, dashboards, floats, skis, wooden propellers 2 bladed.

Many years of experience in using linear-functional management structures have shown that they are most effective in those organizations that produce a relatively limited range of products, where the management apparatus performs frequently recurring tasks and functions.

The connections in the control scheme are linear and functional. Linear links reflect movement management decisions and information between line managers, that is, persons who are fully responsible for the activities of the enterprise as a whole or for all types of work and functions of the enterprise performed by divisions.

The role of top-level managers is to determine the overall strategy of the enterprise, and middle-level and primary managers specify the ideas and strategic tasks outlined by top-level managers, find specific ways, means and methods for optimally solving the tasks set, and exercise operational control over the progress of work performed.

The form of ownership of the analyzed enterprise is a limited liability company.

The supreme management body of the company is the director and founder, whose exclusive competence includes deciding on the issues of determining the main directions of social and production (economic) development, approving plans and reports on their implementation.

Operational management of the enterprise is carried out by the director, who:

independently solves the issues of the enterprise;

acting on his behalf;

has the right to sign and dispose of property;

hiring and dismissing employees of the enterprise;

bears material and administrative responsibility for the accuracy of the data of the accounting and statistical reports.

The chief accountant of the company maintains accounting records of the company's activities, settlements with tax authorities.

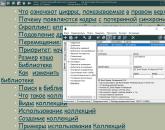

The management bodies and organizational structure of the enterprise are shown in Figure 1.

The average number of employees of the enterprise in 2012 is 21 people.

The company employs the following employees:

Director, Chief Accountant Keywords: enterprise management, conclusion of contracts, accounting, settlements with tax authorities;

Chief engineer and engineer: the activity is related to the design of the company's main products. Perform technical calculations related to repair and operation;

Technologists: perform technological calculations, monitor compliance with the technologies of repair and maintenance work at the enterprise, operate technological equipment for control.

Workers: activities related to the repair and replacement of equipment on hang-gliders;

Drivers: activity is expressed in the delivery of people and goods to facilities, the operation of vehicles.

Rice. 1 The structure of the enterprise Aviaspectr LLC

1.2 Idea of the proposed project

The successful use of the aircraft is facilitated by a comfortable cabin, excellent maneuverability, simplicity and ease of piloting, which is very important in extreme flights near the ground.

Requirements for the qualification of the pilot are minimal - it is necessary to have a permit to perform aviation chemical work.

Aircraft maintenance during operation is carried out after 50 hours, then after 100 (i.e. 50, 100, 200, etc.).

Requirements for equipment for maintenance - you must have a permit from our company.

1.3 Products - multi-purpose four-seater aircraft "Farmer"

The projected aircraft is being created at the level of world standards both in terms of its performance characteristics (TTX) and in terms of reliability. General form aircraft and its performance characteristics are shown in Figure 2.

The concept of the aircraft - achieving high cruising performance combined with an increased level of comfort, has a graceful and dynamic silhouette that creates a pleasing impression on the eye.

The aircraft is made according to the classic high-wing scheme with two Austrian-made Rotax - 912S engines, with a power of 100 hp each. each mounted on the wing, and "T" - shaped tail. Automotive gasoline AI-95 is used as fuel.

"Farmer" - progressive, modern model. This is a new unique style that combines a bright appearance, high flying specifications with high reliability and safety.

The aircraft can be used to extinguish fires, decontaminate surfaces, and transport cargo.

Rice. 2 The main characteristics of the aircraft

2. Market and assessment of aircraft competitiveness

Time is one of the most valuable aspects of our life. Development modern business, its wide geography today requires business man use of high-speed modes of transport. Mobility, speed and comfort are the key components of light aviation.

Recent years have been marked by an increase in the popularity of light aviation, which has led to its great spread in the world. Thanks to this, light aviation today plays an important role in the economy of Western countries.

Light aviation is an excellent business tool. But not only businessmen need efficiency. Politicians, athletes, artists and just travelers sometimes need comfort and mobility.

Light aviation is complete freedom from regular flight schedules, time frames and territorial boundaries.

Light aviation is an opportunity to control your business, regardless of location. On board many executive aircraft there is a telephone connection and the Internet.

In addition, light aviation aircraft are ideal for search missions, surveillance, patrolling, and training flights.

Another important quality light aviation is the ability of aircraft to use small airfields, sometimes with poor coverage, as well as airports of small settlements, in which, due to their commercial unprofitability, flight routes are not provided or are operated at long intervals.

However, even with all the above advantages, the number of aircraft of this class in Russia is quite small. What are the reasons?

Firstly, the lack of aircraft of this class of domestic production.

Secondly, high prices for similar foreign-made aircraft. The well-known four-seat all-composite aircraft SR20 of the American company Cirrus Design costs $250,000 in the basic configuration, while the maximum cost is $280,000. Another example is the DA 40-180 aircraft from Diamond Star, which costs up to $350,000.

Table 1 Comparative characteristics aircraft

|

Quantity |

payload |

Quantity Engines |

Speed maxim-i, |

Range flight poppy |

Price, |

||||

|

heavenly |

|||||||||

|

heavenly |

|||||||||

|

heavenly |

|||||||||

|

Kill-paradise |

|||||||||

|

Designed self- |

Kill-paradise |

Thus, at present, the market for aircraft of this class in Russia is practically not filled.

3. Production plan

Long-term implementation strategy investment project is aimed at organizing the production of aircraft in a short time in the volumes necessary to meet the forecasted demand with minimal costs for development work, pre-production and serial production itself.

For the purpose of unification, the main components and assemblies for various modifications of the aircraft are planned to be manufactured using the same tooling.

In the process of pre-production, a transition was made to new methods of organizing production using automatic design and pre-production systems (CAD / CAM), which will lead to a further reduction in production costs and improvement of management and production technology. The planned production volume from 2015 is 6 aircraft per year.

The aircraft and chemical spray nozzle system are designed for ultra-low volume spraying (ULV) technology with a chemical application rate of about 2-10 l/ha. It is the use of this technology that allows small and inexpensive aircraft to successfully compete with traditional agricultural aircraft. A ground-based refueling complex has been created, which prepares the chemical mixture and allows refueling under pressure, which reduces the time for refueling the aircraft and increases the safety of work.

During the chemical work, the maximum productivity of the aircraft was revealed - 1800 hectares per day at a rate of chemical consumption of 7 l / ha, and at a rate of 3 l / ha - 2800 hectares per day.

To achieve high cruising speed (up to 300 km/h), the following measures were taken:

The wing is cantilever, using a modern laminar profile with reduced sensitivity to pollution. Mechanization - retractable flaps and hovering ailerons, which allows you to get good takeoff and landing characteristics.

Laminar profiles are also used in the vertical and horizontal plumage.

The aircraft landing gear is retractable.

The engines are equipped with variable pitch propellers, which allows maintaining a high efficiency of the power plant in the entire range of operating speeds.

Koki propellers have an increased diameter, which reduces the bottom resistance of the motor nacelles.

The fuselage has a minimum washed surface for a given cabin dimensions. Its shape provides a reduced level of resistance. The created silhouette of the aircraft combines functionality and grace with aerodynamic perfection, thanks to which excellent speed characteristics are obtained.

In the design of the aircraft, along with fiberglass, graphite-epoxy composite materials are used, which makes it possible to increase the weight perfection of the aircraft.

Studying the materials on aircraft, it can be seen that in the field of manufacturing aircraft weighing up to 3.5-4 thousand kg, over the past 5-8 years, many companies have appeared that focus on the production of aircraft from composite materials (CM).

Comparing modern CM with traditional materials (steel, Al, Ti), a number of advantages of CM can be distinguished:

The number of parts in an aircraft structure made of CM is an order of magnitude less than in traditional metal structures. This results in a much shorter production cycle and, as a result, a reduction in the cost of production.

The ability to create surfaces of double curvature without expensive tooling and equipment. As a result, appearance CM aircraft are generally much sleeker and more attractive than metal aircraft, and it is well known that in private and commercial aviation, the exterior (appearance) of an aircraft largely determines customer demand.

The aerodynamic perfection of aircraft made of CM is higher, since at speeds up to 400-450 km/h the main part of the resistance is frictional resistance, and the degree of roughness of CM surfaces is significantly lower than that of riveted metal surfaces.

The number of issues related to the corrosion resistance of the structure is significantly reduced.

The resource characteristics of CM structures are quite high. So the world leader in the production of aircraft from CM "Diamond" establishes the first inspection of the airframe parts of its aircraft after 6 thousand flight hours.

The spacious aircraft cabin (length - 2.8 m, width - 1.24 m and height - 1.25 m) with excellent visibility, ventilation and heating system provides maximum comfort and the possibility of excellent health to the pilot and passengers. The high level of comfort is also determined by the location of the propellers at a considerable distance from the cabin.

The following equipment is installed on the aircraft:

control system of the main aerodynamic organs - mixed type;

control of takeoff and landing mechanization, rudder trimmers, landing gear, VIShs, doors of the engine cooling system - electromechanical;

14 V DC electrical system;

flight and navigation, radio communication equipment;

satellite navigation system;

a high-speed parachute rescue system that allows you to rescue the aircraft together with the crew in emergency situations.

The safety of the aircraft is ensured, among other things, by compliance with the requirements of the AP-23 airworthiness standards.

The operation of the aircraft is carried out according to the state, maintenance can be carried out in non-aerodrome conditions at minimal cost.

In view of the low kilometer fuel consumption (0.14 l / km at a speed of 260 km / h), as well as the presence of a spacious comfortable cab with good overview and the possibility of accommodating various additional equipment the aircraft is ideal for search tasks, surveillance, patrolling.

4. Financial plan

This section of the business plan defines, interprets and analyzes the financial implications of the implementation of the investment project, which may be relevant to the decision to invest in it.

The initial calculation period of the project is 2014.

Financial and economic calculations for the project were carried out in rubles. The initial data (the cost of materials, semi-finished products, finished components, wages and other costs and expenses), estimated in rubles, are taken as of November 2012.

4.1 Production costs, calculation of the planned cost of the product

Conducted feasibility studies of the total cost of manufacturing the Farmer aircraft showed the following:

Investments, including costs associated with the development of design and technological documentation, technological preparation and certification of production, the construction of prototype aircraft and certification tests, amount to 5,950 thousand rubles .

Table 2 Costs for completion of development work and aircraft certification

Let's write out the production costs according to the costing items per unit of output:

1. Article "Basic materials", etc.

Z \u003d 2800 thousand rubles.

2. Expenditure items: "Basic salary of the main workers", "Additional salary of the main workers", "Deductions for social insurance". aircraft plan product

The basic salary of the main workers is 180 thousand rubles.

Additional salary of the main workers - 150 thousand rubles.

Social contributions insurance is established by law in the amount of 30% to general fund salaries:

Social services = 99 thousand rubles.

ZP = 429 thousand rubles.

3. Overhead costs (for depreciation and operation of equipment and shop overheads):

a) Expenses for depreciation and operation of equipment and, in general, fixed assets, are determined by summing up the norms of depreciation for renovation and amount to 300 thousand rubles.

b) Workshop overheads when calculating the cost estimates for production are taken equal to 100% of the tariff wages main workers per year;

Invoice shop = 330 thousand rubles (per unit of production).

Invoicing shop = 330/6=55 thousand rubles

Table 3 Production costs by calculation items per unit of output

The total cost of the annual release program N g. \u003d 6 pcs.,

With total \u003d 6x 3584 \u003d 21,504 thousand rubles.

When calculating the amount of investment, it is necessary to take into account the cost of the annual production program and one-time costs for development work and certification, thus, we obtain the amount of required investment: 21504+5950=27,454 thousand rubles.

4.2 Calculation of profit and profitability of the product

Let's calculate the planned profit, it is determined by the profitability of the product, which we will take equal to 50%

P \u003d (R ed. x C full). /100

where P is profit per unit of product,

R ed - product profitability, 50%,

VAT - value added tax, 18%;

C full - factory cost of manufacturing the product;

P unit =1792 thousand rubles.

The entire profit fund (for the entire production program) depends on the planned profit per unit of product:

P U sq. \u003d P x N sq. \u003d 1792x t6 \u003d 10,752 thousand rubles.

Wholesale price = 3584 x 1.18 x 1.5 = 6344 thousand rubles.

4.3 Calculation of investment performance indicators

Calculation of net present value (NPV).

We will calculate for 3 years.

Investment amount - 27,454 thousand rubles.

Investment income in the first year: 10,792 thousand rubles;

in the second year: 10,792 thousand rubles;

in the third year: 10,792 thousand rubles;

Consider the possibility of implementing the project at discount rates (it is necessary to determine the discount rate at which NPV is positive and the rate at which NPV is negative). Thus, if NPV is greater than 0, then the investment is economically viable, and if it is less than 0, then the investment is not economically profitable (that is, an alternative project, the return of which is taken as the discount rate, requires less investment to obtain a similar income stream).

Let's recalculate cash flows in the form of current values at r = 7%:

PV 1 = 10792 / (1 + 0.07) = 10278

PV 2 = 10792 / (1 + 0.07) 2 = 9810

PV 3 = 10792 / (1 + 0.07) 3 = 9384

NPV(7.0%) = 29472-27,454 = 2018 thousand rubles

net present value is 2.018 million rubles.

Let's recalculate cash flows in the form of current values at r = 10%:

PV 1 = 10792 / (1 + 0.1) = 9810

PV 2 = 10792 / (1 + 0.1) 2 = 8993

PV 3 = 10792 / (1 + 0.1) 3 = 8301

NPV(10.0%) = 27,104-27,454 = -350 thousand rubles

In our case, the project will be effective at a discount rate of 7%.

Calculation of the profitability index (PI).

Profitability Index (PI) is calculated using the following formula:

where NCFi is pure cash flow for the i-th period,

Inv - initial investment

r - discount rate (cost of capital raised for the investment project).

PI = 29472/27454 = 1.07

Calculation of the payback period of investments.

Determine the period after which the investment pays off.

The amount of income for 1 and 2 years: 10278 + 9810 \u003d 20088 thousand rubles. which is less than the investment.

The amount of income for 1,2,3 years: 10278 + 9810 + 9384 = 29472 thousand rubles, which is more than the amount of investments.

Since cash inflows are evenly distributed throughout the period (by default, cash is assumed to be received at the end of the period), it is possible to calculate the balance from the third year.

Balance = (1 - (29472-27550/9384) = 0.8 years (10 months)

The payback period is 2 years and 10 months.

Calculation of internal rate of return (IRR):

IRR = r a + (r b - r a) * NPV a /(NPV a - NPV b) = 7 + (10 - 7)*2018 / (2018-(-350)) = 8.5%

The internal rate of return is 8.5%, which exceeds the effective barrier rate of 7%, hence the project is accepted.

We present all the calculations in the form of a table.

Table 4 Planned project performance indicators

Thus, the project can be accepted for implementation, since at a discount rate of 7%, the net present value is positive. The payback period is 2 years 10 months. The profit index is greater than 1.

Rice. 3 Break even point

Bibliography

1. Zelensky, A.V. Drawing up a business plan: Proc. allowance. Zelensky A.V., Krasnoshchekova G.F. - Samara: Department of KREA, 2001.-76 p.

2. Goremykin, V.A. Business - plan: methodology developed. 45 real. sample business - plans / V. A. Goremykin. - M., 2006 - 348 p.

3. Lansky, A.M. Business planning: method. instructions / comp. A. M. Lansky, D. E. Pashkov. - Samara: Publishing House of SSAU, 2008. - 42 p.

4. Kovalev, V.V. The financial analysis: studies. allowance / V.V. Kovalev, - M.: Finance and statistics, 1999.-511 p.

5. Savitskaya, G.V. Methodology complex analysis economic activity: studies. allowance / G.V. Savitskaya - 4th ed. - M.: INFR-M, 2007. - 384 p.

6. Lieberman, I.A. Analysis and diagnostics of financial and economic activities: textbook. allowance / I.A. Lieberman. 3rd ed. - M.: RIOR, 2004. - 159 p.

Hosted on Allbest.ru

...Similar Documents

Statistical design of aircraft appearance. Purpose, tactical and technical requirements for the aircraft, conditions for its production and operation, determination of aerodynamic and technical characteristics. Development of technology for the manufacture of aircraft parts.

thesis, added 11/21/2011

The procedure for designing a multi-purpose aircraft M 101 T "Gzhel", its principle of operation and purpose, main technical characteristics. Functional purpose and technical description of the stabilizer toe, assessment of its manufacturability and drawing up a diagram.

test, added 11/26/2009

Development of the lever system light aircraft type HAZ-30. Calculation of the reward cyclogram for a typical flight profile. Determination of directive stresses. Plan-prospect of the certification basis. Analysis of harmful and dangerous factors in the laboratory hall of LIP.

thesis, added 01/31/2015

Obtaining by calculation the aerodynamic characteristics of the Tu-214 aircraft in the range of altitudes and flight Mach numbers. Calculation of the geometric characteristics of the aircraft. Selection of the aerodynamic profile of the wing and plumage. Flight subcritical polar.

term paper, added 02/15/2014

Modernization of equipment at OAO Khlebozavod No. 1, Voronezh. Making changes to the scheme of operation of the structure for the development of dough by double or non-dough methods. Business plan for the implementation of the project, calculation of the volume of production to achieve breakeven.

thesis, added 01/07/2010

Development of a business plan as a step towards attracting loans or investments. Determination of the main streams of payments in the implementation of a business plan in JSC "Yaransk Dairy Plant", sources of financing, its effectiveness for production.

term paper, added 02/25/2009

Organization of enhanced oil recovery using simusan polysaccharide. general information on the project for the manufacture of this substance. Marketing strategy plan. Types of risks and their management. Financial plan, calculation of production efficiency.

term paper, added 02/08/2016

Study of the operating conditions of the engine nacelle of a subsonic passenger aircraft. product design requirements. Structural parameters of the air intake. Modeling of the work of the power frame. Technical description aircraft engine nacelle air intake.

term paper, added 03/22/2016

Selecting the type of production. Calculation of the annual product program in production. Execution Synchronization Analysis technological process. Determination of the number of jobs for each operation. Work schedule for discontinuous production.

term paper, added 06/13/2014

Economic substantiation of the projected production of cadmium parts. Calculation of the equipment operating time fund, investments in capital construction; wage fund, raw materials, materials, fuel, energy. Equipment maintenance costs.

The aviation market is small and highly competitive. But still, on it you can find niches that small companies will be able to occupy. It's about about handling, ground handling of flights. Having invested from 5 to 10 million rubles in your business, in a month you can reach “point zero” and receive the first commission. It is especially valuable to hear about how to organize this business from those who directly use the services of handlers - from the owners of airlines. Azat Khakim, Chairman of the Board of Directors of Tulpar Air Group, a popular expert on the Russian aviation market, told the BIBOSS portal about the requirements for handlers and what is the guarantee of their long-term successful work in the market.

Where to start?

The hero of our article notes that opening an airline in our time is a troublesome and thankless task. This business is so serious and low-margin that newcomers have nothing to do in it. It could be a hobby for billionaires - they can afford to buy an airline and play aviation. And there are such examples, but these stories usually end in failure. To open an airline from scratch, you need at least 150-200 million rubles at the initial start, and this is just to start, and it’s not a fact that these funds can be returned. In recent years, a series of disasters in the Russian aviation market has led the Federal Air Transport Agency to aim at reducing the number of airlines and their consolidation. Therefore, Azat Hakim does not advise anyone to open an airline now. He also identified several more niches in the market that he does not advise startups to go into. The catering market is highly competitive. Training training will require huge investments: one simulator costs as much as an airplane. Board maintenance is a low-margin business that requires high qualifications. The creation of aircraft interiors will require the creation of a whole mini-factory and the recruitment of a staff of highly professional engineers, and given the fact that there are almost no "unattached" customers on the market, it will be difficult to find orders.

But it is not all that bad. If the aviation industry attracts the attention of an entrepreneur, then there is a niche in which a beginner can try his hand. This is handling (from the English ground handling) - ground handling of flights. These are a kind of intermediaries that represent the interests of airlines in relations with airport enterprises. The employees of the handling company - supervisors - undertake the organization of the flight, negotiate with the airports about the takeoff and landing of the aircraft, meet and escort the crew, control the supply of food, maintenance, refueling and cleaning the board, provide the crew with transport and hotel rooms. big money to run such a business, you do not need. However, the competition is high, and in order to be allowed into the airport, you must be believed, you must have connections and a reputation.

The owner of such a business must first of all understand how the aviation industry works, how flights are organized, how an airport works. He must know the technical aspects of the work of the crew, the time of departure, arrival. He must know the technology of preparing for a flight, what follows. If he knows all this, for example, because he studied as an aviator, graduated from an aviation institute, worked somewhere in the industry, then he will be able to negotiate with the airport. You can start without an office - regulate processes from home, even from a car. But as it grows, it will be necessary to rent a room inside the airport so that there are supervisors who meet the crew and serve the aircraft.

As a rule, the handlers themselves do not clean the aircraft cabins and do not maintenance. They simply take care of this from the airlines and pay for takeoffs and landings to airports, negotiate with cleaning companies, maintenance companies, catering companies, fuel companies, order minibuses for the crew. It is unprofitable for the airlines themselves to maintain a huge staff of workers who would deal with all this incredible number of issues at each airport. Yes, and it would be difficult to staff it: it requires completely different qualifications, different experience and different knowledge, and the training of appropriate specialists for each carrier would be too expensive and would take too much time.

Azat Hakim

Tulpar Aero Group

It is not easy for new handlers to get to the airport. The airport management is trying to take this business into their own hands, as a rule, their companies are operating, registered as nominees. But with a strong desire to get into the market you can. Lots of ways. For example, recently some guys surprised me. They contacted me, arranged a meeting and offered their handling services at all airports in the world. They themselves lived in London, moved to Moscow, because they believe that the market here is growing. They have offices in Europe and Malta, they work at many European airports, in Moscow. The competition there is fierce, but they succeed. Why? They are fluent in English, have a good education, are very energetic and charismatic. If you persuaded me, it says a lot. From the first meeting, I believed in them. This is world-class handling. And they started only 5-7 years ago. But their advantage is that they also organize the flights themselves. Not every airline has such strong specialists to quickly and competently “break through” permission to fly to other countries, this is a difficult process. But these guys have everything worked out, they provide a full range of services, up to permission to fly to another country. They also take all the expenses on themselves, the airline can pay these expenses and their services after the flight or even a month later. This is the main advantage of turning to handlers, since the airline does not always have free money before the flight, but you already need to fly.

What other nuances of the market do you need to know? You need to know the faces of the participants in this market - airlines, aircraft owners, everyone who will use your services. And start searching: who will become the starting customer, at which airports with whom you can negotiate.

Investment size

Azat Hakim

Tulpar Aero Group

To trust the airline, you need a personal contact, you need to come, meet, I need to see these people. Only after that I give the command to sign the contract.

Where to look for funds to start? Experts do not advise taking loans. The business is low-margin, and loan interest will eat up all your income, you can even go into negative. For a startup, this is not an option. You can sell free real estate and invest own funds. Or find investors and partners. This type of business is not interesting for state support funds.

The operating costs of this business will depend on the volume of orders. In addition, if you hire a staff, you will need to pay a salary and pay for business trips, because the supervisor must be in the city where the serviced aircraft will arrive in advance in order to negotiate with the airport, prepare the runway, and so on.

Step-by-step instruction

Some handling companies enter into contracts with fuel filling companies, buy kerosene and refuel the aircraft themselves, thereby earning more. If the fuel company does not want to conclude a contract with you, know that this is not prohibited by law today. You can complain to the antimonopoly committee, and they will quickly be forced to sign a contract and place the fuel in storage.

The airline should not have any problems during the flight - this is the task of the handling company. If suddenly there was a failure and the plane landed on a spare runway, you need to quickly organize refueling there, etc. Sometimes handlers also take care of issuing visas for the crew.

Azat Hakim

Tulpar Aero Group

What staff is needed for the job? In the beginning, 2-3 people will suffice. The more customers, the more you need to have specialists. A company with serious turnover employs a maximum of 30 people. Each manager takes one or two flights and specializes in them - some in the south of Europe, some in the north, someone takes over Asia. Of course, this requires knowledge of the language. Without knowledge of English, there is no point in hiring a person for the position of supervisor. As a rule, round-the-clock work is mainly due to the time difference between cities and countries. Therefore, it is necessary to provide for the organization of work in shifts. Plus, employees should understand finance, accounting, since all their work is related to paying for the services of organizations. Also, handlers must be sociable, able to negotiate and quickly respond to changing conditions.

Azat Hakim

Tulpar Aero Group

The handler's earnings depend on his ability to get discounts from airports, cleaning companies, hotels, maintenance companies. Due to these discounts, the handler's competitiveness grows - he can offer his services at lower prices. However, the handler can bargain with the airline: if it is ready to pay for your services today, then they will cost, conditionally, a thousand dollars. If she is ready to pay only after a month, then you can increase the agency commission, as it turns out that you are giving money to the airline at interest. And airlines go for it, because they understand that money is expensive. But what percentage you can negotiate with them depends on your art. As a rule, in the case of an annual deferral, 10% per annum is added.

At first, the premises can not be rented. Airlines usually don't even ask if you have an office. The main thing is that you cope with the organization of the flight without delay, because the laws of the market are cruel: it is worth letting the customer down once, or rather, his passengers, and he will no longer work with you. But later you will understand that a rented room in an airport building is not a luxury, but a necessity. The supervisor must be close to the airfield in order to quickly receive and track arrival information and meet the aircraft on time. Its area can be small - 10-15 sq.m. This is a simple room where supervisors can be when, for example, an arrival is delayed.

Documentation

No special permits are required to start this business. Previously, this type of activity was licensed, but today this procedure has been canceled, since it does not require special knowledge, but only entrepreneurial acumen and organizational skills. A person can work at the airport for some time, and if he is smart and enterprising, he will cope with the management of a handling company.

Opening checklist

- Analysis of the market and competitors (range of services, prices, personnel, etc.),

- Choice of range of services

- Registration of an individual entrepreneur or LLC, registration with the tax office,

- Search for employees (if necessary),

- Conducting interviews, selecting candidates,

- Scheduling shifts,

- Loan processing (if necessary)

- Search for the first clients-customers through negotiations,

- Conclusion of agreements with airline service providers.

Is it profitable to open

MS Word Volume: 31 pagesBusiness plan

Download business plan

Reviews (14)

Airlines Business Plan Reviews (14)

1 2 3 4 5

Airline business plan

PaulThank you so much for your business plan. For writing a thesis project - it's just perfect. A bit recalculated the financial part in order to achieve uniqueness and you're done.

Pavel, thanks for the response. It’s great that with the help of an airline business plan you were able to write a complete thesis. We hope the defense goes well. We wish you good luck in all your endeavors.

Airline business plan

AlexanderVery clear and well thought out business plan. Not that I was going to open my own airline. Of course not. It's too much for me. But I wanted to understand how a business plan is drawn up, what is the point. Now everything is clear to me. Thank you.

Alexander, thank you for your feedback. Of course, the airline is a serious and expensive business. But it is worth remembering that everything that surrounds us is made by ordinary people who are not endowed with superpowers. This thought helps to decide on many things. We wish you success in all your endeavors.

Airline business plan

DenisEverything is presented in accessible language. It pleased. He was able to sort out serious issues without outside help. My verdict - this business plan is worthy of attention. Thank you.

Dennis, thank you for your review and feedback. Creation of an airline is a serious application. The sky has long and confidently been divided by the sharks of this business. We wish you to enter the aviation services market and stay there as long as possible.

The main thing about the business plan of the airline

If you came up with the idea to open your own airline, then you do not have any special financial problems and are not expected. Otherwise, it makes no sense to take on such a grandiose project. This serious business requires no less serious attitude to the process of its creation. Moreover, the slightest miscalculation is fraught with such material losses that after them, not every businessman will be able to get back on his feet.

But, despite the apparent difficulties, the airline, as a business, has very good prospects, which are due to the loss of passenger confidence in state-owned companies. From private airlines people expect high level service and adequate prices for tickets. But the main requirement is good technical condition air transport.

Before investing a lot of money in the creation and development of a business, it is necessary to carefully analyze both the positive and negative experiences of other companies. It's much better than learning from your own mistakes. In addition, you should take into account all the factors that can affect the result of your work, including the regular increase in fuel prices.

Fly planes...

Modern Russian airlines today perform many various functions. In addition to the usual passenger traffic, they are engaged in the transportation of goods, carry out charter flights. Significant initial capital is not the only component of success. It is important to spend money wisely, calculating each step, clearly understanding what result this or that action can lead to.

Much in this type of business depends on the professionalism of the specialists who will work for you. But the state of technology has an even greater influence on the success of the business. If your fleet will consist exclusively of old, obsolete aircraft, you should not hope that you will be able to earn a positive reputation. Success accompanies those businessmen who are able to offer their passengers flight safety combined with a high level of service.

It is very important to determine the specific numbers that you cannot do without at the initial stage of creating a business. First of all, this is the optimal number of aircraft that will allow you to satisfy customer requests, but at the same time, winged transport will not stand idle for a long time without work. If the fleet is too small, then the client will have practically no choice. An excessive amount of air transport can lead to a significant loss financial resources in case of downtime.

Developing a marketing strategy is an integral part of your business. Come up with a catchy company name in advance, order the production of a logo and slogan development from specialists. In the future, this will have a significant positive impact on the active promotion of the business and the airline's payback. If you need additional investments, please contact the bank for help. A professional, well-designed airline business plan will help you improve your chances of getting a loan.

A ready-made airline business plan from scratch with examples of opening calculations

A good airline business plan is pleased to bring to the attention of all interested on our website. Let's make a reservation right away - this is a project for serious investors who create a business not for a year or two, but for the long term. A private airline today is an alternative to state-owned units that, having outdated equipment, are in no hurry to “leave the game”. That is why an increasing number of people flying on airplanes are waiting for the entry of private companies into this market.

Look for finished document, which would serve as a "support" and support at the first time, would allow you to outline the steps for the implementation of the project? We have it on our website. With it, you will understand where to start, where will he go basic capital and how to make your airline a profitable, promising business.

Having studied the information on opening an airline, you can immediately begin to act. Of course, there will be many costs, they will turn out to be great, but by using our document, you will spend everything “in business”. It is from the correct initial actions that the profitability of the entire project will later depend. And there is no doubt that the services of a good airline will be in demand.

In stock Airline business plan 5 12Sample business plan: Ensky Airlines

0Sample business plan: company Ensk Airlines

1. Executive Summary

Company Ensk Airlines is a new airline in its infancy. It was organized in order to fill a specific niche vacant in the domestic air transportation market. This niche is the segment of cheap transportation in Central Russia. The demand for low-cost, short-haul air travel allows for large profits to be made.Company management ^ Ensk Airlines consists of experienced managers who have worked in the air transportation industry for a long time. Before company formation Ensk Airlines they ran the company Flight, whose fleet has grown from a single Yak-40 aircraft to 16 Il-99 aircraft. In the two years that have passed from 2003 to 2005, managers managed to raise the company's income Flight up to 3.750 billion rubles.

Our research and forecasts show that in the first year of its existence, a company that owns six airliners and operates flights from Ensk and to Ensk over short distances is capable of generating revenue in the amount of 2.750 billion rubles. It is assumed that the average aircraft load will be 55%. We forecast revenue to rise to $5.4 billion in year 2 and average 2-year utilization to reach 62%. By the end of the third year, the income will reach 9 billion rubles, and the aircraft load will reach 80%.

During the first year, the company's net profit will amount to 25.330 million rubles, by the end of the second year - 525.420 million rubles, and by the end of the third year - 1.728 billion rubles. During the first year, the profit will be about 1% of total sales, by the end of the second year - 10%, and by the end of the third year - 19%.

During the first year, the company will be forced to incur large out-of-pocket expenses until the business stabilizes. This is due to large organizational efforts and payment for legal services. To ensure these costs, it is necessary to attract investors.

1.1. Goals

Obtain flight certificates by March 1, 2007.

Start regular flights no later than July 1, 2007.

Provide the required volume initial capital.

To provide flights with the forces of two Il-99s a month after the start of flights, four Il-99s - after four months, and six Il-99s - after six months.

During the second year, increase the fleet by one aircraft per month.

1.2. Mission

Company's mission Ensk Airlines- to provide safe, efficient and low-cost air transportation. The company's top priority is safety. To do this, the company selects the most reliable aircraft models. In addition, the company strives to ensure the timeliness of flights and quality passenger service.^

1.3. Keys to Success

Obtaining government certificates

Securing funding

Experienced Managers (already available)

Smart marketing, extensive advertising and an aggressive go-to-market strategy

Quality service and maximum security

Timeliness of transportation

Rapid income growth

Cost control and minimization. In 2006, the total cost of transporting one passenger per kilometer was 10 rubles. This allows the company to be classified ennes airline one of the cheapest carriers on the local flight market. (For comparison, the cost of transporting one passenger per kilometer in the company National Airlines is 18 rubles). There are only three companies on the market, the cost of services of which is even lower than in the company Ensk Airlines. Currently, the cheapest air transportation is carried out by the company Southern Airlines, the total cost of transporting one passenger per kilometer is 9 rubles.)

1.4. Risks

Equipment reliability

Crew training

Economic Growth Rates Affecting Total Transportation Volumes

2. Brief description of the company

Company Ensk Airlines is a closed joint stock company registered in Ensk on January 1, 2007.

^

2.1. Company owners

The total number of shares is 20,000,000. Of these, 1,000,000 shares are for managers and will be distributed among them after the completion of the initial period. It is expected that the total share of the shares of the founders and managers will not exceed 15%.

The seed capital will be provided through the issuance of debt, distributed through a private placement. "Transitional" capital will be received in exchange for preferred shares. Further investments will be obtained through the sale of shares on open market(IPO). The expected amount of initial capital is 7.5 million rubles, transitional capital - 87.5 million rubles, IPO - 250 million rubles. (the estimated value of the share is 300 rubles).

^

2.2. Company Establishment Plan

During the first year of operation, the company plans to open new routes that are in greatest demand and use the profits to buy new aircraft.

Table 1. Costs of setting up a company

| ^ Start-up costs | |

| Legal services | RUB 100,000.00 |

| Licensing | RUB 1,000,000.00 |

| Business plan development | RUB 1,000,000.00 |

| Contract with an underwriter | RUB 250,000.00 |

| Insurance | RUB 750,000.00 |

| Recruitment | RUB 4,000,000.00 |

| Advertising | RUB 100,000.00 |

| Rent | RUB 50,000.00 |

| ^ General costs | RUB 7,250,000.00 |

| Assets | |

| Cash | RUB 100,000.00 |

| Securities | 0.00 rub. |

| Accounts receivable | 0.00 rub. |

| Inventory | RUB 100,000.00 |

| Other current assets | RUB 100,000.00 |

| ^ General Assets | RUB 300,000.00 |

| Lack of capital to get started | -6 950 000.00 rub. |

^

2.3. Location and opportunities of the company

Company Ensk Airlines plans to rent a small office in the suburbs, not far from the city airfield.

3. Services

Company Ensk Airlines carries out air transportation over short distances for a relatively inexpensive fee.^

3.1. Description of services

Ensk Airlines is a “discount” airline operating domestic flights from and to Ensk. Its slogan is “no frills”. The main priority of the company is the safety and timeliness of transportation, as well as high-quality passenger service.

All airline tickets ^ Ensk Airlines designed for passengers who do not seek increased comfort and want to save money. However, this by no means means a reduction in flight safety requirements. Just a range of services intended for passengers in the airliners of the company Ensk Airlines, narrowed down to the essentials.

3.2. Competition

The main competitor of the company ^ Ensk Airlines is a company Flight, which owns 86% of the local air transportation market. The monopoly position of this company has led to overpriced flights to and from Ensk. It should be emphasized that the company Flight does not provide its passengers with any discounts.Company ^ Ensk Airlines believes that it can get a significant share of the local air transportation market through cheaper service (the cost of transporting one passenger per kilometer from the company Ensk Airlines is 10 rubles, and the company Flight- 18 rubles). At present, the company's passenger traffic Flight began to decline due to too high prices. Our prices are able to compete even with the prices of such generally recognized discounters as the airline Gamma. This opens up great prospects for our airline.

Maintenance of aircraft of the same type can significantly reduce the cost of equipment repair and staff training.

The main factor influencing success in competition, is the airline's lowest ticket price ^ Ensk Airlines . A homogeneous fleet of airliners and too much appetite of competitors gives our company a big advantage. Other airlines using a variety of aircraft are forced to spend a lot of money on their maintenance, compensating for this. high prices for a ticket. Company Ensk Airlines does not seek to conquer the entire national market. Its niche is local air transportation at low prices. This circumstance creates a barrier that large national air carriers cannot overcome.

An additional condition for winning the competition is constant cost savings, which is one of the main priorities of the company. Ensk Airlines. This applies to both wages and operating costs. The degree of exploitation of airliner crews in the company Ensk Airlines 60% above the industry average. Pilots and navigators fly an average of 85 hours per month, while the average for the industry is 50-60 hours. The company plans to use the saved funds for insurance and bonus payments flight personnel.

Exclusion of meat dishes and foodstuffs offered to passengers on board the company's airliners ^ Ensk Airlines , allows you to save about 75 rubles. for one passenger seat. In addition, this allows you to save on refrigeration equipment at the airport. Company goal Ensk Airlines- operation of the fleet 11 hours a day, 7 days a week.

All airliners have 200 passenger seats. This allows you to achieve maximum profit per passenger seat. The company plans to operate one type of aircraft - Il-99.

Our ticket booking system allows you to book tickets quickly and cheaply, and is also easy to use. This saves money on staff training.

^

3.3. Release of information materials

The advertising documentation of the company is under development. It will include a description of the company's services and a list of discount programs for customers.

^

3.4. Company operation

Company Ensk Airlines plans to lease several airliners “under a dry license”, i.e. without fuel, for 4.2 million rubles. per month. Negotiations are currently underway with the company Aeroservice. It is expected that over the next few years our fleet will be replenished with 80 Il-99 airliners.

Over the next two years, the company will operate 80 aircraft on average 120 days a year. The advantage of operating aircraft of the same type allows you to save money on their maintenance and training of flight crews.

Ticketing system purchased from the company CMS. The company paid for 5 million rubles. for licensed software and about 25 thousand rubles. for each of 50 workstations.

Planned aircraft maintenance will be carried out by the company's own personnel ^ Ensk Airlines operating at each of the destination airports. In addition, spare parts warehouses will be set up in each of these cities. Company management Ensk Airlines considers it necessary to maintain a high level of aircraft maintenance and ensure flight safety. Overhaul of aircraft will be carried out at the manufacturing plant at the rate of 875 rubles. per hour of work. This is common practice. Thus, scheduled aircraft maintenance does not threaten the company's competitiveness. Ensk Airlines.

Ground handling includes the following activities: parking, loading and unloading luggage, as well as carrying services at all destination airports.

Meals on board aircraft include only confectionery and soft drinks. They will be purchased from independent suppliers on a competitive basis.

3.5. Technology

All equipment purchased by the company ^ Ensk Airlines will be carefully reviewed. The technological advantages of the company are as follows.Airliners

Il-99 aircraft are new and reliable. Many of the problems faced by discount air carriers stem from outdated equipment, often over 20 years old. Despite the low cost of renting such aircraft, their operation is fraught with great risk. Very often occurring failures of equipment lead to flight delays, passenger dissatisfaction and increase the risk of flights. Company Ensk Airlines believes that it is possible to save on everything except flight safety. Thus, we focus on the highest standards of aircraft reliability and safety. Our passengers must be sure that we will deliver them to the right place at the estimated time safe and sound, although without much comfort.

In addition, the operation of a homogeneous fleet of new aircraft will allow the company to avoid additional costs associated with the licensing of obsolete aircraft. Since all the aircraft that the company Ensk Airlines, plans to lease, released in 2000-2002, in the next few years the company may not worry about them overhaul. Renting new aircraft also eliminates problems with finding spare parts and flight safety.

More importantly, the new Il-99 aircraft fully comply with European requirements for engine noise levels. Although some domestic carriers consider these regulations optional, we believe that sooner or later they will be applied to aircraft operating domestic flights. In this case, the company will benefit.

^ Ticket Reservation System

The main paper ticket reservation systems used so far are - Transit And Armor- morally and physically obsolete. Major carriers may not be able to stop using them just yet, as the replacement of the ticket reservation system is associated with gigantic capital costs. However, the company Ensk Airlines can afford at the stage of formation to immediately choose a modern automated system reservations electronic tickets, which allows you to quickly and cheaply book seats on the desired flight. This system has three advantages: 1) speed, 2) ease of staff training and 3) integrity. It allows passengers to be served 75% faster than the industry average. Many ticket reservation systems serve one client for two minutes or longer (although often the service time is extended to 8–10 minutes). Our system can significantly reduce this period. This will increase demand for our services and save a lot of money for our company.

The cost of staff training is also reduced many times over. The operators of traditional paper ticket reservation systems are characterized by high turnover, as their work is hard and requires a lot of stamina. New system e-Vouchers facilitates the process of searching for tickets and speeds up the service. In addition, it is easy to operate and requires only basic computer skills from the operator.

The electronic ticket reservation system consists of 50 workplaces and a central service station, connected into one computer network. This facilitates its maintenance and speeds up the solution. possible problems associated with the redirection of passenger traffic.

^

3.6. Future Services

The company will service IL-99 aircraft with 200 passenger seats on board. Most travel will be paid for with electronic rather than paper tickets. The company assumes that the majority of passengers will use the e-ticket reservation system (although this implies a 30% surcharge). Service on board will be carried out only at the request of passengers. All service on board is free, except for the sale of alcoholic beverages. Meat products are excluded. Seat numbers are not reserved. Discounts for regular customers are not planned.

^

4. Brief description of the market

The city of Ensk is the most convenient place to create a new airline. Before making a decision to establish an airline, management carried out a thorough marketing research passenger traffic between different points of departure and destination. The main factors that the company focused on are the demand for services and commercial feasibility.

The study found that the company ^

Ensk Airlines

there is an opportunity to occupy a promising niche on local routes that are unprofitable for nationwide companies. In addition, none of the existing companies will develop local routes in the near future, as it is difficult for them to reorient their flights. The only potential threat to the company Ensk Airlines are new airlines that can expand their activities in the local market. Therefore, our company must act quickly and vigorously before its competitors get ahead of it.

^

4.1. Market segmentation

The airline industry is dominated by a few large companies. The air travel market is characterized by mergers, acquisitions and capital consolidation. However, as in most other rapidly developing markets, divided between major players, there are niches in the air transportation market that are not profitable for large companies and are not occupied by anyone. Our study revealed the existence of two segments: price and route. The first segment is determined by the cost of tickets for a flight from point A to point B, in the second - if possible, get to point B from point A directly or in a roundabout way.

The price sector has almost exhausted its possibilities, as the market is filled with offers of cheap transportation. It should be emphasized that, as a rule, low prices It's just a suggestion, not a promise. Thus, the attractiveness of a particular segment should be assessed as a whole, focusing on the quality of service, price and route choice. The main thing in this complex is duration route. Currently, airlines are divided into short-range and long-range carriers. The long-haul carrier market is equipped with dedicated long-haul airliners that are unprofitable for short hauls. Consequently, only specialized companies. Company Ensk Airlines believes that its technical capabilities are fully consistent with the goal - to occupy the short-distance transportation market in the Ensk region.

For local shipments, it is advisable to use one origin center. This allows you to consolidate services and save money. At the same time, in terms of one kilometer, short hauls are more profitable than long hauls. Calculations show that the local air transportation market is capable of generating multimillion-dollar profits.

Table 2. Target market analysis

| ^ Market Analysis | |||

| ^ Market segments | 2007 | 2008 | 2009 |

| Ensk-Krasnogorsk | RUB 500,000,000.00 | RUB 600,000,000.00 | RUB 800,000,000.00 |

| Ensk-Sinegorsk | RUB 600,000,000.00 | RUB 700,000,000.00 | RUB 900,000,000.00 |

| Ensk-Belogorsk | RUB 700,000,000.00 | RUB 800,000,000.00 | RUB 950,000,000.00 |

| Ensk-Zelenogorsk | RUB 800,000,000.00 | RUB 900,000,000.00 | RUB 1,000,000,000.00 |

| Ensk-Chernogorsk | RUB 550,000,000.00 | RUB 450,000,000.00 | RUB 650,000,000.00 |

| Ensk-Verkhnegorsk | RUB 250,000,000.00 | RUB 500,000,000.00 | RUB 700,000,000.00 |

| Ensk-Nizhnegorsk | RUB 100,000,000.00 | RUB 500,000,000.00 | RUB 800,000,000.00 |

| Total | RUB 3,500,000,000.00 | RUB 4,450,000,000.00 | RUB 5,800,000,000.00 |

^

4.2. State of the Industry

Since 1993, the government has been making efforts to denationalize the air travel market. Until now, the air travel market has been dominated by state companies. Routes were limited, fares were fixed, costs were under control. It should be emphasized that the consequences of market monopolization have not been completely overcome, and so far many major air carriers have not yet reached optimal efficiency. This circumstance opens up great prospects for discounters.

Currently, carriers providing low-cost services are able to achieve high profits, gain larger market shares, and even increase the number and range of routes. One example of a successful business development is a discount airline Gamma, which we focus on when developing our business plan.

Currently, most major airlines are making losses. Company management ^ Ensk Airlines believes that this is due to the high cost of staff, large transaction costs and poor management. We believe that large carriers are not capable of competing with smaller airlines in the local route market.

It should be emphasized that air carriers are able to provide many services, but these services are not always cheap. Recently, airlines began to receive many complaints from passengers about the discrepancy between the quality of services and their prices. Company Ensk Airlines seeks to achieve an optimal price / quality ratio.

^

4.2.1. Market Participants

Company Ensk Airlines does not consider the main national air carriers as its competitors in the market of cheap services on local routes. We believe our focus should be on three companies: Gamma, Vega And Pilot.

Company Gamma is an example of a reliable and successful discount air carrier. The cost of transporting a passenger per kilometer at the company Gamma lower than the company Ensk Airlines, and for the last 25 years, the aircraft of this company have not suffered a single disaster.

Company Vega is an exemplary financial model for a start-up company. The profit that its investors received was extremely high. However, the activities of this company go beyond ordinary transportation.

Company Pilot is a classic example of mismanagement in the aviation industry. Despite this, the company owns 86% of the air transportation market in the Ensk region. The company is in second place. Gamma with their 2%.

Company management Ensk companies carefully studied the experience of its competitors, since they all achieved great success in their market niches. Therefore, we must use their experience and avoid the mistakes made.

^

4.2.2. Key competitors and customer behavior

A critical factor influencing the success of any new airline is the visibility of its trademark. Passengers prefer to fly with well-known air carriers and do not trust newcomers. Company management Ensk Airlines believes that he will be able to win the trust of passengers very quickly. Funds for this are included in the business plan budget. The main source of information about our company should be local newspapers and television. As practice shows, these means of advertising have proved to be the most effective in promoting new airlines to the local transportation market. In addition, flight safety is an extremely important factor. Consumers like to save money, but are not inclined to risk their lives. Company Ensk Airlines makes special efforts in these directions.

The main competitor of our company is the company Gamma providing cheap services on local routes.

The strengths of this company are as follows.

Staff training

Large client base.

Safety

Popularity

Traditional ticket reservation system

Unusual forms of transportation

^

4.2.3. Distribution channels

Airline sales have historically been handled either by the airlines themselves or by travel agencies. Modern computer technologies and means of communication make it possible to radically change passenger service. Travel agencies currently account for 80% of air ticket sales. This distribution channel is associated with very high costs. The commissions paid by airlines to travel agencies are currently too high. Incentives and rewards have degenerated into a system of coercion and bribery.

The cost of printing and distributing paper tickets is also high. Travel agencies believe that each ticket contains about 750 rubles. represent reimbursement for ticket printing costs. In addition, many of these agencies add their own surcharges to the initial ticket price.

Currently modern technologies avoid the physical printing of paper tickets altogether, so that airlines can create their own e-ticket distribution systems and refuse services travel agencies. Company Ensk Airlines plans to open 50 passenger service centers, which are components of a single round-the-clock computer system ticket reservations. In addition, we plan to open a Web site and process orders via the Internet.

Company ^ Ensk Airlines suggests that more than 90% of its tickets will have electronic form and sold without intermediaries.

Electronic form of company tickets Ensk Airlines allows her not to wait 30 days until the transactions with the clearing house that processes the orders of travel agencies are completed. Convenient ticketing system and friendly Information system should attract passengers accustomed to using the services of traditional airlines.

^

5. Strategy and implementation

The main factor influencing the company's success is flight safety and cheap tickets. In order to generate profits while lowering ticket prices, a company must take the following steps.

Use effective means advertisements, which are local television and radio media, as well as outdoor advertising.

Centralize all aircraft maintenance operations and optimize their cost.

Centralize the ticket reservation system and optimize their cost.

Combine direct ticket sales with their distribution through distributors.

5.1. Marketing strategy

The marketing goal is the local market. The advantage of the local market lies in the clear identification of funds effective advertising. Company Ensk Airlines there is no need to develop a broad nationwide advertising program. Company management Ensk Airlines believes that advertising stands placed on the streets of the city will be the most effective. The cost of their installation will be about 2.5 million rubles.

In addition, the company Ensk Airlines intends to advertise on television and radio. Newspapers and magazines will not be used.

5.4.1. Positioning

Company Ensk Airlines provides safe, efficient and low-cost air transportation over short distances.5.4.2. Cost price

Data on the cost of goods and services are given in table. 3.Table 3. Cost of goods and services

| Cost price | |||

| Product | 2007 | 2008 | 2009 |

| Regular transportation | RUB 728,000,000.00 | RUB 730,000,000.00 | RUB 750,000,000.00 |

| Charter flights | RUB 200,000,000.00 | RUB 205,000,000.00 | RUB 210,000,000.00 |

| Total cost | RUB 928,000,000.00 | RUB 935,000,000.00 | RUB 960,000,000.00 |

5.4.3. Pricing

Company Ensk Airlines developed two programs as part of the pricing strategy

Regular air transportation. The cost of a flight on a regular route will depend on the distance.

Ensk-Krasnogorsk 2750 rub.

Ensk-Sinegorsk 3500 rub.

Ensk-Belogorsk 4500 rub.

Ensk-Zelenogorsk 5500 rub.

Ensk-Chernogorsk 6000 rub.

Ensk-Verkhnegorsk 7000 rub.

Ensk-Nizhnegorsk 8000 rub.

Second program. The cost of a flight per passenger on a charter route will depend on the range and customer requests.

Ensk-Krasnogorsk 5750 rub.

Ensk-Sinegorsk 7000 rub.

Ensk-Belogorsk 9000 rub.

Ensk-Zelenogorsk 11000 rub.

Ensk-Chernogorsk 12000 rub.

Ensk-Verkhnegorsk 14000 rub.

Ensk-Nizhnegorsk 16000 rub.

5.2.2. Promotion strategy

Our promotion strategy is based on outdoor advertising, as well as advertisements on television and radio. In addition, the company plans to organize advertising campaign and organize presentations at major firms in the local market.

In the company's budget Ensk Airlines advertising costs will amount to about 50 million rubles.

^

5.4.5. Marketing programs

In addition to the previously listed go-to-market programs, the company plans to launch its own Web site.

5.5. Sales strategy

In order to attract passengers without resorting to discount programs for frequent travelers, the company ^ Ensk Airlines plans to establish direct contacts with the transport department of the administration of Ensk and special departments of corporations. We believe that our offers are beneficial for customers. Currently, Ensk is the third largest banking center in the country and is growing faster than all the others industrial centers. For this reason, we believe that our profit volume will grow at a rate of 100% per year.^

5.4.1. Sales forecast

According to the company's forecast Ensk Airlines annual ticket sales by the end of the first year will be 2.75 billion rubles, at the end of the third year - 5.4 billion rubles, at the end of the third year - 9 billion rubles.

The increase in sales during the second and third years is due to the increase in the aircraft fleet and the opening of new routes.

The forecast of monthly sales is given in table. 4.

Table 4. Sales plan

| ^ Sales Plan | |||

| 2007 | 2008 | 2009 |

|

| Regular transportation | RUB 2,000,000,000.00 | RUB 4,000,000,000.00 | RUB 7,000,000,000.00 |

| Charter flights | RUB 750,000,000.00 | RUB 1,400,000,000.00 | RUB 2,000,000,000.00 |

| Total Sales | RUB 2,750,000,000.00 | RUB 5,400,000,000.00 | RUB 9,000,000,000.00 |

| ^ Selling costs | |||

| 2007 | 2008 | 2009 |

|

| Regular transportation | RUB 1,000,000,000.00 | RUB 2,000,000,000.00 | RUB 3,000,000,000.00 |

| Charter flights | RUB 250,000,000.00 | RUB 600,000,000.00 | RUB 900,000,000.00 |

| Total sales costs | RUB 1,250,000,000.00 | RUB 2,600,000,000.00 | RUB 3,900,000,000.00 |

^

5.5. Calendar plan

Control marks are specified in tab. 5. Responsibility for the implementation of activities lies with Konstantin Sergeev, President of the company.

Table 5. Control marks

| ^ Control marks | Plan | |||||

| Start | End | Estimate, rub. | Manager | Department |

||

| Raising initial capital | 1.07.2007 | 30.07.2007 | 62 500 | Sergeev | Adm. |

|

| Paperwork | 1.07.2007 | 15.07.2007 | 62 500 | Sergeev | Adm. |

|

| Private placement of shares | 15.07.2007 | 30.07.2007 | 2250000 | Sergeev | Adm. |

|

| Distribution of debt obligations | 15.07.2007 | 1.08.2007 | 250000 | Sergeev | Adm. |

|

| Distribution of preferred shares | 1.8.2008 | 1.10.2009 | 250000 | Sergeev | Adm. |

|

| Recruitment | 1.08.2007 | 1.01.2008 | 10000 | Petrov | OK |

|

| Placement of shares on the open market | 1.03.2008 | 1.06.2008 | 100000 | Sergeev | Adm. |

|

| Leasing of two aircraft | 1.04.2008 | 1.06.2008 | 240000000 | Sergeyee | Adm. |

|

| Obtaining a license | 1.07.2007 | 1.08.2008 | 5000000 | Sidorov | OP |

|

| Leasing of the third aircraft | 1.06.2008 | 1.08.2008 | 120000000 | Sergeev | Adm. |

|

| Leasing of the fourth aircraft | 1.08.2008 | 1.09.2008 | 120000000 | Sergeev | Adm. |

|

| Total | 487 985 000 | |||||

6. Management summary

Company management Ensk Airlines has vast experience. There is not a single manager who would not perform similar functions in other airlines. We do not train staff, but simply hire experienced and educated employees.

Konstantin Sergeev is a highly respected manager with extensive experience in the air travel industry. For a long time he worked at the central office of the company Flight while serving as Vice President of Marketing. Work in a company Ensk Airlines is his attempt to own business using your experience and knowledge.

^

6.1. Organizational structure

The company consists of seven departments.

Flight Operations Division

Aircraft Operations Division

Financial department

Marketing department

Administrative department

Human Resources Department

customer service department

| ^ staffing | |||

| 2007 | 2008 | 2009 |

|

| ^ Staff costs | Staff costs | Staff costs |

|

| The president | RUB 35,000.00 | RUB 40,000.00 | RUB 45,000.00 |

| Executive Director | RUB 25,000.00 | RUB 30,000.00 | RUB 35,000.00 |

| Vice President | RUB 25,000.00 | RUB 30,000.00 | RUB 35,000.00 |

| CFO | RUB 25,000.00 | RUB 30,000.00 | RUB 35,000.00 |

| chief pilot | RUB 40,000.00 | RUB 50,000.00 | RUB 60,000.00 |

| Operations Director | RUB 20,000.00 | RUB 25,000.00 | RUB 30,000.00 |

| Director of quality | RUB 20,000.00 | RUB 25,000.00 | RUB 30,000.00 |

| Marketing director | RUB 20,000.00 | RUB 25,000.00 | RUB 30,000.00 |

| Ticket office director | RUB 20,000.00 | RUB 25,000.00 | RUB 30,000.00 |

| Service Director | RUB 20,000.00 | RUB 25,000.00 | RUB 30,000.00 |

| Pilots | RUB 450,000.00 | RUB 1,000,000.00 | RUB 450,000.00 |

| Stewardesses | RUB 300,000.00 | RUB 1,600,000.00 | RUB 500,000.00 |

| mechanics | RUB 360,000.00 | RUB 1,600,000.00 | RUB 500,000.00 |

| Cashiers | RUB 600,000.00 | RUB 750,000.00 | RUB 1,000,000.00 |

| Clerks | RUB 60,000.00 | RUB 150,000.00 | RUB 100,000.00 |

| Total: | RUB 2,020,000.00 | RUB 5,405,000.00 | RUB 2,910,000.00 |

6.2. Management

KONSTANTIN SERGEEV. The president. 51 years oldKonstantin Sergeeev has been working in the field of air transportation for 28 years. He first served as a pilot, then became a chief pilot, and subsequently made a career as manager in major airlines. Graduated from the Ensk Institute of Civil Aviation. Last job - Vice President of the company Flight.

EVGENY SEMENOV. Executive Director. 49 years old.

Retired military pilot. Rank: Lieutenant General. In the civil service, he worked as the chief pilot of the airline Northern lights, director of flight operations of the airline Subtropic, as well as the head of the civil aviation pilot training center.

^ GRIGORY KLAROV. Vice President 56 years old.

Former company vice president Gamma. Worked as chief pilot of companies Subtropic And Vega. Last job - Vice President of the company Vega.

DENIS ADAMOV. CFO, 47 years old.

Graduated from the Financial Academy. Worked as a bank director Premium. Last job - financial director companies Altair.

BORIS KRYLOV. Chief pilot, 50 years old.

25 years served as a pilot on civil aviation airlines, chief pilot of the company Altair. He mastered flights on Tu-77, Yak-88 and Il-99 aircraft.

SEMYON DYAKONOV. Operations Director, 41 years old.

Military engineer. He graduated from the Enskoe military flying school. Served in military aviation. After resignation - director of operations of the companyAltair.

NIKOLAY KOBELEV. Director of quality. 42 years.

Military engineer. Inspector 1st class. Last job - Airline Quality DirectorSubtropic.

LYUDMILA VLADIMIROVA. Marketing director. 49 years old.

19 years worked as a sales manager of the company^ Southwestern Airlines . Last job - chief sales manager of the companyjet.

YULIA PETROVA. Director of ticket offices. 38 years.

For more than 10 years, she worked as the director of the ticket reservation system in an airline.^ Southwestern Airlines . Participated in the development and implementation of an electronic ticket reservation system in an airline jet.

MARIA BENEDICTOV. Service Director. 43 years.

She has worked as a flight attendant on international airlines for over 15 years. Last job - director of service at an airline jet.

^

7. Financial plan

Business financing will be carried out at the expense of the incoming cash flow. The main investments will be made in the lease of new aircraft. In addition, the necessary expenses include the costs of outdoor advertising and accommodation advertisements on radio and television.

^