How to get a TIN: possible ways

Numbers surround every person virtually all the time: every day we are faced with money, settlements at retail outlets, remember what day and month it is?

A citizen's passport and taxpayer identification number (TIN) are the most important documents of a modern person that are required when entering a university, during employment and solving other everyday tasks.

In this regard, we will try to figure out how to get a TIN correctly and what is needed for this?

First, you need to clarify the question of what is a TIN?

Definition and interpretation of TIN

Taxpayer Identification Number (TIN) is an individual unique number under which each person is identified as a taxpayer.

It is worth noting that the TIN is valid for all types of taxes, as well as fees in force in Russia.

Notably, organizations receive a ten-digit set of numbers, while citizens receive a twelve-digit set.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

+7 (499) 350-63-18

(Moscow)

+7 (812) 627-14-92

(Saint Petersburg)

It's fast and for free!

Useful facts

Foreigners and persons who do not have citizenship, but are registered as individual entrepreneurs (IEs), get the opportunity to acquire an identification number through the assistance of the tax authority at the address where they temporarily reside.

If a person has the citizenship of the Russian Federation, but is not registered at the place of residence, and at the same time owns real estate or a vehicle, you will need to register in cash. authority at the location of the property, or at the place of registration of transport.

Methods for obtaining a document

In this video, you will learn where how to get a TIN for an individual in Moscow, as well as throughout Russia. Enjoy watching!

There are several ways for a citizen to obtain an identification number.

Both methods can be successfully used.

It is worth noting that every day the bureaucracy is becoming a thing of the past, making the procedure for issuing a TIN and other important documents easier.

Therefore, progressive modern citizens more often use the services of the worldwide Internet, through which you can register an enterprise, get a TIN.

Method number 1:

- filling out a sample application for obtaining a TIN;

- appeal to cash body at the place of actual residence with a passport and an application;

- getting information about when you can get a TIN.

This method is the most popular option for obtaining the necessary document.

There is another method of obtaining a taxpayer identification number, more progressive. It is believed that using the services of the Internet is more profitable and faster than resorting to the outdated method.

Method number 2:

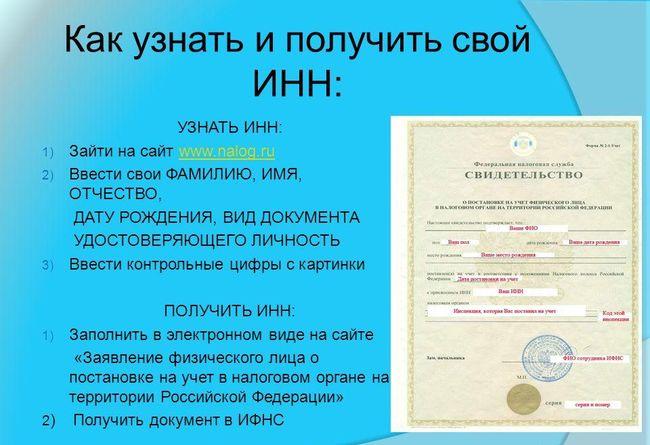

- you can use a specialized service on the Internet, for which you need to visit the official resource of the Federal Tax Service;

- you can fill out an application for a tax number in several approaches;

- the application is sent to cash. authority, then you can monitor the status of the application at any time;

- as the application for a TIN progresses, the applicant will receive information and contacts from the tax authority that is responsible for issuing an identification number;

- You will need to provide an email address on the application where you can receive notifications.

An example of an application for obtaining a TIN for a child

It is noteworthy that after filling out and sending an application for obtaining a TIN, the Federal Tax Service of the Russian Federation places the responsibility for the safety of personal data on its shoulders.

According to experts, the registration of an identification document by a child deserves special attention.

You can also get or find out your TIN through public services.

Obtaining a TIN for a child

The legal representative of a child (his parent), not older than 14 years old, in order to obtain a TIN document, undertakes to contact the tax office at the place of residence, where they provide a certain set of documents.

Without these documents, it is unlikely that it will be possible to obtain the identification number in question.

Documentation:

- original documents;

- documentation that confirms the registration of the child at the place of residence, including an extract from the house book, a copy of the certificate of registration at the place of residence;

- application in the form No. 2-2-Accounting, where the parent is the representative, and the child is the applicant;

- a copy of the passport of the parent signing the application;

- a copy of the birth certificate indicating citizenship;

- a copy of the insert indicating citizenship (required if there is no mark in the certificate).

When applying for an identification number for more than one child, you will need to complete the applications and then make as many copies of the passport as the number of children you receive an identification number, as they must be attached to each number.

Details of obtaining a TIN for an individual

For a better understanding of the process of collecting documents, applying for and obtaining a TIN, below is an algorithm of actions that every person who wants to receive a personal identification tax number will need to go through without fail.

How to find out your TIN online?

It is worth noting that without this document it is unlikely that you will be able to get a good job!

Sequence of steps:

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work