How to get a TIN for an individual

An individual taxpayer number (TIN) must have every citizen working or doing business. It is issued in the form of a certificate. You can issue it upon reaching the age of 14, and the child, to whom the property is registered, even earlier. Below is a detailed algorithm on how to get a TIN for an individual, with a sample application, screenshots and explanations.

Where to go

The information that you need to apply for these purposes to the tax office at the place of registration is already outdated. From January 1, 2017, an application for a TIN can be submitted to any tax office, regardless of whether it is linked to a residence permit.

What documents do adult taxpayers need?

You will only need to provide:

- Passport. It means that you need to come with the original and its photocopy. After their reconciliation, your passport will be returned to you, and a copy will remain in the tax office.

- Statement. There is a strictly prescribed form 2-2 accounting, which consists of 3 sheets. It will be issued by an inspector. If you submit documents online, then the application form for filling out will be provided to you on the website of the Federal Tax Service (https://service.nalog.ru/zpufl/) or the State Services only after registration.

Documents for issuing a TIN for a child

- Statement. The same application form is filled out as for adults: it will have a separate column for information about the legal representative of the child. It is he (it can be one of the parents, guardian, guardian) who fills out the application, but on behalf of the child! The signature at the end is put not by the child, but by the person who filled it out.

- Representative's passport. Take the original and a copy with you (the original will be given after presentation).

- Birth certificate. Again on the same principle: original + copy.

- A document containing an indication of the place of registration(if it is not indicated in the certificate of the child).

The personal presence of a minor at the time of filing is not required.

Application Form

If it’s difficult for you to deal with screenshots, for clarity, you can see a text sample of an application for obtaining an individual’s TIN ().

How to fill out an application so that it is accepted the first time

- Write words in block capital letters, one letter in each cell, and dates in numbers. If you fill out the form on a computer, then select the font Courier New (point size 16).

- Fill in the fields from the first cell, leaving no space in front of the text.

- Strikethroughs, corrections with correctors, “erasing” at the site of errors and other deformation of the sheets are not allowed.

How to get a TIN via the Internet

Let's start with the fact that only those who have an EDS (electronic digital signature) can “get” a TIN using the Internet. If it is not there, then it will not be possible to get the finished document in hand without visiting the tax office. In this case, it is only possible to submit an application and photocopies of documents via the Internet. And in order to pick up the finished certificate, you still have to go to the inspection with a passport.

There are two ways to get a TIN online:

- through the portal of the State Service;

- through the official website of the FTS.

In both cases, you need to register on the sites.

After registering on the State Service website, you will still have to complete authorization by filling out the data in the questionnaire, and then wait for confirmation by Russian Post by sending a password to enter your personal account. There is no such thing on the website of the Federal Tax Service, which means that the process of submitting documents is faster.

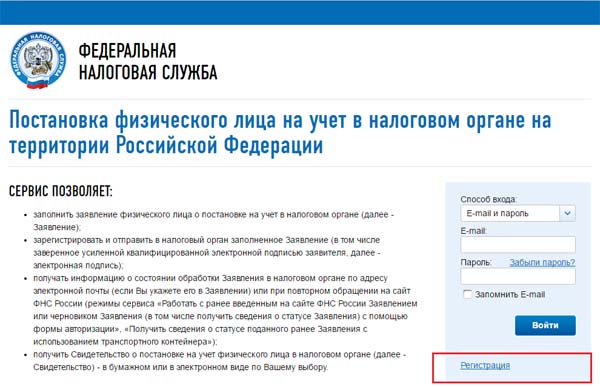

Website of the Federal Tax Service

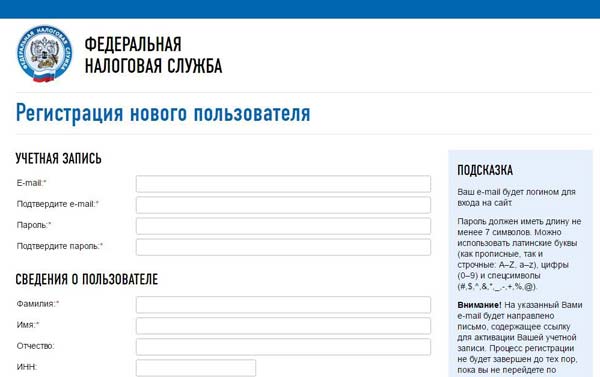

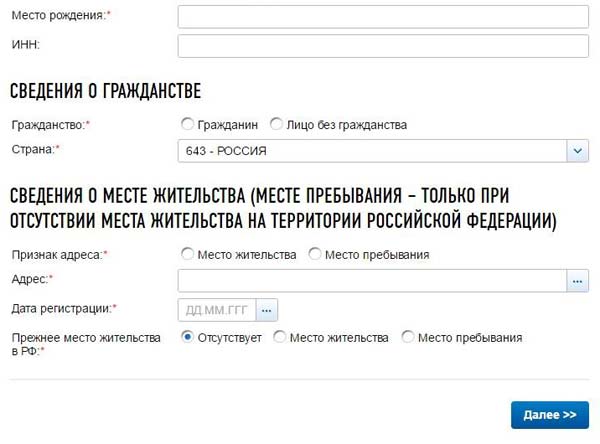

After that, such a questionnaire will appear on the screen. You can fill it to a minimum - only fields with an asterisk.

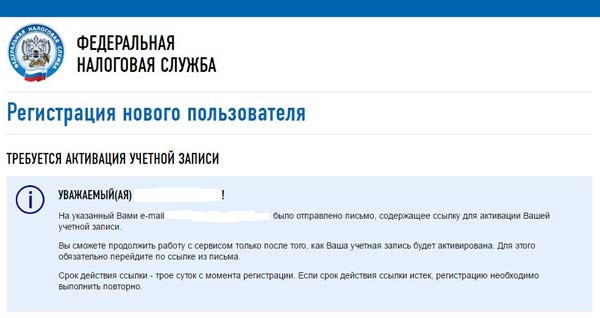

When you're done, click "continue" and this is what will appear.

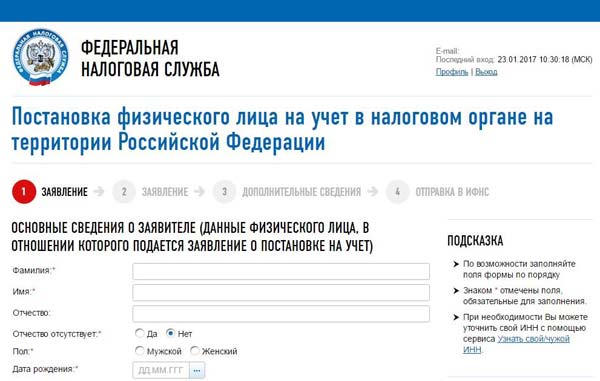

Next, wait for an email. Once received, follow the link in the email. You will be taken back to the main page of the site, but the data will be saved in the e-mail and password fields. You just have to click "Login", after which you will see it.

Only by filling in this data, you will get access to the application form. The procedure for filling it out is described in detail above, so we will consider how to transfer an already completed form to the tax office.

- Method 1. Just press the "submit" button at the last step of this procedure. Suitable for those cases if you can then get a certificate of the TIN of an individual in person at the tax office.

- Method 2. If you have an EDS and do not want to go to the inspection, then install the "Legal Taxpayer" program and fill out an application using it. Follow the steps in sequence, then no difficulties should arise. If you want to receive a certificate not only in paper form, but also in electronic form, fill out an additional request (the program will prompt you to do this automatically). Then prepare the shipping container with the application, on which the EDS is applied, again using the program, after which you can send it for processing and find out its results. When the certificate is ready, it will be sent in pdf format (electronic version) by e-mail, and a “paper” copy will be sent by registered mail by Russian post.

public services

The service for obtaining a TIN will appear for the user on the site only after registration, and subsequently - filling in passport data, phone number, e-mail.

In addition, in order to get an inn through the public service website, you will have to go through authorization. You will be prompted to fill in your TIN and SNILS. Later you will receive a password by Russian Post at the place of residence that you specify. With this password, as well as a login (this is either an email address, or TIN, or SNILS - to choose from), you can get into your personal account on the site, finally fill out the form 2-2 accounting and send it to the right inspection.

And on this portal, you can also use the EDS, so as not to visit the tax office in the future, but to receive a ready-made certificate by Russian Post or by e-mail.

How to apply by mail

If it is not possible to visit the tax office, you can send documents by registered mail, but you will have to follow a number of nuances:

- the application must be correctly filled out (without errors and blots), otherwise it will not be accepted;

- copies of the passport and the document confirming the place of registration (if it is not a passport) must be notarized.

As you understand, notary services are not free, so if you are a busy person, it would be more rational and economical to immediately issue a power of attorney from a notary to someone who can not only submit, but also pick up the TIN certificate instead of you! After all, if you pay a notary only for certifying copies, then in the future you will still have to go personally to the tax office to get a TIN, and using the recommended scheme above, you will be completely exempted from walking through government corridors.

If it is not possible to personally obtain a TIN certificate

Then a representative can do it for you. It can be any person over 18 years of age. You can issue a power of attorney at any notary. The estimated cost of his services is from 1500 to 2000 within Moscow.

How long does it take to get a TIN

The law allotted a period of five days from the date of receipt of the application. On the sixth day, you can already go and get a ready-made TIN (do not forget your passport!).

But if you submitted the form by mail or the Internet, then the five-day period begins to be calculated from the moment you receive a registered letter or process electronic data received through the website of the State Service or the Federal Tax Service. This date will appear on the mail notification you receive or email.

How much does it cost to get a TIN

This public service is provided free of charge. But if you receive it again, then the state duty will be 300 rubles.

In addition, if you send documents by mail, then please note that the average cost of certification of one sheet by a notary is 60 rubles. And there are only three sheets, which means that you will have to pay approximately 180 rubles. Plus, do not forget that you also have to pay for postal services. If you resort to the services of a representative, also calculate the cost of issuing a power of attorney (1500-2000 rubles).

How to get a duplicate TIN of an individual

The fact is that it is impossible to get a copy of the TIN of an individual. If the TIN has been lost, then a new certificate is issued with the same taxpayer number as it was before (it remains unchanged throughout the life of an individual). However, this is still not a copy, but a completely new document.

The application for issuing a duplicate certificate of Inn has the same form of 2-2 accounting, since in fact you are asking for a new certificate. In the form of this form at the top of each page there is a column for filling out the TIN. Enter your tax number here. If you do not know him, it is easy to fix: you just need to go to the site https://service.nalog.ru/inn.do, fill out the form and send a request. The TIN number will appear in the result line.

You can also apply for the restoration of a lost certificate in all available ways:

- personally;

- by mail;

- through a representative

- over the internet.

But you only need to pick it up personally at the tax office (even the option with an EDS is not allowed).

Please note that the reissuance service is paid:

- the standard state duty is 300 r;

- with accelerated issuance of a new certificate - 400 rubles.

Do I need to get a new TIN when changing my full name

There is no such obligation, however, the individual is interested in this.

Example. Krinichnaya G.V. took her husband's surname "Dolzhenko". She changed her passport, but she did not need to change the TIN certificate. But suddenly her aunt came from Germany (according to the plan - for 3 days) and decided to give her niece (now Dolzhenko G.V.) an apartment in Moscow. They refused to register the transaction due to outdated data in the TIN and recommended replacing it with a new one. Krinichnaya G.V. filed the necessary documents with the tax office and was told that she would have to wait 5 days until a new certificate was issued. Her aunt had to change not only her plans, but also her return flight tickets, as the deal could not be finalized in 3 days.

No fines or other sanctions are applied to a person who has not changed his certificate.

At its core, this is not a reissue (as in case of loss), but a replacement for a good reason. Therefore, the state fee for this procedure is not charged! Also, if you have an EDS, you can receive a finished document by e-mail (for comparison: if you lose your TIN, this is impossible).

The new certificate will contain the previous TIN number.

Change of registration - the basis for changing the TIN

As has been repeatedly repeated, the taxpayer number itself always remains the same! Another thing is a document that contains a TIN, that is, a certificate ... After all, it was drawn up indicating some data on registration, but what if it has changed?

You don't need to get a new certificate. If you officially registered at a different address, then the migration service will transfer information about this to the local tax office, and that, in turn, will inform your "old" inspection, where you will be deregistered.

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work