Features of the declaration of belonging to small businesses. Declaration of belonging to the SME: how to take part in public procurement Sample declaration for small businesses

Many businesses and individuals participate in so-called tenders or auctions. There is a document during this process that is not mandatory but adds benefits. The role of such a document is played by a declaration of belonging to a small business.

The presence of this document is written in the procurement papers. Then the company receives additional points.

The usefulness of this document lies not only in the fact that it is used by those who participate in tenders. It has gained great popularity among representatives when purchasing. Otherwise, it is impossible to prove that someone represents a small business.

The document can be prepared in any form.

The main requirement is compliance with the conditions set out in part 1 of article 31 of the Law on the contract system.

This also applies individual entrepreneurs.

How to keep accounts, if you are an individual entrepreneur - you will find all the information.

After that, you can copy the requirements of the customer. Just instead of responsibilities, write about the fact that they are already being fulfilled.

How is the LLC filled out?

Rules for companies approximately the same as for individual entrepreneurs. They can simply provide more information about their activities. The form of drawing up the document is the same - free.

- The date when the document was written is placed at the top, in the left corner.

- After that, we write that the document confirms that the enterprise belongs to small businesses. Because the company meets certain criteria.

- After that, all the criteria that have already been mentioned above are listed.

- Then the chief director of the enterprise puts his signature.

What else must the participant declare?

According to the law, a variety of requirements may be presented to the applicant. These requirements are sometimes approved at the state level by special government decrees.

The customer may refuse to cooperate with companies that are already on the black list of suppliers. Everyone can get acquainted with such a register; it is in the public domain on the State Procurement website. An organization from this list will be excluded from possible partners for transactions, even if it offers the most favorable conditions.

Everything you need to know about printing for individual entrepreneurs can be found in the article.

Depending on the specific conditions of procurement, the following types of declarations are required:

- To confirm belonging to the SMP, or small enterprises.

- To confirm that the uniform requirements for all participants are met.

Without a declared form, it is impossible to confirm that the company complies with the requirements. In this case, you do not need to deal with the execution of additional documents or information to confirm your information.

Additional design rules

If the requirements are not described in article 31, customers cannot ask for confirmation of information, according to the law. Otherwise, administrative punishment will follow.

The authorities admit that the purchase itself violates the law, and then cancel it.

Information may not be declared if it is included in the application but is redundant. Such purchases can be appealed to the regulatory authorities.

Are there attachments to the declaration?

Participants themselves attach additional documents to their applications. It is not recommended to do this on your own. After all, most often such papers are left without consideration.

You will see the rules for filling out a tax return

The absence of a declaration is a serious reason for a tenderer to be denied consideration of an application altogether. And the law does not provide for the possibility to present the document after the application has been rejected.

Problems with taxation

Even those who have debts can take part in tenders.

But for the last reporting period they should not exceed 25 percent of the total book value of the assets.

Law 44-FZ does not require confirmation of the absence of debts. One declaration is enough. Customers may require confirmation only in some cases. To do this, contact the IFTS, prepare a fresh certificate.

The counterparty is responsible for setting the validity period. Help is included in the application. The form is issued in the form of ordinary papers, or as an electronic document. Such a requirement is often set to cut off unnecessary participants. Applications must be submitted within 5-7 days maximum.

The declaration is filled out in accordance with Art. 4 of the Federal Law of July 24, 2007 No. 209-FZ, clause 11 of the Regulations, approved. Government Decree No. 1352 dated December 11, 2014, Order No. 262 of the Ministry of Economic Development dated May 31, 2017, clarifications from the Ministry of Economic Development.

In the declaration, depending on compliance with the criteria, it is necessary to confirm the assignment to small or medium-sized businesses. At the same time, in relation to the declarant, it is necessary to indicate:

- name of the procurement participant;

- location address;

- TIN / KPP, number and date of issue of the certificate of registration;

- OGRN;

- information on compliance with the criteria for inclusion in the NSR, as well as information on manufactured goods, works, services and activities (in tabular form).

The declaration may be submitted on paper or in in electronic format. In paper form, the declaration is filled out in black, purple or blue ink. filling electronic form declarations must be made in capital letters in Courier New font, 16 to 18 points high.

Items 1 to 11 are required to be filled in the table.

In paragraphs 1 and 2, if the criteria specified in them are met, in column 5, “yes” or “does not exceed at the time of filling” is entered. If desired, in column 5, you can indicate the actual indicator.

SMEs that are not LLCs put dashes in the indicated columns.

In paragraphs 3 to 6, you must indicate “yes” or “no”, depending on the compliance with the conditions given in them.

In paragraphs 7 and 8, only cells 7-4 and 8-4 are filled, respectively, with actual values.

Paragraph 9 indicates information about licenses with a listing of all data from the Unified State Register of Legal Entities or EGRIP: series and license number, date of issue, date of commencement of validity, date of expiration, name of the licensed type of activity for which the license was issued, information about the address of the place of implementation of the licensed type of activity , the name of the licensing authority that issued or reissued the license, information on the suspension of the license, the state registration number and the date of making an entry in the Unified State Register of Legal Entities (EGRIP) containing the specified information. If there are no licenses, "none" is indicated.

Paragraph 10 of the table indicates data from the Unified State Register of Legal Entities or EGRIP with the transfer of OKVED2 and OKPD2 codes.

In paragraph 11, it is necessary to indicate the types of activities actually carried out, the goods produced by the NSR entities, the work performed, the services rendered, listing the OKVED2 and OKPD2 codes.

Inaccurate information in the SME declaration

The inclusion of false information in the SME declaration may result in:

- removal of an SME participant from participating in the selection of a supplier (contractor, performer) or refusal to conclude a contract with the winner of the determination of a supplier (contractor, performer) at any time before the conclusion of the contract;

- termination of the concluded contract with the recognition of the SME person as having evaded the conclusion of the contract;

- adoption by the customer of a decision on unilateral refusal to execute the procurement contract;

- inclusion of an SME person in the register of unscrupulous suppliers in the event of termination of the procurement contract.

Information about organizations and individual entrepreneurs that correspond to their classification as small or medium-sized enterprises are subject to inclusion in the Unified Register of Small and Medium-Sized Businesses. We talked in more detail about maintaining such a register and the information reflected in it in a separate one. And what is meant by a certificate of belonging to small and medium-sized businesses (SMEs) or an SME statement?

SMP extract

Information about small and medium enterprises, which is contained in the register, is posted and updated on the 10th day of each month on the official website of the Federal Tax Service in a special section. The posted information is publicly available for 5 calendar years following the year in which such information was posted on the site (Part 9, Article 4.1 of Federal Law No. 209-FZ dated July 24, 2007).

Confirmation of the belonging of an organization or individual entrepreneur to small and medium-sized businesses is carried out by an interested person when he applies to the register (Letter of the Federal Tax Service dated 08.08.2017 No. GD-4-14/15554@). To do this, it will be enough to indicate on the site one of the details of the organization or individual entrepreneur: TIN, PSRN, PSRNIP, name of the organization, full name. IP.

Information generated on the website of the Federal Tax Service from the register can be exported to Excel or saved in PDF format. Such pdf information is signed by an enhanced qualified electronic signature and have legal force in accordance with paragraphs 1 and 3 of Art. 6 of the Federal Law of April 6, 2011 No. 63-FZ.

extradition tax inspectorates similar information in paper form with original signature and not printed.

Certificate of a small business entity: sample

But if an organization or individual entrepreneur participates in the procurement of goods, works, services certain types organizations in accordance with the norms of the Federal Law of July 18, 2011 No. 223-FZ, then to confirm the status of a small or medium-sized enterprise, it will be enough either to fill out and submit a declaration, or to provide it on paper or in the form electronic document SMP extract from the website of the Federal Tax Service (Regulation, approved by Government Decree of December 11, 2014 No. 1352).

The public procurement system under 44-FZ provides for preferential terms for small businesses - more auctions and competitions are held for them. But the status must be documented. This task is solved by the SMP declaration. In it, the procurement participant indicates information with which he can be identified as a small business entity. We tell you what such a declaration looks like, how to fill it out correctly and offer to download a sample filling out.

What is the Declaration of belonging to small businesses in accordance with 44-FZ

Federal Law 44-FZ on public procurement requires government customers to conclude at least 15% of all annual contracts with small businesses (Article 30). This is one of the measures to support individual entrepreneurs and small businesses. The main characteristics of a small business are:

- number of employees up to 100 people;

- annual revenue up to 800 million rubles per year.

Suppose government agency announced an auction and indicated that only SMEs (small businesses) can participate in it. How will the bidders confirm to the customer that they belong to small and medium-sized businesses? This task will be solved by a declaration of belonging to small businesses. This document is provided in a set of tender documentation and is drawn up according to a unified model (we will consider it in the next section).

If the procurement information indicates that it is intended for small businesses, it is better for the participant in the procedure to immediately prepare a declaration and submit it by own initiative(sometimes customers forget to request a document). This will help expedite the conclusion of the contract and prevent many problems with meeting deadlines.

The SMP declaration confirms that the organization belongs to small businesses and has the right to participate in public auctions under 44-FZ

Blank document

The SMP declaration should be filled out in a unified form approved by Decree of the Government of the Russian Federation of October 20, 2015 No. 1169. In that normative act changes are made regularly, and the declaration form changes slightly. Before filling out a document for your supplier, check that you are using the current version.

Sometimes customers request a declaration "in an arbitrary form": a certificate that the company belongs to small businesses. Even in this case it is recommended to use unified form- is filled in just as simply, but provides a full range of information on compliance with the SMP.

The small business affiliation declaration form is a 4-page document where the bidder first enters their details and then confirms compliance with legal criteria. It ends with the signature of the head of the organization (indicating his position) and the seal.

Where can I get a declaration of belonging to the NSR:

request from the customer - the organizer of the auction;

- download from the website of the tax service;

- download from trusted resources on the Internet (for example, use the legal aggregator "Consultant Plus");

- download from our material.

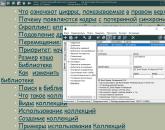

How to fill out the SMP Declaration correctly

Consider how the form is filled out in stages. This is a very simple document, most of which is only a yes or no choice. Working with the document begins with the fact that the author of the declaration indicates his data:

- full name of the organization;

- confirmation that refers to small or medium-sized businesses;

- address;

- TIN and KPP;

- OGRN.

In the purchasing information state portal make a note if the auction is intended for small businesses

- the share of participation of state and municipal institutions in the authorized capital - no more than 25% (the exact value must be indicated);

- the share of participation of foreign legal entities in the authorized capital - no more than 49% (the exact value is also indicated);

- whether JSC shares belong to the high-tech and innovative sector of the economy - only “yes” or “no”;

- whether it is planned to introduce the results of intellectual activity into practice;

- have the status of a participant in the Skolkovo project;

- are the founders legal entities from the list of recipients state support innovative activity;

- average number of employees for the previous calendar year - indicate the exact value;

- income for last year- specify the exact value in millions of rubles;

- information about the obtained licenses - specify the details (if any);

- information about goods and services indicating OKVED and OKPD2;

- information about technological and innovative products - indicate whether it is produced or not;

- whether he participates in approved partnership programs with SMP - if yes, then write a partner;

- executed state and municipal contracts for the past year - indicate the number of transactions and their total amount;

- confirmation that the management of the company and Chief Accountant not convicted of economic crimes;

- confirmation that the organization is not listed in the register of unscrupulous suppliers.

The document ends with the signature of the director of the organization or an authorized person indicating the position.

Preparing a declaration of belonging to the NSR will take no more than 10 minutes, but it will protect the organization from refusing to conclude a state contract.

Download Sample

The declaration of belonging to the NSR is a fairly simple document, which rarely causes difficulties when filling out. However, in order to complete the form correctly, it is useful to study finished sample filling:

Conclusion

The small business affiliation declaration helps companies participate in more public procurement. This document is filled out in a unified form. Includes information confirming that the organization belongs to the SME - the number of employees, annual income, the share of participation of state and foreign companies in the authorized capital.

According to the norms of the law dated April 5, 2013 No. 44-FZ. Article 30 of Law No. 44-FZ obliges customers to purchase from SMEs and socially oriented NGOs. The share of such suppliers in the annual volume of purchases should be at least 15% (with starting price transactions of no more than 20 million rubles). In this case, the turnover on purchases is not taken into account:

related to ensuring the defense capability of the state and its security;

volumes of transactions on lending services;

amounts of contracts with a single supplier;

agreements in the field of nuclear energy;

transactions implemented by a closed method of determining the supplier.

This requirement can be met in two ways:

the purchase was made directly from a small enterprise;

the order is given to an institution that does not belong to the small business group, but the subcontractor or co-executor in the transaction will be a small enterprise.

Declaration of belonging to small businesses - sample

Features of the implementation of the procurement procedure with the participation of representatives of small businesses are spelled out in the government Decree of December 11, 2014 No. 1352. The introduction of an obligation to conclude transactions in the field of procurement with representatives from among the SE entities is a measure of state support for small businesses, therefore, enterprises must confirm their status as a small entity (the criteria are given in Article 4 of the Law of July 24, 2007 No. 209-FZ). You can do this in two ways:

on paper, a declaration of belonging to small businesses is drawn up;

V electronic format instead of a declaration, you can present information (extract) from " unified registry subjects of small and medium business”.

Submission of a declaration along with a package of documents may be required if the company information has not yet been entered in the SME register, and if the competition is held only between representatives of small businesses. In other cases, the declaration occurs through electronic platforms automatically - this provision is valid from 01.07.2018. (Article 51 of Law No. 44-FZ).

The criteria for recognition of SME companies are spelled out in Art. 4 of Law No. 209-FZ. Among the criteria is the structure of the authorized capital. The state, public and religious organizations, foundations (if they are members of the company) cannot own shares in excess of 25% of the authorized capital. Companies that are not representatives of small businesses can have no more than 49% of the capital of a small business. Average headcount employees for a small enterprise should not exceed the level of 100 people, for a medium - 250 people. The annual income limit for a small entity is 800 million rubles, for medium-sized enterprises - 2 billion rubles.

A declaration template confirming the compliance of the enterprise with the requirements for small businesses is given in the annex to the Regulation approved by Resolution No. 1352.

The structure of the document includes:

The name of the participant submitting the application.

A statement that the company meets the legal criteria for classifying enterprises as small businesses.

The declaration of belonging to small businesses must contain data by which the procurement participant can be identified. This is the address of the company, the registration codes of the TIN and KPP, the day of registration, the PSRN number.

The table block provides information on the criteria by which an enterprise meets the conditions for recognition of SMEs. This section specifies the structure of the authorized capital, indicates the presence or absence of shares related to the innovative sector of the economy. Business companies provide data on participation in the development and implementation of products of intellectual activity, innovations. To confirm the status of SMEs, it is necessary to indicate the number of hired personnel and the volume of revenue receipts in the previous annual interval. It is mandatory to enter data on the current licenses of the enterprise, business lines and types of goods sold (services, works).

Columns 1 to 11 must be filled in the tabular part of the declaration. If the indicator given in the table is met (the enterprise meets the specified requirement), the word “yes” is entered, in the opposite situation, “no” is written. If false information is found in the declaration, the customer has the right to reject the application. If the contract is signed on the date of discovery of the discrepancy, it is terminated at the initiative of the customer. For a participant who has reflected false data in the declaration, this is fraught not only with the loss of the contract, but also with inclusion in the list of unscrupulous suppliers.

Popular

- Photo Print Pilot - print photos at home

- Epson Easy Photo Print - photo printing application

- How to behave in a job interview

- What is the difference between a supermarket and a hypermarket?

- Feathered evil: what happens in the nest where the cuckoo threw her egg

- Eagle owls and owls How to determine the sex of a long-eared owl

- What year did the Internet appear

- Owl as a pet How to distinguish the gender of an owl

- Birds of the Moscow Region (photo and description): large predators and small birds A bird that makes different sounds

- The Board of Directors of the PIK group of companies re-elected the board of the company Aleksey Kozlov Pik