Sample letter of guarantee for payment. How to write a letter of guarantee for payment for services

Treaties are ancient. Since ancient times, the procedure and amount of payments were essential conditions, without which the contract was not considered concluded. Yes, and making a profit, in fact, is the main goal of an economic contract. The reputation of a dishonest payer could haunt the debtor from year to year and repel potential customers and partners from him.

What guarantees a letter?

In the modern world, a good reputation is as valuable to a business executive as it was in ancient times. However, non-payers are different: malicious and forced. The former are gradually becoming the talk of the town in business circles, and knowledgeable businessmen are fenced off from them. The latter are hostages of some unforeseen circumstances, when there is no way to repay the obligation on time. Probably, it is for the second category that a letter of guarantee to a creditor can become a worthy way out of this situation.

A sample payment guarantee letter is primarily a non-commercial business document. It cannot be presented for payment, it is impossible to write off funds with its help. The letter only emphasizes the good will of the debtor and his readiness to fulfill the agreements as soon as possible.

The letter guarantees that the counterparty is friendly, aware of his delay, but cannot fulfill the agreement on time for reasons beyond his control, and often due to force majeure.

When is a letter of guarantee required?

The legislation does not establish when it is necessary to draw up such a document, because a letter of guarantee does not have the force of a transaction. A deal always creates or terminates obligations or rights, and a letter of guarantee is only informational and diplomatic in nature.

When it is necessary and when it is not necessary to draw up a letter of guarantee, the parties decide by agreement between themselves. It is probably worth writing such a commitment when your partner insists on it. Also, the debtor may try to persuade the counterparty to postpone the trial by guaranteeing him payment of the debt with an installment schedule attached.

The lender should clearly understand several points:

- having received a letter of guarantee from the debtor, you by no means ensure the collection of the debt in the future, because the document provided has no legal force and can be considered in court only as one of the indirect evidence of the existence of a debt;

- no bank will accept a letter of guarantee for payment - this is not an instruction from the owner to write off funds, but only a promise to pay them in the future.

The debtor should also consider the following:

- The receipt by your addressee of a letter of guarantee and even a favorable response to it do not deprive the creditor of the opportunity to still go to court. So don't be surprised if you get an agenda for the meeting.

- Even if you are in a difficult financial situation, try to fulfill the warranty promises on time - take care of your reputation. It is unlikely that they will believe you again.

How to write a letter of guarantee

A sample letter of guarantee for payment can be found in business document references and business communication guides. It is not only a legally savvy professional who can draw up such a document, but also a talented entrepreneur or manager who wants to maintain relations with a business partner and resolve the issue without bringing the case to court.

The form of the letter of guarantee for payment is free, it is filled out depending on the specific needs of the sender. As in any business document, there are essential details and turnovers.

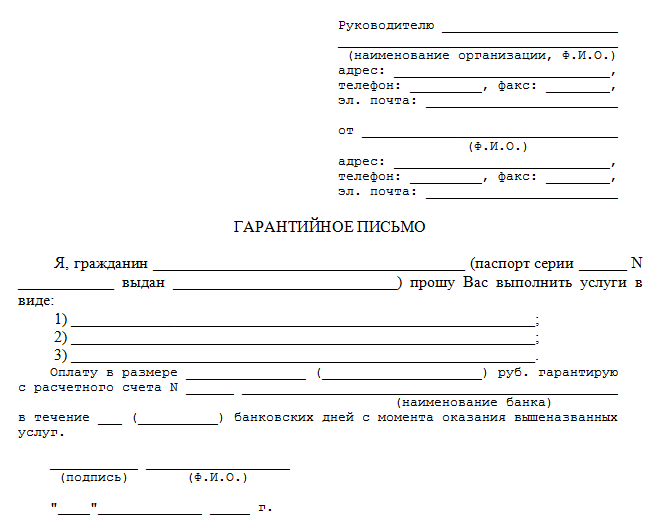

Sample letter of guarantee for payment for services

Next, let's talk specifically about the document itself. A letter of guarantee for payment of a debt, a sample of which will be discussed below, is one example of such a document. It is quite suitable for the development of letters of guarantee and in other areas.

Chairman of the Board

JSC "Whirlwind"

Vetrov A. A.

st. Skobarya, 61,

Tmutarakansk.

Dear Alexander Alexandrovich!

On October 31, 2011 our companies signed a contract for consulting services, which was annually prolonged and executed by our parties in a timely manner.

However, due to circumstances beyond our control, payment for the services provided by your party in March and April 2015, we cannot make it in a timely manner. In confirmation of this, we are sending you copies of court decisions and orders of the bailiff on the recovery of damages in favor of a third party.

We guarantee the repayment of the debt before 06/01/15, about which we will immediately inform you.

We hope for your understanding and further fruitful cooperation.

Appendix: a copy of the court decision on debt collection;

a copy of the decision of the bailiff on the arrest of the bank account.

Sincerely,

Director of PE Firm "Chukh"

Laptev V.V.

Is the letter of guarantee part of the contract?

As already mentioned, a letter of guarantee is not a deal, but rather a unilateral confirmation of intentions to pay debts in the future. The sample letter of guarantee for payment gave us a fairly clear idea of the sound and direction of this document.

A special clause in the letter of guarantee will also not turn it into a part of the contract, binding on both parties, because the contract is always a multilateral deal, agreed upon, signed and sealed by everyone. A letter of guarantee is an act of goodwill: the counterparty may accept it, or may ignore it.

Required details

The letter of guarantee is drawn up according to the template of business documents and must be solid, thoughtful and justified. A sample letter of guarantee for payment is issued on company letterhead and contains the following sections:

- "cap" indicating the position, surname and initials of the head of the addressee company;

- the location of the company to which the letter is addressed;

- then come the date and the outgoing registration number of the letter of guarantee - the number will add solidity and reliability;

- this is followed by a statement of the situation with reference to the contract under which the debt was formed, indicating the reasons for the delay and determining clear terms for repaying the debt;

- if there are documents confirming the above, you can attach their certified copies to the letter;

- if there are attachments, they are listed before the signature;

- after drawing up the letter, it is signed by the first person of the company or his authorized deputy. At the same time, "with respect" is written by hand;

- it is desirable, after the signature of the head, to indicate the name and phone number of the performer, with whom, if necessary, you can contact and clarify controversial issues.

That's it, the letter of guarantee is ready!

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work