How to get a TIN certificate

The taxpayer identification number (hereinafter - TIN) is an integral attribute of everyday life, participating not only in the tax accounting system, but also in economic, social and other areas of human life. Such a digital code is assigned to each individual and legal entity in the Russian Federation at birth or at the time of registration of the organization. And to all other persons under the jurisdiction of the state - when they apply to the tax authority. Consider in the article all the known ways to obtain a TIN certificate.

Why do you need a TIN

This individual number is primarily needed to control tax deductions. With it, the relevant authority easily performs the process of accounting for data, and also determines the amount of tax revenues to the "treasury" of the state, identifying each payer. In addition, the presence of the number in question facilitates many social and domestic activities. The paper with the specified code, issued by the inspection, is the TIN certificate (hereinafter referred to as the Certificate).

Who is entitled to a TIN

We can conditionally distinguish four groups of citizens who, upon request, are issued a special certificate with an identification number:

- ordinary individuals, including children;

- legal entities;

- individual entrepreneurs (IP);

- foreign organizations.

The corresponding certificate to any specified person is issued once and only after the death of the person or the liquidation of the enterprise is declared invalid. By the way, obtaining a certificate for individuals is not a prerequisite. As a rule, the first need for its presence arises when applying for a job. Although when receiving loans, benefits and other events, the TIN is a mandatory document.

Individuals

If you fall into this group, then the legislation provides for three options for communicating with the tax authorities:

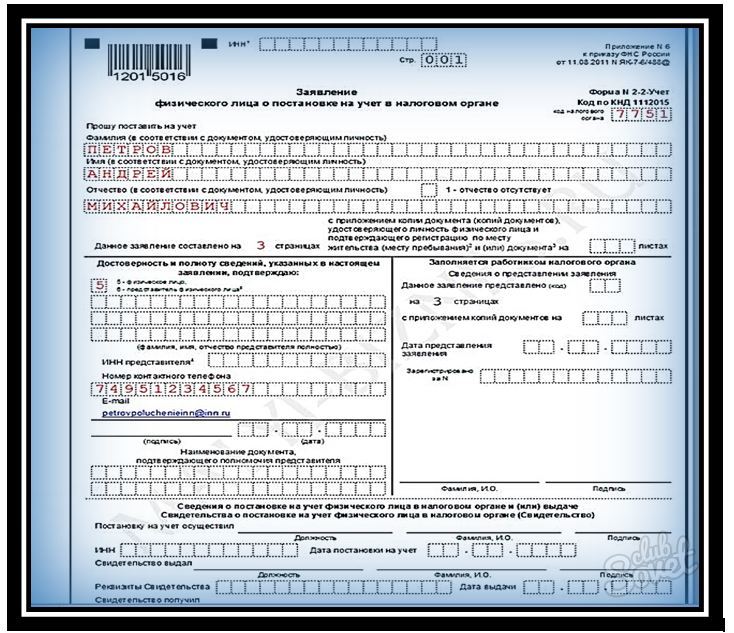

- Personal contact. Contact the inspectorate located at the place of your registration. In the case when a Russian citizen does not have a residence permit, you need to go to the tax office where any of his property was registered (real estate, car, etc.). You can determine the location of the authority using the website of the Federal Tax Service (hereinafter referred to as the FTS).

- Through the Internet. Moreover, there are several official services on the World Wide Web, by visiting which you can get paper with a TIN:

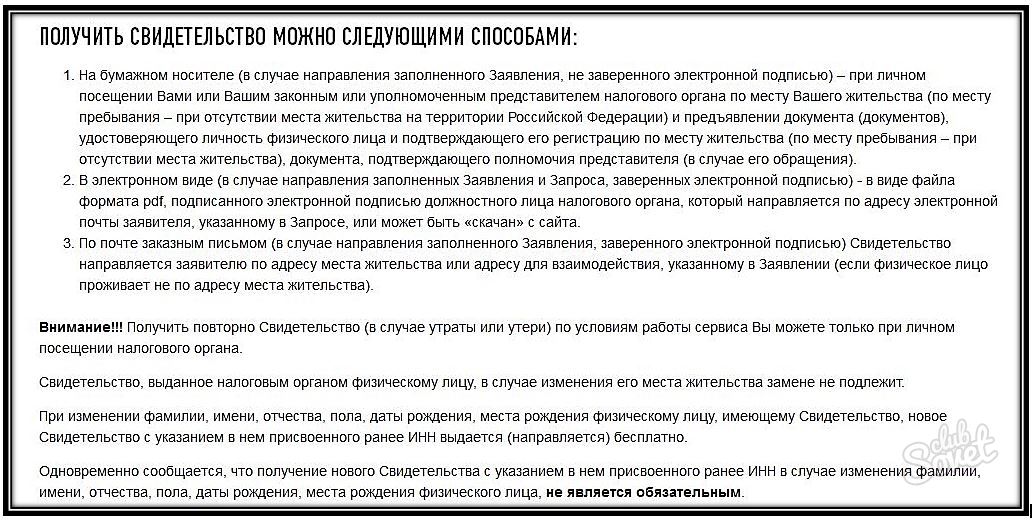

- Tax Service Portal. To do this, select the registration item in the list of electronic services and fill out the on-screen application form. The maximum processing time is 15 days. After the status of the request changes, you can receive the document using the methods specified on the web service (standard paper or its electronic version).

- State Services website. The template for filling out an application for issuing a certificate is located in the "taxes and fees" section. The subsequent procedure is the same as described above.

- Postal communication. Send the application in the prescribed form with acknowledgment of receipt. Attach a copy of your passport, certified by a notary, without fail.

Download on our website:

Entrepreneurs

An individual with the status of "individual entrepreneur" can obtain a Certificate both at the time of registration of his form of activity, and before that moment according to the principle described for ordinary citizens.

Legal entities

If you are an organization of any form of activity, then you can receive a certificate of assignment of a TIN at the time of registration of your legal entity at the place of application. In this case, in addition to the list of constituent documents, fill out a special application form required for tax registration. For foreign organizations, the procedure for obtaining a Certificate is similar.

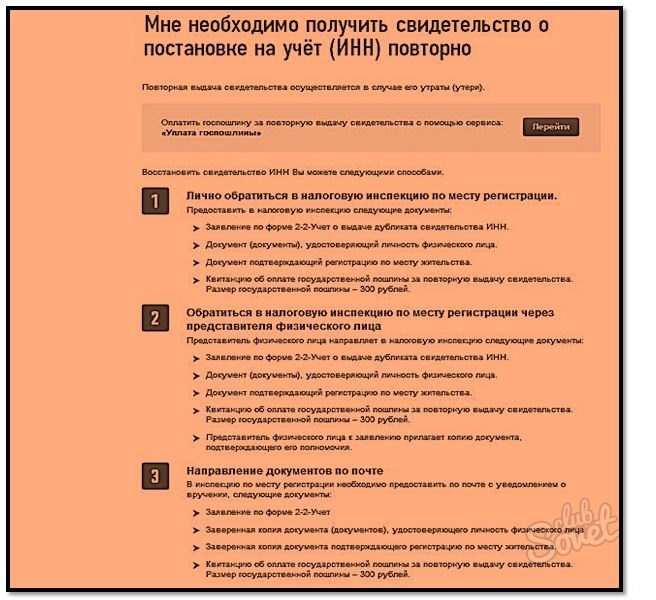

Reacquisition

If the Initial application for the Certificate is free, then the subsequent one requires payment of a state duty in the amount of 300 rubles. A duplicate with a printed number can be picked up only by contacting the department in person. There is no prescribed application form in this case. Therefore, the document is drawn up in free written form in the name of the head of the Federal Tax Service.

To obtain a certificate of tax registration, you do not need to perform complex steps, but simply submit an approved application form in any accessible way. Within the five-day period established by law, the requested document will be in your hands.

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work