Conditions for granting discounts to buyers. Discounts discounts strife! (Recommendations for sellers on documenting discounts)

Giving a discount is an important marketing ploy used by many companies to reward the customer for certain actions, such as regular purchases of large quantities of products.

A price discount is a reduction in the price set by a company for a product sold, a service rendered, or work performed.<1>. The grounds for granting a discount may be different - from the above-mentioned regularly made significant purchases up to the special status of the buyer (for example, a regular customer), the onset of a season of temporary decrease in demand, and other grounds. The company's marketing policy may provide for the possibility of providing customers not only with those types of discounts that are widely used in world practice (for example, seasonal discount, cash payment discount), but also other types of discounts due to the specifics of the company's activities, the characteristics of the sales market for its goods, works or services.

<1>Usually, the price initially set by the company for its product, work, service is called the initial or basic price.

At the same time, companies do not always properly document both the grounds and conditions2 for granting discounts, and the very fact of granting a discount. In view of this, both the company itself, which provided the discount, and its buyer (or customer under the contract paid provision services or contract) carry risks of adverse tax consequences. Such consequences for the company-seller (performer, contractor) is the need to determine the tax base for income tax and VAT based on the initial, basic, price, i.e. price, from which the amount of the discount has not been deducted, which, in essence, means the need to pay a certain part of income tax due to own funds. An unfavorable consequence for the buyer may be the inclusion in the composition of non-operating income that increases the tax base for income tax, the amount of the discount received by him.

<2>The conditions for granting discounts include, in particular, the possible amounts of such discounts.

In the absence of proper documentation of the grounds and conditions for granting a discount and the very fact of granting a discount, it will be difficult for the seller company and its buyer to defend their position in a dispute with the tax authority both at the stage of filing objections to the tax audit act and in court.

So, in order to avoid financial losses for the seller and the buyer as a result of disputes with the tax authorities, firstly, the grounds and conditions for granting a discount and, secondly, the fact of granting a discount must be documented.

Grounds and conditions for granting discounts

In accordance with paragraph 2 of Art. 40 of the Tax Code of the Russian Federation, when exercising control over the completeness of the calculation of taxes, the tax authorities are entitled to verify the correctness of the application of prices for transactions only in the following cases:between related parties;

on commodity exchange (barter) operations;

when making foreign trade transactions;

with a deviation of more than 20% upwards or downwards from the level of prices applied by the taxpayer for identical (homogeneous) goods (works, services) within a short period.

According to paragraph 3 of Art. 40 of the Tax Code of the Russian Federation in these cases, when the prices of goods, works or services applied by the parties to the transaction deviate upward or downward by more than 20% percent from the market price of identical (homogeneous) goods (works or services), the tax authority has the right make a reasoned decision on the additional charge of tax and penalties calculated in such a way as if the results of this transaction were assessed based on the application of market prices for the relevant goods, works or services.

At the same time, Art. 40 of the Tax Code of the Russian Federation, it is established that when determining the market price, the usual price markups or discounts when concluding transactions between independent persons are taken into account. In particular, discounts caused by:

- seasonal and other fluctuations in consumer demand for goods (works, services);

- loss of goods quality or other consumer properties;

- expiration (approaching the expiration date) of the expiration date or sale of goods;

- marketing policy, including when promoting new products that have no analogues to the markets, as well as when promoting goods (works, services) to new markets;

- implementation of prototypes and samples of goods in order to familiarize consumers with them.

In Art. 40 of the Tax Code of the Russian Federation lists five grounds for discounts, however, in terms of their economic essence, discounts, for example, caused by seasonal fluctuations in demand, are also due to the marketing policy of the selling company, as well as discounts established due to the promotion of a new product on the market, as well as any other reasonable, t .e. stimulating the buyer to any action that brings economic benefits to the seller, a discount. In view of the foregoing, it can be concluded that Art. 40 only says that the discount must be reasonable, and then the transaction price for the seller and the buyer for tax purposes will be reduced by the amount of this discount. In other words, the discount should stimulate the buyer, for example:

- purchase goods, order the provision of services, perform work in conditions of reduced demand for this product, service, work;

- purchase a product, service, work in large volumes compared to the planned ones;

- to acquire such a product, service, work in the future for a long time, etc.

So, the decision of the authorized body of the selling company on what discounts the selling company provides, on the size of these discounts, on which categories of buyers these discounts are provided, and also what the stimulating nature of such discounts is, should be properly documented. Such a decision can be called a documentary expression of the company's marketing policy.

Keep in mind that the need to strengthen your position in the market may require a sudden change pricing policy, including discount policies, for example, in the course of negotiating with a strategically important potential buyer, the seller company may need to offer a potential buyer a discount that was previously authorized body no decision was made, or to agree to provide the potential buyer with the discount declared by him. In such cases, it can be recommended to fix in the local act of the selling company the procedure for documenting discounts that go beyond the discounts already established by the company. It is desirable that such a procedure for documenting allows you to fix what exactly the stimulating nature of the discount provided is expressed.

Registration of the fact of granting discounts

As a rule, the parties enter into one of three discount agreements.Firstly, the parties can agree on providing a discount even at the conclusion of the contract, then the price of goods, work, services will be determined in the contract itself, already taking into account the discount.

Example 1. The price of the goods under this contract is 768 (seven hundred sixty-eight) rubles. for one unit of production, in addition, the buyer pays the supplier VAT - 138 (one hundred and thirty eight) rubles. 24 kop. The price of the goods is determined taking into account a 35% discount provided to the buyer on the basis of the order of the head of the supplier No. 132 dated March 25, 2003 as a buyer purchasing products in the amount of at least 20,000 (twenty thousand) units under one supply agreement.

It should be noted that the parties at the stage of negotiations, during which all the terms of the contract are discussed, can come to an agreement on providing a discount when concluding a contract on given conditions. Such an obligation to provide a discount can be made in writing, in which case there is no need to duplicate the discount agreement in the contract.

Secondly, the parties can agree to provide a discount upon the occurrence of certain conditions (for example, upon reaching a certain volume of purchases) specified in the contract. In this case, the change in the price of the contract will be caused by the occurrence of these conditions.

Example 2 The price of the goods under this contract is 1200 (one thousand two hundred) rubles. for one unit of production, in addition, the buyer pays the supplier VAT - 216 (two hundred and sixteen) rubles. In case of early (but not less than 1.5 months before the due date) fulfillment by the buyer of the obligation to pay for the goods, the supplier will provide the buyer with a discount of 24% of the amount of the repaid debt on the basis of order No. 132 of the head of the supplier dated March 25, 2003.

If the discount is stipulated by the contract and the occurrence of a certain condition, then the parties may draw up an act on the achievement of such conditions. Regarding return Money constituting the amount of the discount, upon the occurrence of such conditions, the following should be noted. Considering the wording of paragraph 4 of Art. 453 of the Civil Code of the Russian Federation that the parties are not entitled to demand the return of what was performed by them under an obligation before the moment of amendment or termination of the contract, unless otherwise provided by law or by agreement of the parties, the parties to the contract, in order to avoid the corresponding risks, must stipulate that the overpaid amount refundable to the buyer by the seller (unless the obligation to return this overpaid amount is otherwise terminated).

Example 3. On the basis of clause 5.6 of the supply agreement No. 459 dated April 2, 2004, as well as on the basis of clause 14 of the order of the supplier's head No. 132 dated March 25, 2003, the parties drew up this act confirming that the supplier must provide the buyer with a discount of 149 867 (one hundred and forty-nine thousand eight hundred and sixty-seven) rubles. Since payment under the supply agreement No. 459 dated April 2, 2004 was made by the buyer in full, the parties agreed that the amount of 149,867 rubles. is overpaid. The parties also agreed that the supplier's obligation to return the overpaid amount in the amount of 149,867 rubles. will be terminated: in part 59,000 (fifty-nine thousand) rubles. - set-off with a similar counterclaim from the supplier to the buyer for payment for the goods under supply agreement No. 460 dated June 3, 2004; the rest - by transferring the remaining amount of money to the buyer's settlement account specified in the supply agreement No. 459 dated April 2, 2004.

Thirdly, the parties can also agree to provide a discount in the period after the conclusion of the contract (and until the moment of its execution, since upon execution the contract is terminated and it becomes impossible to change it).

In any of the above cases, the discount agreement must be concluded in the form required by law.

List of deals<3>, for which a mandatory written form is provided, Art. 161 of the Civil Code of the Russian Federation. These are the deals:

legal entities among themselves and with citizens;

citizens among themselves for an amount exceeding at least 10 times the minimum wage, and in cases provided for by law - regardless of the amount of the transaction.

<3>The agreement is a multilateral transaction.

In accordance with paragraph 1 of Art. 452 of the Civil Code of the Russian Federation, an agreement to amend or terminate a contract is made in the same form as the contract, if from the law, other legal acts, contract or customs business turnover does not follow otherwise.

According to Art. 162 of the Civil Code of the Russian Federation, non-observance of the simple written form of the transaction deprives the parties of the right, in the event of a dispute, to refer to evidence of the transaction and its conditions, but does not deprive them of the right to provide written and other evidence. In cases expressly specified in the law or in the agreement of the parties, failure to comply with the simple written form of the transaction entails its invalidity (for example, failure to comply with the simple written form foreign economic transaction entails the invalidity of the transaction). In accordance with Art. 160 of the Civil Code of the Russian Federation, a transaction in writing must be made by drawing up a document expressing its content and signed by the person or persons making the transaction, or persons duly authorized by them. An agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging documents by postal, telegraph, teletype, telephone, electronic or other communication, which makes it possible to reliably establish that the document comes from the party under the agreement. The above also applies to agreements to change the contract (in particular, to agreements to change the price of the contract).

The main provisions on the conclusion of the contract are provided for in Art. 432 of the Civil Code of the Russian Federation. The contract is considered concluded if the parties have reached an agreement on all essential terms of the contract in the form required in the relevant cases. Essential are the conditions on the subject of the contract, the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type, as well as all those conditions regarding which, at the request of one of the parties, an agreement should be reached. The contract is concluded by sending an offer (offer to conclude a contract) by one of the parties and its acceptance (acceptance of the offer) by the other party. In accordance with Art. 433 of the Civil Code of the Russian Federation, the contract is recognized as concluded at the moment the person who sent the offer receives its acceptance.

Offer according to Art. 435 of the Civil Code of the Russian Federation, an offer addressed to one or several specific persons is recognized, which is quite definite and expresses the intention of the person who made the offer to consider himself to have entered into an agreement with the addressee who will accept the offer. The offer must contain the essential terms of the contract.

Acceptance in accordance with Art. 438 of the Civil Code of the Russian Federation, the response of the person to whom the offer is addressed about its acceptance is recognized. The acceptance must be complete and unconditional. The performance by the person who received the offer, within the period established for its acceptance, of actions to fulfill the conditions of the contract specified in it (for example, the transfer by the seller company in response to the buyer's offer to provide him with a discount after early payment for the goods on account of the discount) is considered an acceptance, unless otherwise provided by law, other legal acts or not specified in the offer.

In view of the foregoing, all agreements between legal entities on discounts must be made in writing.

Given that a change in the price of the contract does not affect the date of sale under the contract, when granting a discount, the tax base of the period in which the sale took place must be adjusted.

T. VASILYEVA,

lawyer, member expert council ACG "Interexpertiza"

"Main book", 2009, N 3

(Documentation of discounts)

To outperform competitors and keep high level sales, companies use various incentive mechanisms consumer demand. One of the most common and effective of them is the provision of discounts to customers. However, if prices, taking into account such discounts, deviate from the usual ones by more than 20%, then the tax authorities can check the correctness of the application of prices for tax purposes and charge additional taxes. Therefore, it is important for an accountant to pay special attention to the correct documentation discounts provided. About what documents you need to stock up in order to avoid additional charges, we will tell in the article.

What is a price check?

The tax authorities can check the prices of goods (works, services) only if the discount exceeds 20% within a short period of time<1>. There is no precise indication of what period should be considered short in the legislation. It is determined depending on the specific circumstances of the organization's activities, the specifics of specific goods (works, services)<2>. Therefore, for some taxpayers for such a period, the tax authority may take 30 days, and for others - a quarter or a year<3>.

If during a tax audit it is established that the prices for specific goods (works, services) have been reduced by more than 20% of the market price of identical goods (works, services), the tax authority has the right to charge additional income tax and VAT based on market prices , as well as calculate the corresponding penalties<4>.

In addition to this, the tax authorities hold taxpayers liable for non-payment or incomplete payment of tax amounts under Art. 122 of the Tax Code of the Russian Federation and collect a fine. The legality of such fines is a subject of constant debate. The courts often take the side of the taxpayers, but motivate their position in different ways. For example, some point out that the tax authorities cannot apply sanctions at all when controlling prices in accordance with Art. 40 Tax Code of the Russian Federation<5>. Others note that taxpayers do not violate the norms of tax legislation, since it does not oblige them to sell goods (works, services) at prices not lower than market prices or independently calculate taxes based on market prices<6>.

Meanwhile, when determining market prices, tax authorities are required to take into account the usual discounts when concluding transactions between independent persons, including those established by the marketing policy of the organization.<7>. Therefore, companies have the right to provide discounts of more than 20%, and such a price reduction will be completely justified if this is provided for by the marketing policy. It is the price, taking into account the discount, that will be considered the market price in a particular situation.

Therefore, in order to substantiate one's position in the field of pricing, including before the tax authorities, it is necessary to correctly document the "discount" mechanism.

Discounts can be provided for both future and already completed deliveries. In the first case, depending on the terms of the contract, the buyer purchases the goods at a reduced price either immediately or after certain conditions are met (for example, the purchase of the volume of goods prescribed in the contract). In this case, the discount is already included in the price of the goods, and it is not visible from external documents. In the second case, the price is reduced for the already sold goods upon the occurrence of circumstances provided for by the contract (for example, discounts on the total volume, for early payment, etc.). Therefore, the final price, that is, the price including the discount, will be known only after the shipment of the goods.

Thus, the procedure for granting all discounts in force in the company must be fixed in internal documentation. And the use of discounts for already shipped goods should also be reflected in the external document flow with counterparties.

<1>Subparagraph 4, paragraph 2, Art. 40 of the Tax Code of the Russian Federation.

<2>Letter of the Ministry of Finance of Russia dated July 24, 2008 N 03-02-07 / 1-312.

<3>Decree of the Federal Antimonopoly Service of the Moscow District dated April 10, 2008 N KA-A40 / 1764-08-P.

<4>Paragraph 1, paragraph 3, Art. 40 of the Tax Code of the Russian Federation.

<5>Decree of the Federal Antimonopoly Service of the Far Eastern District of August 14, 2006 N F03-A51 / 06-2 / 2519.

<6>Decree of the Federal Antimonopoly Service of the Central District of August 31, 2004 N A14-1733-04/45/25.

<7>Paragraph 2, paragraph 3 of Art. 40 of the Tax Code of the Russian Federation.

Internal documents

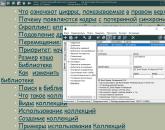

The first thing you should do is to develop and approve a document detailing the pricing procedure, including the types of discounts, the grounds and the procedure for their provision. For example, adopt a marketing policy (regulations on discounts, an order to provide discounts, etc.).

Now discounts are often individual in nature, so it is sometimes very difficult to establish fixed discount rates and consolidate a single procedure for their application. For example when companies, knowing that a competitor is approaching their customer, simply set the price lower than that of the competitor.

Given these circumstances, it is very important that the applied system of pricing and discounts be flexible and easily adaptable to changing conditions. Therefore, it is advisable to include in the marketing policy only general provisions price formation and discounts, and the specific list of buyers and the amount of discounts due to them should be indicated in other, more mobile and operational, organizational documents (orders, instructions, instructions, price lists, etc.).

I approve

CEO LLC "Romashka"

Ivanov /Ivanov A.V./

Marketing policy for the 1st quarter of 2009

- The price of a product can be changed in order to:

- promotion of sales of products;

- strengthening the positions occupied by the Company in the sales market;

- implementation of the approved budget of the Company.

- To achieve the above goals, the Company uses the following pricing procedure:

5.1. The price set in the Appendix to the Marketing Policy may be reduced depending on the number of purchased goods.

5.2. Also, buyers can be provided:

- discounts for early repayment of debt for goods;

- discounts on goods purchased on a prepaid basis;

- discounts for ordering goods within 10 days after receiving a message about the arrival of new goods;

- discounts on goods due to the approaching expiration date of its expiration date;

- discounts on seasonal goods;

- discounts for strategically important buyers.

- The amount of the discounts indicated in paragraph 5 is established by order of the General Director.

External Documents

The condition on the price of the goods may be reflected in the contract. If the prices for the goods are set in the price list, then in the contract you can make a reference to this price list.

In a situation where the parties fixed a fixed price in the contract, and then agreed to reduce it, an additional agreement must be concluded to the contract<8>.

Additional Agreement No. 1 to the Supply Contract No. 07/2008 dated November 20, 2008

Moscow

Romashka LLC, hereinafter referred to as the "Supplier", represented by General Director Ivanov A.V., acting on the basis of the Charter, on the one hand, and Oduvanchik LLC, hereinafter referred to as the "Buyer", represented by Director Petrov S. V., acting on the basis of the Charter, on the other hand, have entered into this Supplementary Agreement as follows:

- Supplement the Supply Contract N 07/2008 dated November 20, 2008, clause 4.4 with the following content:

"4.4. The Buyer is provided with the following discounts to the price of the goods specified in clause 4.1 of the Agreement:

- in the amount of 15% of the amount of delivery, including the amount of VAT, - when purchasing goods in excess of 500,000 (Five hundred thousand) rubles. per month including VAT;

- in the amount of 25% of the delivery amount, including the amount of VAT, - when purchasing goods in excess of 1,000,000 (one million) rubles. per month including VAT.

Upon reaching the specified indicators, discounts are provided to the Buyer for subsequent deliveries.

- This Supplementary Agreement shall enter into force from the moment of its signing and is an integral part of the Supply Contract No. 07/2008 dated November 20, 2008.

- Signatures and seals of the parties:

CEO Director

LLC "Romashka" LLC "Dandelion"

Ivanov /A.V. Ivanov / Petrov / S.V. Petrov/

M.P. Seal of LLC "Romashka" M.P. Seal of LLC "Dandelion"

Discounts are one of the most common ways to stimulate sales. We will analyze in detail existing classification discounts, the procedure for their application, which depends on a number of conditions, with particular attention to the granting of discounts in the light of federal law"On the basics of state regulation trading activities V Russian Federation».

Discounts: types and brief characteristics

IN modern conditions In the economy, the system of price discounts is increasingly used as one of the most important factors in stimulating sales. This allows sellers not only to keep regular customers, but also to attract new ones.

There is no definition of the concept of discount in civil and tax legislation. In accordance with the concepts of business turnover, a discount is understood as a reduction by the seller of the previously declared value of the goods, which leads to a decrease in the price of its sale.

Discounts can be divided into two groups:

- provided by the seller to the buyer as a result of revising the price of the goods specified in the sales contract (the buyer is provided with a discount for the purchased goods);

- provision by the seller to the buyer without changing the price of a unit of goods (discounts in the form of a premium, remuneration, bonus, etc.).

When setting prices for goods (with the exception of price ranking), the seller has the right to provide discounts from the price. At the same time, the provision of a discount from the price can be considered as an agreement on a new price in the contract or as a price change after the conclusion of the contract. The seller offers the buyer to fulfill certain conditions and take advantage of the discount. The buyer retains the right to take advantage of this offer or refuse it. Thus, the discount is two-way.

The system of discounts is various. First of all, it is necessary to highlight planned and tactical discounts.

Planned discounts are usually used for promotional purposes. For example, a manufacturer in supermarkets installs refrigerated display cabinets for soft drinks. They are installed at the expense of the manufacturer, as a result of which the supermarket receives a significant income at minimal cost.

Tactical Discounts are of a different nature. The main ones are:

- discounts for the volume (quantity) of the purchased goods;

- seasonal discounts (discounts for out-of-season purchases);

- bonus discounts;

- discount discounts;

- coupons (coupon).

The type of discount depends on the nature of the transaction, the terms of delivery, relationships with customers, market conditions, the seasonal nature of production and consumption.

Discounts for a large volume of purchases can be simple (non-cumulative), cumulative (cumulative) and stepped. The mechanism of their formation is different. So, simple discounts encourage buyers to purchase large batches of goods of the same name. As a result, the selling company saves on the costs of organizing sales, storing, transporting goods, processing documentation, etc.

But in this case (providing a discount for sales volume), the buyer must also take into account the economic consequences, and they are ambiguous. On the one hand, the buyer wins by purchasing goods at a reduced price, and on the other hand, he loses, because he is forced to increase his expenses for storing large quantities of goods (sometimes they are very significant due to the lack of their own storage facilities, etc.).

Cumulative (cumulative) discounts involve a decrease in the price of a product with an increase in the amount of purchases over a certain period of time, even if such purchases consisted of small individual batches of goods. They got their name due to the fact that the volume of purchases is calculated on an accrual basis, that is, the accumulation (cumulative) of the amounts of goods sold.

The differentiation of such discounts is based on the volume of purchases by the buyer. The procedure for their provision is different, it must be provided for in the contract for the supply of goods.

Discounts for accelerated payment of goods often referred to as cash discounts. They are provided to buyers who pay for goods at an earlier date (in some cases, payment for goods in cash is taken into account in amounts not exceeding the established limits). When establishing such discounts, the contracts should provide for the amount of the discount, the period for its provision and the period for payment of the goods by the buyer.

The most widespread seasonal discounts(discounts for out-of-season purchases). They are pre-season and post-season.

Pre-season discounts are provided to the buyer if he purchases goods before the start of the next season, that is, outside the period of the year for which they are intended (sports, garden equipment, fans, etc.). In this case, discounts should be differentiated (the earlier goods are purchased before the start of the season, the greater the discount should be).

Post-season discounts usually installed before the end of the season (on clothes, shoes, furs, accessories, etc.). As a rule, the largest number of purchases in this case is made in the first days of sales.

In Russia, unlike the countries of Europe and the USA, there are no mandatory dates and terms for such sales. This can be explained by the lack of appropriate legislative and regulatory framework at prices.

A significant part of buyers in the West make their purchases also in the early days seasonal sales. Discounts at this time reach up to 70%. Usually, winter sale lasts from the Christmas holidays until mid-February, and summer - from the first days of July to mid-August.

Bonus Discount usually given to regular customers. The mechanism of action of such discounts is different. The following procedure is often used bonus discount: a certain amount of money is credited in favor of the buyer, calculated either as a percentage of the cost of the purchased goods, or in a fixed amount for each purchase. The buyer each time pays the supplier the full cost of the goods, excluding tax discounts, at the same time the supplier credits part of the paid amount for the goods to the buyer's personal account, which can use it to pay for the next batch of goods.

A bonus discount can also be provided to all customers (for example, in retail trade) when purchasing a particular product in a certain period of time. Typically, such a discount is in the form of a "gift" and is used as part of advertising campaigns in order to accelerate the sale of goods. However, from the point of view of taxation, such a procedure for granting a discount may be unprofitable for the seller, since the gratuitous transfer of goods is subject to value added tax (VAT).

Discount discounts are provided to regular customers for all or certain products on the basis of discount cards. The procedure and conditions for issuing them are different and are established by the seller. Such discounts can be simple and cumulative.

A slightly more complex form of price reduction − coupon when the coupon owner is offered a discount in the form of:

- a certain percentage of the price of the goods;

- a certain amount of money;

- reduction in the price of any product indicated in the coupon.

Coupon distribution methods are different (mailing, through the press, handing a coupon to a visitor in a trading company, placing a coupon in the packaging of an already purchased product, etc.).

Getting a coupon from a trading company is the most effective form of distribution. Compared to other forms, its costs are insignificant, and the rebound effect, according to some experts, is 10-20%.

Having considered the main types of discounts, we will dwell on the issues of providing some of them when concluding contracts between legal entities.

The procedure for granting discounts

As already mentioned, there is no official definition of the concept of "discount". As a rule, it is understood as a reduction in the initial price of the goods, established by agreement of the parties to the contract.

In accordance with civil law (clauses 1, 2 of article 424 Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation)) the performance of the contract is paid at the price established by agreement of the parties. Changing the price after the conclusion of the contract is allowed in cases and on the conditions provided for by the contract, the law or in the manner prescribed by law. This fully applies to supply, purchase and sale agreements used by sellers and buyers in their activities.

Any changes to the contract, including those related to a decrease in the price of goods, are agreed upon by the participants in the sale and purchase transaction (clause 1, article 450 of the Civil Code of the Russian Federation).

From the point of view of civil law, a discount should be understood as a reduction in the original price of the goods.

Discounts should also include bonuses. However, according to some authors, the premium and discount are not identical, although they are a form of customer encouragement. So, the premium is understood as a monetary or material incentive for achievement, merit in any field of activity (for example, the purchase of goods in a certain amount, early payment for goods, etc.).

However, the Decree of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 7, 2012 No. 11637/11 states that the premiums paid by the seller for the fulfillment of certain conditions of the supply agreement are one of the forms of discounts, therefore, they can change the price of the goods and influence the formation tax base for VAT. However, this provision needs some clarification.

As you know, a significant part of the goods is sold at free prices, that is, concluded by agreement of the parties. However, federal laws may provide state regulation prices for certain types of goods, trade allowances (margins) to their prices. In addition, limiting maximum and (or) minimum levels prices by public authorities.

Article 8 of Federal Law No. 381-FZ of December 28, 2009 (as amended on December 31, 2014) “On the Basics of State Regulation of Trading Activities in the Russian Federation (hereinafter referred to as Federal Law No. 381-FZ) provides that business entities engaged in trading activities, when organizing trading activities, with the exception of cases established by this Law and other federal laws, independently determine the prices for the goods sold.

However, if federal laws provide for state regulation of prices for certain types of goods, trade allowances (margins) for them, including the establishment of their limits(maximum and (or) minimum) by public authorities, then the establishment of prices for such goods, trade markups (margins) to prices is carried out in accordance with:

- specified federal laws;

- normative legal acts of these state authorities and (or) normative legal acts of local self-government bodies adopted in accordance with them.

Note!

If the growth of retail prices for certain types of socially significant food products essentials will be 30% or more within 30 calendar days in a row on the territory of a separate subject of the Russian Federation or the territories of subjects of the Russian Federation, the Government of Russia has the right to establish maximum permissible retail prices for them. This is done in order to stabilize retail prices for these types of trade for a period not exceeding 90 calendar days.

Scroll certain types socially significant essential food products and the procedure for establishing maximum allowable retail prices is established by the Government of Russia.

The price of the contract for the supply of food products, which is concluded between business entities - suppliers of food products and engaged in trading activities, is determined based on the price of food products by agreement of the parties, taking into account the provisions discussed above (Article 8 of Federal Law No. 381-FZ).

When concluding a supply contract, a fee may be included in the price of food products. It is paid to an economic entity carrying out trading activities upon the purchase of a certain amount of food products.

The amount of remuneration is agreed upon by the parties to the contract when it is included in the delivery price. However, this remuneration is not taken into account when determining the selling price of food products. The amount of remuneration cannot exceed 10% of the price of purchased food products.

The payment of appropriate remuneration is not provided if trading activities are carried out with socially significant food products according to the list of the Russian Government.

It is not allowed to include in the price of the contract for the supply of food products other types of remuneration by subjects of trading activity when they fulfill the terms of this contract, as well as its change (Article 8 of Federal Law No. 381-FZ).

When carrying out trading activities, economic entities may provide services for advertising food products, marketing, other services for the promotion of food products on the basis of contracts for the provision of services for a fee, that is, on the basis of separate agreements. Coercion to conclude such contracts is not allowed.

If the above requirements are not met, the cost of providing the relevant services to the seller will not be expensed for income tax purposes. Attention is also drawn to this in the relevant letters of the Ministry of Finance of Russia (dated 12.10.2011 No. 03-03-06/1/665, dated 19.02.2010 No. 03-03-06/1/85 and some others). In addition, in such cases, administrative liability is provided (Article 14.42 of the Code of Administrative Offenses of the Russian Federation) in the form of a fine (for officials and organizations).

At the same time, it is prohibited to impose conditions on the counterparty supplier of food products to reduce the price to a level that, taking into account the trade markup (margin) to such a price, did not exceed the minimum price of such goods when they are sold to business entities in the course of similar activities (Article 13 of the Federal Law No. 381-FZ).

Note!

Granting a discount by the seller is possible both during the current delivery and after the goods are shipped.

From an accounting and tax accounting providing a discount for the current supply of goods is the easiest way for counterparties. This can be explained by the fact that at the time of shipment of the goods, the seller and the buyer know the final price recorded in the relevant shipping documents.

Issues of pricing, price discounts are directly related to VAT.

The seller's revenue is calculated in prices, taking into account the discount provided. This price is taken into account when calculating VAT.

If the buyer is given a discount from the price after the goods are shipped, then on the basis of paragraph 3 of Art. 168 tax code RF (hereinafter referred to as the Tax Code of the Russian Federation), the seller must issue to the buyer, within 5 calendar days from the date of drawing up an additional agreement to the sales contract, an adjustment invoice, which is the basis for the seller to deduct the amount of tax that was additionally assessed upon shipment of goods based on from the original price.

For your information

When the value of goods changes in the event of a price decrease, the seller's deduction is the difference between the tax amounts calculated based on the cost of goods shipped before and after such a decrease (clause 13, article 171 of the Tax Code of the Russian Federation).

In turn, the buyer of this product restores part of the amount of the so-called "input" tax, which was previously accepted by him for deduction. The difference between the amounts of tax calculated on the basis of the value of shipped goods before and after the price change is subject to recovery.

Stimulation of the counterparty-buyer due to premiums provided from the aggregate price goods sold for a certain time without changing the price, does not allow the supplier of the goods to issue adjustment invoices, which provide for aggregate delivery indicators. The procedure for issuing adjustment invoices is applicable only to cases of revision of the price of goods.

According to some taxpayers, established rules the use of adjusted invoices, which do not allow taxpayers to issue such invoices in conjunction with delivery indicators, leads to certain difficulties in their preparation and is contrary to the Tax Code of the Russian Federation.

Arbitrage practice

There are objections to this from the Supreme Arbitration Court of the Russian Federation (Resolution No. 13825/12 dated January 11, 2013). The position of the court was substantiated as follows. Chapter 21 of the Tax Code of the Russian Federation defines particular cases of reducing the cost of delivered goods, however, they are the only possible ones in relation to reducing the initial price, reducing the cost of delivered goods. The court also noted that in 21 of the Tax Code of the Russian Federation does not provide for special provisions in cases of payment of premiums that do not affect the initial price for a certain volume of purchases. In this regard, when the total value of shipped goods changes without changing the unit price of goods, the provisions of tax legislation on adjusted invoices do not apply.

Most often, the premium is paid at a certain volume of purchases by the buyer. In the opinion of the tax authorities, the application of such premiums does not give rise to tax liabilities for either the seller or the buyer. This is due to the definition of the object of taxation for VAT. In this case, the object of taxation is the sale of goods (works, services). When paying a premium, there is no such implementation.

The amounts of these premiums do not increase the VAT tax base, since the receipt of the premium is not associated with payment for goods (works, services) sold, therefore, this amount cannot increase the buyer's VAT tax base. Corresponding explanations on this matter are given in the letters of the Ministry of Finance of Russia, the Federal Tax Service of Russia and in separate resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation.

The situation is different in terms of VAT taxation of premiums paid to the buyer for performing any actions in the interests of the seller. The premium paid to the buyer for the provision of a service on behalf of the seller is a fee for the provision of the service. In this regard, the seller is obliged to issue an invoice to the buyer (with VAT), and the buyer, in turn, on the basis of the invoice will be able to use the tax deduction.

G. A. Gorina, Ph.D. economy sciences, prof. Department of Taxes and Taxation of the Russian University of Economics them. G. V. Plekhanova

I APPROVE General Director of the importing organization "A" ————————- Ivanov Ivanov I.I. ——- ————— (signature) (full name) "17" __January__ 2012

Section I. General Provisions

1. This provision defines the procedure and conditions for providing buyers with discounts from the selling prices formed and placed in the price list for imported goods and their sizes.

2. This provision has been developed with the aim of accelerating the turnover of the organization's working capital, increasing the volume of sales of goods and expanding their markets.

3. This provision is mandatory for application by all employees of the organization, in official duties which includes negotiating and concluding contracts for the sale of goods.

4. Economic calculations to justify the expediency of selling goods on the terms of providing a discount from the selling price, they are compiled by the sales department and submitted for approval to the director of the organization or his deputy.

5. The decision to grant discounts on selling prices for goods is made by the director or his deputy.

6. If an agreement is reached on providing a discount from the selling price, the price of the goods agreed with the buyer in the supply contract or the price agreement protocol on the terms of the discount is not subject to revision and change, unless otherwise specified by law.

Section II. Types of discounts provided from selling prices for goods, their size and terms of provision

1. Discount for the terms (terms) of payment for goods of foreign origin - a discount from the selling price provided to buyers for preliminary or advance payment for goods, as well as when paying for goods in full or in parts of the deadline established by the contract earlier.

———————————————————————— ¦ N ¦ ¦ Unit. ¦ ¦Size ¦ ¦p/n¦ Product name ¦change. ¦ Payment term ¦discounts,¦ ¦ ¦ ¦ ¦ ¦ % ¦ +—+—————————+——+—————————+——-+ ¦ 1 ¦Synthetic detergents ¦ 1 kg ¦Preliminary ¦ 2 ¦ ¦ ¦household means ¦ ¦(advance) payment ¦ ¦ ¦ ¦destination (universal):¦ +—————————+——-+ ¦ ¦powder ¦ ¦Payment within 3 days ¦ 1 ¦ ¦ ¦ ¦ +—————————+——-+ ¦ ¦ ¦ ¦Pay within 5 days ¦ 0.5 ¦ —-+——————————+ ——+—————————+———

2. Discount for the volume of the lot - a discount from the formed selling price, provided to buyers for a one-time purchase of goods of foreign origin of one name in a certain quantity (weight, volume) exceeding the established value of the minimum lot.

———————————————————————— ¦ N ¦ ¦ Unit. ¦ ¦Size ¦ ¦p/n¦ Product name ¦change. ¦ Minimum lot ¦discounts,¦ ¦ ¦ ¦ ¦ ¦ % ¦ +—+—————————+——+—————————+——-+ ¦ 1 ¦Synthetic detergents ¦ 1 kg ¦8000 ¦ 2 ¦ ¦ ¦ household products ¦ +—————————+——-+ ¦ ¦ purpose (universal):¦ ¦15 000 ¦ 3 ¦ ¦ ¦ powder ¦ +———— —————+——-+ ¦ ¦ ¦ ¦20 000 ¦ 4 ¦ ¦ ¦ ¦ +—————————+——-+ ¦ ¦ ¦ ¦30 000 or more ¦ 5 ¦ —- +—————————+——+—————————+———

3. Special discount - a discount from the selling price for goods of foreign origin, provided to regular customers for the duration of relationships, the regularity or stability of orders, etc.

———————————————————————— ¦ N ¦ ¦ Unit. ¦ Conditions of provision ¦Size ¦ ¦p/n¦ Product name ¦change. ¦ discounts ¦discounts,¦ ¦ ¦ ¦ ¦ ¦ % ¦ +—+—————————+——+—————————+——-+ ¦ 1 ¦Synthetic detergents ¦1 kg ¦ When purchasing goods not ¦ 3 ¦ ¦ ¦ household products ¦ ¦ less than 1 time in 10 days in ¦ ¦ ¦ ¦ destination (universal):¦ ¦ for 5 years ¦ ¦ ¦ ¦ powdered ¦ +——————— ——+——-+ ¦ ¦ ¦ ¦ When purchasing goods not ¦ 2 ¦ ¦ ¦ ¦ ¦ less than once a month in ¦ ¦ ¦ ¦ ¦ ¦ for 5 years ¦ ¦ ¦ ¦ ¦ +——————— ——+——-+ ¦ ¦ ¦ ¦ When purchasing goods not ¦ 1 ¦ ¦ ¦ ¦ ¦ less than once a quarter in ¦ ¦ ¦ ¦ ¦ ¦ for 5 years ¦ ¦ —-+———————— —+——+—————————+———

4. Commission discount - a discount from the selling price for goods of foreign origin, provided to subjects entrepreneurial activity engaged in wholesale and retail(residents of the Republic of Belarus) in accordance with the concluded commission agreements for the sale of goods by them on the territory of the republic.

———————————————————————— ¦ N ¦ ¦ Unit. ¦ Conditions of provision ¦Size ¦ ¦p/n¦ Product name ¦change.

Enter the site

¦ discounts ¦discounts,¦ ¦ ¦ ¦ ¦ ¦ % ¦ +—+—————————+——+—————————+——-+ ¦ 1 ¦Synthetic detergents ¦1 kg ¦When selling goods on ¦ 3 ¦ ¦ ¦household ¦ ¦territory of the republic ¦ ¦ ¦ ¦appointment (universal):¦ ¦ ¦ ¦ ¦ ¦powder ¦ ¦ ¦ ¦ —-+—————————+ ——+—————————+———

5. Dealer discount - a discount from the selling price for goods of foreign origin, provided to its permanent representatives (sales agents) in accordance with the dealer agreements concluded by them for the sale of goods within the city of Minsk and beyond.

———————————————————————— ¦ N ¦ ¦ Unit. ¦ Conditions of provision ¦Size ¦ ¦p/n¦ Product name ¦change. ¦ discounts ¦discounts,¦ ¦ ¦ ¦ ¦ ¦ % ¦ +—+—————————+——+—————————+——-+ ¦ 1 ¦Synthetic detergents ¦1 kg ¦When selling goods ¦ 6 ¦ ¦ ¦household ¦ ¦inside Minsk ¦ ¦ ¦ ¦appointment (universal):¦ +—————————+——-+ ¦ ¦powder-like ¦ ¦When selling goods on the territory of Minsk region ¦ ¦ ¦ ¦ ¦ ¦Minsk and Minsk region ¦ ¦ —-+—————————+——+—————————+———

6. In accordance with this Regulation, if the purchaser of the goods has the right to provide a discount on several grounds, the discount is granted on one basis, providing for the largest discount.

Section III. Final provisions

1. This regulation comes into force from the moment of its approval by the director of the organization.

2. The sale of goods received in the form of a commodity discount is carried out at selling prices formed in accordance with the generally established procedure.

3. In the event of a change in the current legislation, the application of this provision before making changes to it is carried out in the part that does not contradict the law.

Document page source: https://belforma.net/forms/Regulations/Regulations_on_the_order_of_application_of_discounts_Sample

The main objective of discounts is to increase turnover and strengthen the company's position in the sales market. Sometimes an organization fails to get the desired response from customers. How to provide discounts, attract a wide audience of customers and get the maximum benefit from it?

The cost of the goods must be positively assessed by the buyer. By itself, the discount does not bring the desired result. In order for the offer to be of interest to the target audience, a specific reason is needed. This may be due to several conditions:

- Sincerity. The company may confess its intentions, and say that the price reduction is due to the desire to revive sales and make their customers happy.

- The more purchases, the bigger the discount. For example, for the purchase of 2 products, the client receives a discount of 15%, and for three - 25%. Thanks to this, the profit stream increases several times.

- Test poll. For example, an organization is trying to figure out how many people would be willing to use a service if the price were reduced by 20%.

REGULATION ON DISCOUNTS.

Thus, the company will be able to find out whether the discount is justified, and how many customers can be counted on.

In order for the company to be able to promote the product and attract new customers by providing discounts, it must announce them in advance. You can make an announcement and warn potential customers about the launch of the program. For this purpose, the company can send letters or SMS messages to the phone. Buyers will be up to date and start preparing their wallets in advance.

Often there are situations when the effectiveness of the discount is very small, and sometimes not at all. Most often this happens for several reasons:

- The "pseudo-discount" effect. The client ignores the offer if he treats it with distrust. For example, often on store shelves there are price tags that indicate two values, where the highest is crossed out.

- Customers will be wary of an offer if the discount on the item is high enough, but the company does not justify the reason for its offer.

- Too high a percentage of the discount can alienate the buyer. There will be fears and, most likely, he will take advantage of the offer of competitors.

Using discounts as the main pricing strategy is not safe. Over time, it will be more difficult for the enterprise to return to the main cost, to explain to the client the reason for the cost. Providing a discount on the 2nd, then on the 3rd, etc. purchase of a product is justified only in moments of stagnation and overcrowding of the market. In normal situations, it is reasonable to give discounts to customers who ideally fit into the “VIP” category. These include clients who:

- Make payments on time.

- Loyal.

- Actively cooperate and provide information.

- There are jointly implemented projects.

- They are among the regular customers and have already left good review about cooperation, and were also able to attract new customers.

As a result of lowering the cost of services, the seller's profit decreases. But by providing customers with discounts, the company achieves other, no less significant tasks. For example, new customers are attracted and sales volumes increase. As a result, the buyer takes a more advantageous position in the market, and trademark acquires a recognizable and positive image. Following the growth of turnover, the profit of the seller also increases.

What to pay attention to

- A discount should be provided only to those buyers who have already managed to use the services at the full cost at least 1 time, as they can be deleted from the number of "random" customers. That is why most businesses provide discounts only to regular customers.

- More buyers trust high quality and reasonable price, so the cost of the service should cover the cost of the costs. It is more reasonable to provide a discount to regular customers who were able to generate income for the enterprise and a significant turnover of products.

- Discounts should be regular, and contribute to the activities of the enterprise every day. Items may be sold at various discounts depending on the period of time. The price must go up and down, and all changes must be advertised.

- As an effective marketing move can serve as gifts and surprises to customers, especially on holidays. This approach will help to gain trust and credibility.

The conditions for providing discounts to customers are fixed in the marketing policy of the organization. To reduce the risk of financial losses as a result of disagreements with the tax authorities, the selling company is obliged to document the conditions and methods for its implementation.

The provision of a discount is of interest to the tax authorities, and they begin to actively check the correctness of the application of prices. If they find out that the price has gone down as a result market value more than 20%, the seller will be required to recalculate and pay them to the budget on their own. This number does not include only regular discounts, for example:

- Seasonal discounts caused by changes in product demand.

- Markdown of goods due to loss of qualities and properties, as well as expiration dates.

- Dealer, bonus and promotional cost reduction, prescribed in the company's marketing policy.

Such discounts are issued by order of the entrepreneur for any amount. Subsequently, on its basis, the commission draws up an act for markdown.

In conditions of successfully selected instruments, discounts bring maximum benefits. In order to avoid claims from the tax authorities, the company's accountant is obliged to fully substantiate it in accordance with Art. 40 of the Tax Code of the Russian Federation, and provide a properly executed package of documents. The campaign must have a specific cost, size and discount period.

___________________________________________________ (full name of the legal entity, TIN, address)

I approve

Supervisor

_____________________

_____________________

"___"________ ___ G.

Internal corporate standard "Regulations on discounts and premiums"

1. Scope and scope

1.1. The internal corporate standard "Regulations on discounts and premiums" (hereinafter referred to as the "Standard") establishes General requirements to the procedure for calculating discounts, premiums and bonuses, the conditions and procedure for their provision to counterparties ______________________________________ (hereinafter referred to as the "Company"). (Name legal entity)

This Standard also defines the list, powers and responsibilities of all officials involved in the process of providing discounts, bonuses and bonuses, as well as the motivation system for such officials.

1.2. This Standard is mandatory for all divisions of the Company.

2.

Internal corporate standard "Regulations on discounts and premiums"

General provisions

2.1. Discounts and bonuses are provided in order to implement the marketing policy.

2.2. Objectives of the Standard:

— adequate determination of the terms of contracts with buyers of the Company's goods, containing conditions for granting discounts and paying bonuses, including in them by law established requirements and the exclusion of conditions that are contrary to law, as well as incomplete, ambiguous and conflicting requirements;

— elimination of contradictions between the terms of the agreement on the provision of discounts and the payment of bonuses and the requirements of officials who analyze this agreement;

– conclusion of a contract on terms that can be duly fulfilled by the Company and the buyer.

2.3. Economic efficiency implementation of the system of discounts, bonuses and bonuses used by the Company is evaluated according to the following parameters, calculated quarterly before the 10th day of the first month following the reporting month (quarter):

increase in sales volumes by ___ percent monthly (quarterly);

(or: ensuring the Company's income from the sale of goods of at least ______ thousand rubles;)

increase in the number of new customers by at least _____ per month;

growth net profit Companies from sales for the month (quarter) of at least _____ thousand rubles.

2.4. This Standard defines:

— the procedure and algorithm for calculating discounts, premiums and bonuses;

— conditions and procedure for providing discounts, premiums and bonuses to counterparties;

— the procedure for analyzing competitors' prices for similar products in the context of all markets for their sale;

- list, powers and responsibilities of all officials involved in the process of providing discounts, bonuses and bonuses, and their interaction in this process;

— a system of motivation for all employees of the Company involved in the process of providing discounts, bonuses and bonuses, etc.

3. The procedure for calculating the amount of discounts, premiums and bonuses

3.1. A discount on ________________________________________________________________ (name of goods) with a sales volume of at least ________ is provided according to the following scheme: - for the period from _______ to _______ there is a discount of ______%; — for the period from _______ to _______ there is a discount of ______%. 3.2. The premium for the sale of _____________________________________________ (name of goods) with a sales volume of at least ________ is provided according to the following scheme: - for the period from _________ to _________, a premium in the amount of ________%; - for the period from _________ to _________, a bonus in the amount of _________%. 3.3. Bonuses for the sale of _____________________________________________ (name of goods) with a sales volume of at least ________ are provided according to the following scheme: - for the period from _________ to _________ bonus in the amount of ________%; — for the period from _________ to _________ bonus in the amount of _________%. 3.4. Written proposals from the sales department, marketing department and other employees of the Company on the provision of discounts, bonuses, bonuses are considered by a commission consisting of: ________________________________ - chairman of the commission; (position, surname, initials) ________________________________ - member of the commission; ________________________________ is a member of the commission.

3.5. The Commission makes a reasonable and economically well-thought-out decision on the advisability of submitting a proposal for the provision of discounts, bonuses, bonuses for consideration by the Company's management within ____ days from the date of their receipt.

4. Competitor price analysis procedure

4.1. The marketing department conducts weekly (monthly, etc.) research of certain market segments with the involvement of other companies and external specialists.

4.2. Ready reports are provided to the interested departments of the Company no later than the ___ day of each month (quarter).

5. Types of marketing funds

———————————————————————————————— ¦View ¦Retail¦Purpose ¦Conditions ¦Fixed/ ¦Ability ¦General ¦ ¦ marketing network during ¦Companies ¦ ¦ ¦ ¦ ¦ ¦ ¦ Validity ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ Marketing¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ Agreement ¦ ¦ +—————+———+—————+—— ———+—————+—————+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦in points ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦sales ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+———+—————+—————+— ————+—————+——--+ ¦Fund ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦joint ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦release ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦promotional ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ editions ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+———+—————+—————+—————+—————+———- + ¦Opening fund ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ new ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦stores ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦retail chain¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+———+ —————+—————+—————+—————+———-+ ¦And so on…¦ ¦ ¦ ¦ ¦ ¦ ¦ —————+——— +—————+—————+—————+—————+————

Source and procedure for creating a bonus pool<*>, the terms of its provision with detailed description indicators to be met, for which the retail chain is rewarded.

<*>Bonus pool is a special fund formed by the Company and intended to reward sales leaders ( retail chains) complying with the established norms.

6. Powers of employees to provide discounts, bonuses, bonuses

6.1. The powers of each employee who makes decisions on the provision of discounts, bonuses, bonuses:

———————————————————————— ¦Position ¦ Retail sales ¦ Wholesale¦ ¦ employee ¦ (size, conditions<**>¦(size, conditions<**>¦ ¦Companies ¦provisions) ¦provisions) ¦ ¦ +—————————+——————————+ ¦ ¦discounts ¦premiums ¦bonuses ¦discounts ¦premiums ¦bonuses ¦ +—— ———+——-+———+———+———+———+———+ ¦ Head ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+——-+—— —+———+———+———+———+ +———+———+———+———+ ¦Head ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦division ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦marketing, ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦sales (and etc. .d.) ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+——-+———+———+———+———+———+ ¦Sales Manager¦ ¦ ¦ ¦ ¦ ¦ ¦ +—————+——-+———+———+———+———+———+ ¦Seller ¦ ¦ ¦ ¦ ¦ ¦ ¦ —————-+— —-+———+———+———+———+———-

<**>Sale volume, sale price, payment terms, etc.

6.2. Each of the above persons bears full individual liability for real damage caused to the Company in case of exceeding their authority or illegal actions.

6.3. IN non-standard situations the decision to grant discounts, premiums, bonuses is made only by the head of the Company.

7. Control

7.1. Control over the implementation by the employees specified in clause 6.1 of the Standard of their powers is carried out by an independent auditor (or: audit service).

8. Employee motivation system

8.1. The system of motivation of employees involved in the sale of goods:

————————————————————————<***>provision) ¦ ¦ +—————————————————+ ¦ ¦Bonus ¦Additional ¦Valuable gift ¦ ¦ ¦ ¦vacation ¦ ¦ +———————+——— ——-+—————-+——————+ ———+ ¦Deputy ¦ ¦ ¦ ¦ ¦ Head ¦ ¦ ¦ ¦ +———————+—————-+—————-+——————+ ¦Head ¦ ¦ ¦ ¦ ¦ subdivisions ¦ ¦ ¦ ¦ ¦ marketing, sales ¦ ¦ ¦ ¦ ¦ (etc.) ¦ ¦ ¦ ¦ +———————+—————-+—————- +——————+ ¦Sales Manager ¦ ¦ ¦ ¦ +———————+—————-+—————-+——————+ ¦Seller ¦ ¦ ¦ ¦ ———————-+—————-+—————-+——————

<***>Achievement of the goals and objectives of the marketing policy, depending on the employee.

8.2. The system of motivation is reflected in the prisoners with such workers employment contracts(Article 255, paragraph 21 of Article 270 of the Tax Code of the Russian Federation and Article 57 Labor Code Russian Federation).

9. Responsibility for the implementation and overall control of compliance with the Standard

Control over compliance by the Company's employees with the requirements of this Standard is carried out by the Deputy Head for Economics ( Commercial Director etc.).

Head of the Marketing Department

Here is another question on which I observe porridge both in the minds and in the price lists of companies.

How does this porridge look? Let me give you a non-fictional dialogue. I think it's very recognizable, isn't it?

Dialogue of the village and the beginning. sales department:

Sereg, TransTech is asking for a discount... more.

- And what? How much does he have?

- minus 7%

- Wow! and how does he take, and how does he pay?

- normally takes, here for 200 thousand vzal.

- on credit?

- Well, yes, he does. Let's give, he says, he will take more discount.

- and pays, pays how?

- Well, yesterday I paid 100

- owe how much?

- 400, but he says he will pay in a week.

- well... well, give him another 2%... no, give him 1%

In a rush to show professionalism, and realizing the senselessness of the dialogue, many of us will immediately rush to comment: it is not clear what 1% is, for what, what does it mean to "take more"? And of course we will be right with you. Let's figure out what you need to "give" for and how much to "give".

Discount classification

The discount can be one of three types:

- marketing discount;

- marketing discounts;

- logistics discounts.

Direct discounts are referred to as marketing discounts. unrelated with current and well-established sales logistics: goods - in exchange for money. These discounts affect development prospects, stimulate partner relationships (CRM), and structure the sales channel.

Sales discounts include discounts directly related to current transactions, to ensure a given profitability of sales and the current planned inventory turnover for concluded (concluded) transactions.

Logistic discounts include discounts for optimizing cash and commodity flows that affect current financial indicators company activities.

Marketing Discounts

Hidden promotional discount

Such discounts include the organization by the manufacturer of advertising their products with a list of trading companies that sell these products. Thus, the manufacturer actually saves the money of its dealers on advertising their trade names, which, by its economic nature, is tantamount to providing them with an additional discount.Functional discount (discount for distribution)

The manufacturer provides various functional discounts to the players of the trading channel who provide him with different types services (logistics, services for the development of a sales network, building a dealer network). Functional Discount in the Marketer's Dictionary

Dealer discount

It is provided by the manufacturer to its permanent representatives or sales intermediaries (for example: an affiliate program for servicing customers in a chain of stores: promotions, use of promotional rooms, merchandising, etc. are stimulated by a dealer discount).

Discounts based on intercultural communications

IN practical activities marketing is faced with a very important circumstance, which should be attributed to the so-called cultural differences, which is also the subject of marketing research.

In the Central Asian, Arab, some Balkan countries and some Transcaucasian republics, in the course of trade negotiations it is considered a matter of honor to achieve a large discount from the offer price. And although this circumstance is associated with a complex of Eastern mentality, many importers will not sign an agreement that does not contain a clause on discounts exceeding 20-30% of the offered price in general. Since this fact is known in the marketing and sales environment, some companies consider it necessary to artificially inflate prices by the expected percentage, and then present it with a discount specified in the contract.

Service discounts

A significant part of industrial production needs maintenance during the period of operation. The creation and maintenance of an efficient service network, which requires significant investment and effort, is favored by providing a service discount. This approach to solving the problem would be acceptable if it were possible to monitor the implementation of additional functions by the recipient and a way to evaluate the effectiveness of such a discount.

- on the part of the buyer - the amount of costs for storing the goods purchased in advance before the start of the season of its sales (including payment for loans attracted for this);

- on the part of the manufacturer - the amount of costs and losses that he would have to incur if the manufactured goods were stored before the start of the season in his own warehouses, and production was either stopped due to the deadening of working capital in stocks finished products or was supported by additionally raised loans to replenish working capital.

Therefore, the amount of discounts should provide the buyer with savings greater than the increase in his costs of storing goods before the period of seasonal demand rise. On the other hand, the manufacturer can provide such discounts - for an amount no greater than the amount of his losses due to a slowdown in capital turnover as a result of storing goods before the start of the season in his own warehouses and not receiving sales proceeds.

The logic of discounts for out-of-season purchases requires their differentiation in time: the earlier the product is purchased before the start of the season, the greater the discount should be.

Discounts to encourage new product sales.

Such discounts can be seen as an addition to the planned discounts that promote the promotion of a new product to the market. As a rule, such discounts in the form of financing a national advertising campaign with the names of trade companies selling this product are not enough. For example, such advertising does not really give consumers information about where they can actually buy the mentioned product in their city (district).

Therefore, dealers and end sellers have to conduct their own advertising campaigns using local authorities mass media (advertising rates in which are usually lower than in the national press or on national television). This gives them the opportunity to indicate the addresses of their stores in such advertising, which really provides an increase in sales.

Discount to encourage sales - a measure of reduction in the standard selling price that is guaranteed to resellers if they take on new products for sale, the promotion of which on the market requires increased costs for advertising and sales agents.Sales discounts

Discount for turnover, bonus discount (bonus)

The discount is provided to regular customers on the basis of a special power of attorney. The contract in this case establishes a scale of discounts (scale of discount), depending on the turnover achieved within a certain period (usually one year), as well as the procedure for paying amounts based on these discounts.

Such a system of discounts is drawn up in the form of columns price list. This is the price list. I call (well, I like it this way) the price columns - price protocols: 1st protocol, 2nd protocol. Why so? Coordination and recording of prices - legal basis transactions, fixed in the Civil Code of the Russian Federation. If somewhere in other articles you stumble upon "price protocols" - this is from this.

Logistic discounts

Other types of discounts can be categorized tactical logistics.

They are united by an economic source - profit(!), as well as a common task - to create additional incentives for the buyer to make a purchase. The use of logistics discounts leads to a decrease in the real purchase price of the goods and, accordingly, to an increase in the buyer's premium. This premium is the difference between the economic value of the product for the buyer and the price at which he was able to buy this product.

The main types of discounts include:

Volume discount

Proportionate price reduction for buyers purchasing large quantities one kind goods. Usually the discount is set as a percentage of the total cost or unit price of the set scope of delivery, for example, 10% discount for orders over 1000 pieces. Discounts may be offered on a non-cumulative basis (per order placed) or on a cumulative basis (on the number of items ordered in a given period).

Quantity discounts should be offered to all buyers, but in this case, the supplier/seller should ensure that the amount of the discounts does not exceed its cost savings due to the increase in the volume of goods sold. This savings can be formed by reducing the costs of selling (trade processing), warehousing, maintaining inventory and transportation of goods. Discounts of this kind can also serve as an incentive for the consumer to make purchases from one seller (constant purchases).

Discount for cash payment

If it is necessary for you, reduction of the price for buyers who promptly pay bills in cash. A buyer who pays within 10 days receives, for example, a two or three percent reduction from the payment amount. This discount can also be applied partially, for example, only for a percentage of the total amount received within 30 days. With a larger volume of delivery or more expensive equipment, this type of discount can greatly activate the local counterparty, who is interested in selling faster and getting his considerable income.

Such discounts are widely used to improve the liquidity of the supplier / seller, the rhythm of his cash receipts and reduce costs in connection with the collection of receivables.

Discount for waiving receivables (for reducing the terms of receivables)

The discount can also stimulate the reduction of the terms of the commodity credit provided by the supplier to the client.

Progressive discount

A discount for quantity or series is provided to the buyer on the condition that he purchases a predetermined and increasing in quantity product. Serial orders are of interest to manufacturers, since production costs are reduced in the manufacture of the same type of product. The discount is given after the fact, or in advance, under an agreement fixing such a progression. Sells often gives such a discount without a contract, by verbal agreement. These are the agreements that need to be recorded in any case, at least within the company in the CRM system.

Export discounts (export rebate)

Provided by sellers when selling goods to foreign buyers in excess of those discounts that apply to domestic buyers. Their goal is to increase the competitiveness of goods in the foreign market.

Discount for faster payment.

The main task of discounts for accelerating payment is to reduce the maturity of receivables and accelerate the turnover of the firm's working capital. Therefore, this commercial tool can be more attributed to the field of management than the actual pricing. But since such discounts are set in relation to prices, they are traditionally determined by price makers together with financiers and accountants.

Discount for expedited payment - a measure to reduce the standard selling price, which is guaranteed to the buyer if he makes payment for the purchased consignment of goods earlier than the period established by the contract.

The Fast Payment Discount Scheme has three elements:

- the actual quantitative value of the discount;

- the period during which the buyer has the opportunity to use such a discount;

- the period during which payment of the entire amount of the debt for the delivered consignment of goods must be made, if the buyer does not exercise the right to receive a discount for accelerated payment.

The amount of the rate for expediting payment is usually determined by two factors:

- the level of such rates traditionally prevailing in the given market;

- level of banking interest rates for loans to replenish working capital.

The connection of the discount for the acceleration of payment with the price of credit resources is quite logical. If the manufacturer cannot achieve an acceleration in the repayment of receivables, then he has to replenish his working capital mostly through loans. Faster payment for shipped goods reduces the need to raise funds and generates savings through lower interest payments.

At the same time, the level of discounts for expediting payment is usually significantly higher than the price of credit resources.

This excess of the discount level over the price of loans is justified by the large positive effect that accelerated payment has on financial condition seller firm. This effect arises due to the fact that early payments:

- accelerate the flow of funds to the seller's account and improve the structure of his balance sheet, which is essential for obtaining loans by him, and also affects the assessment of the company's position by investors (including the price of its shares on stock exchanges);

- reduce credit risks associated with accounts receivable, and increase the reliability financial planning;

- reduce the company's costs of organizing the collection. accounts receivable.

Discount for off-season purchase

This is a measure to reduce the standard selling price, which is guaranteed to the buyer if he purchases seasonal goods outside the period of the year for which they are intended. The purpose of using discounts for out-of-season purchases is to encourage buyers to purchase these products before the start of the next season, at the very beginning, or even out of season. This provides faster asset turnover and allows manufacturers to seasonal goods reduce seasonal fluctuations in the load of their production capacity.With a well-established system of seasonal discounts, manufacturers get the opportunity to organize and complete the production of goods for the next season long before it starts and start preparing for the production of products for the next season in a timely manner.

The amount of seasonal discounts is usually quite small and is determined by:

Discounts for complex purchases of goods.

Many firms that sell complementary product lines use a special type of discount to encourage customers to purchase several products from such a line, i.e., to buy in bulk.

Discount for complex purchase of goods - a measure of reduction in the standard selling price that is guaranteed to the buyer if he purchases this product together with other complementary products of this company.