Cost of goods sold

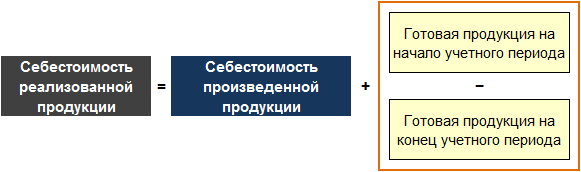

Cost of goods sold ( English Cost of Goods Sold, COGS) represents the amount of production costs that were sold during the reporting period. For a trading company, this is the amount of expenses for the purchase of goods for further resale that were sold during the reporting period. The cost of goods sold is calculated as the balance of finished goods at the beginning of the accounting period plus the cost of products sold during the accounting period, minus the balance of finished goods at the end of the accounting period. Theses are expired costs, and thus the actual costs for the year.

It should be noted that the cost of purchasing goods includes not only the cost of these goods, but also all costs associated with the purchase, such as transportation costs, insurance, customs duties, etc. Collectively, these costs are known as direct costs. When determining the cost of goods sold, only net purchases are taken into account, that is, the cost of returned goods and the amount of direct costs associated with them are not taken into account.

Formula

The methodology for calculating the cost of goods sold for a manufacturing enterprise differs from that for a trading company.

For a trading company, the formula is as follows:

In this case, the net purchase of goods is calculated by subtracting the cost of returned goods and discounts (for example, for early payment or for quality) from the gross purchase. In turn, examples of direct costs are: costs for internal logistics, insurance, customs duties, excise duties, etc.

For a manufacturing enterprise, the cost of goods sold is calculated as follows.

Familiarize yourself with the method of calculating the cost of manufactured products ( English Cost of Goods Manufactured, COGM) can be found by following this link.

Methods for estimating the cost of inventory

The cost of goods sold to some extent depends on the company's chosen policy for accounting for the cost of inventory (both raw materials and finished products):

- FIFO method ( English First-in, First-out, FIFO);

- LIFO method ( English Last-in, Last-out, LIFO);

- average cost method.

Also, its value will depend on the chosen inventory accounting system:

- system of continuous accounting of stocks;

- periodic inventory system.

Examples of calculating the cost of goods sold

Example 1

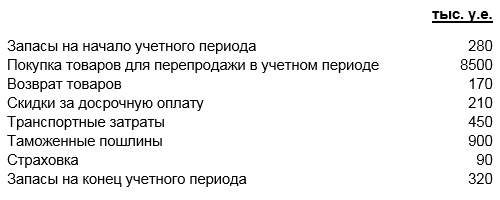

Below is the data on the costs of the trading company in the accounting period.

Net purchase of goods for further sale amounted to CU 8,120 thousand, and direct costs CU 1,140 thousand.

Net purchase of goods = 8 500-170-210=8 120 thousand c.u.

Direct costs = 450+900+90 = 1,140 thousand c.u.

Thus:

Cost of goods sold = 8,120+1,140+280-320 = 9,520 thousand c.u.

Example 2

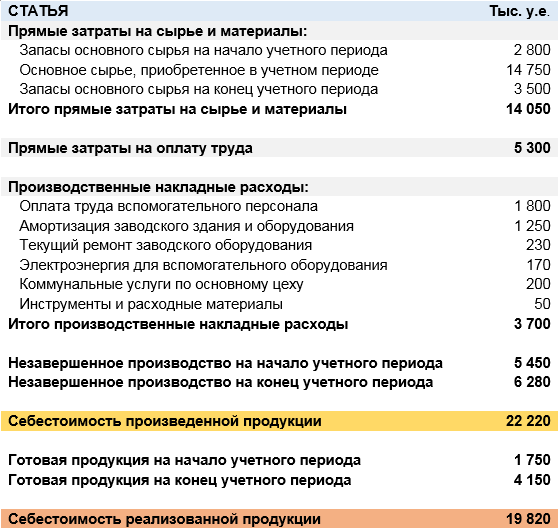

Calculation of the cost of goods sold by a manufacturing enterprise is shown in the table.

As a rule, the calculation of the cost of goods sold by a manufacturing enterprise consists of five sections.

- Direct costs for raw materials and materials.

- Direct labor costs.

- Manufacturing overhead.

- Unfinished production.

- Finished products.

At the same time, direct costs for raw materials are calculated as the sum of their balance in stock at the beginning of the accounting period and the net purchase (gross purchase minus returns and discounts) in the accounting period, minus their balance at the end of the accounting period. For the conditions of the above example, they are 14,050 thousand USD (2800+14750-3500).

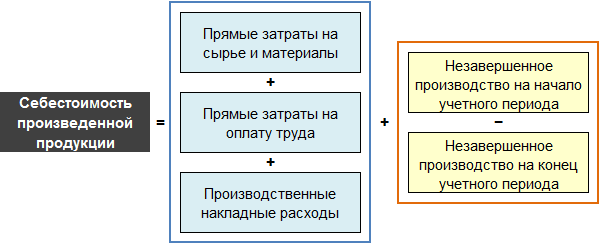

In turn, the cost of manufactured products is calculated according to the following formula.

For the above conditions, it is 22,220 thousand c.u. (14050+5300+3700+5450-6280).

Thus:

Cost of goods sold = 22,220+1,750-4,150 = 19,820 thousand c.u.

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work