How can an individual apply for a TIN certificate via the Internet

Russian law establishes that every resident of the country, excluding certain categories of the population, must pay taxes. This norm is imperative, since the payment of taxes is one of the sources of income for the Russian budget.

In order to record all taxpayers, a special document is issued. This is a TIN certificate obtained from the Tax Inspectorate at the place of registration of a citizen.

How to apply for a TIN online and get a certificate

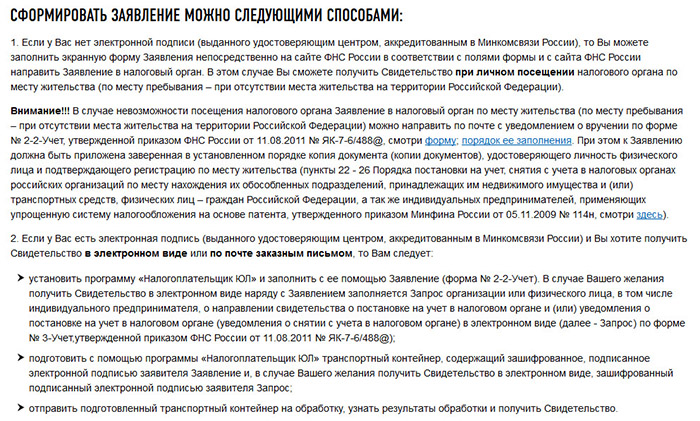

The most common way among Internet users is the site of the tax service of Russia. In the option - obtaining a TIN, on the page that opens, an application is filled out from a citizen about registering him with the inspection. The application, filled in accordance with all the rules, is sent to the tax authority. The user can independently track the fate of his application on the same site. After accepting an application from citizens, the tax authority is responsible for the safety of the information indicated in it.

You can get a TIN when you visit the Tax Inspectorate at the place of registration in person, as well as send your representative there. But his authority must be confirmed by a power of attorney.

An application for a TIN can be edited several times. Tracking your application is also possible by e-mail address, but only if the user specifies it.

The applicant will also see the contacts of the Tax Inspectorate, which must issue a document to the citizen.

A TIN can be obtained in several ways:

- On paper. Issued if the applicant sent an application for a document without an electronic signature.

- As an electronic document- if the citizen has an electronic signature, and he certified the application with it. The document is given to the citizen in file format. The file is signed by the electronic signature of the tax inspectorate officer.

- By registered mail. But those citizens who have an electronic signature will be able to use this method.

An electronic signature is a requisite that certifies the correctness of the information in the document, and also confirms that the signature belongs to its owner. A Russian who has received an electronic signature and uses it on the Internet has a certificate. This is a document confirming that the verification key belongs to the owner of the certificate. Signatures are issued by specialized certification centers or their representatives.

What documents are needed

A passport is required to obtain a TIN. Every citizen of the Russian Federation, starting from the age of 14, can independently obtain a certificate. If registration is not indicated in the main document, an additional document confirming it is required. If a citizen changed his surname, a document is required explaining the reason for this fact.

If you need to get a document for a child under 14 years old, then you must provide the main document of the legal representative and a birth certificate.

Order TIN online - step by step instructions

On the website of the tax service of the Federal Tax Service of the Russian Federation

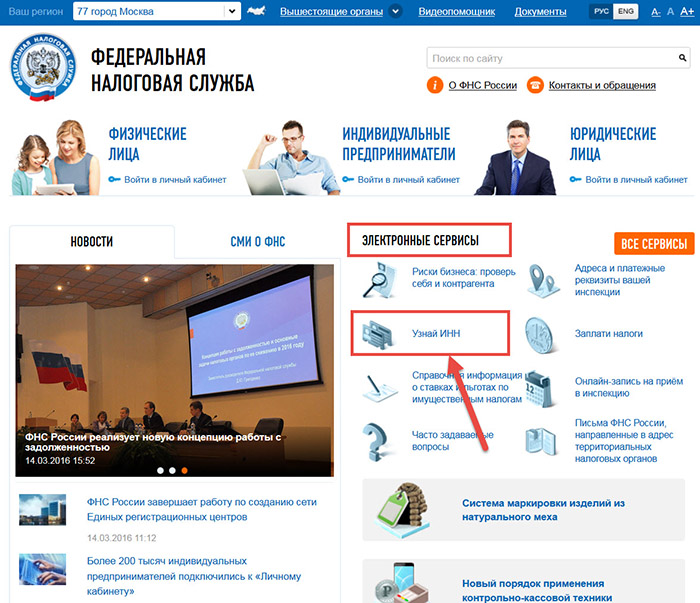

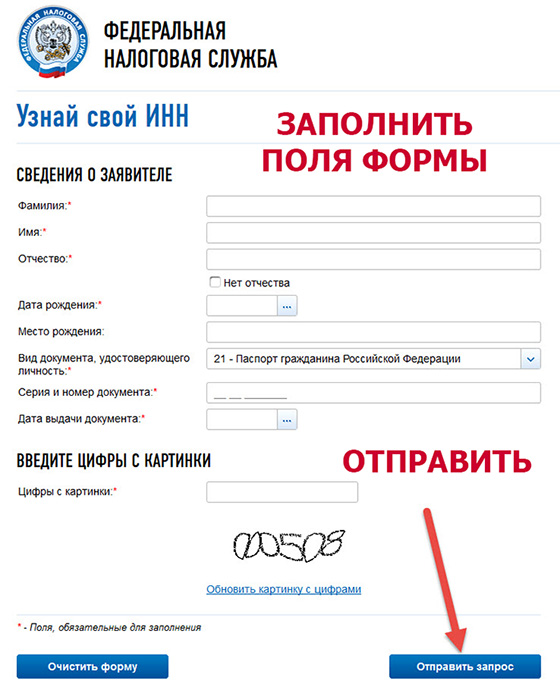

If the user is not sure whether he is registered with the tax office, you can easily check this by clicking on the "Find TIN" tab in the "Electronic Services" section (LINK). Click on it and enter the required information.

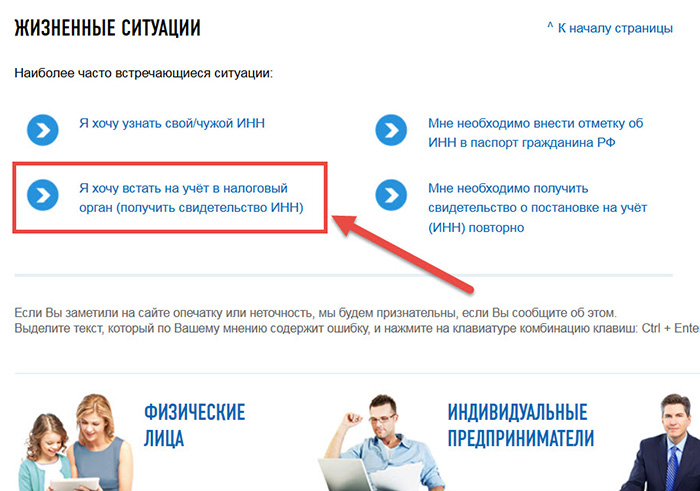

If the TIN is missing, then you need to go to the page of individuals, to the tab "get or find out the TIN".

After the transition, the next page will open.

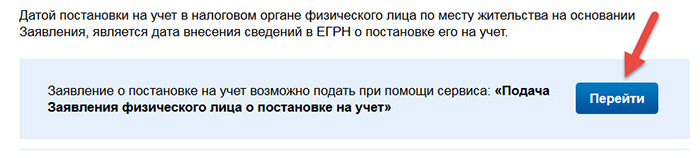

By clicking on the tab highlighted in red in the screenshot,

the user can download a sample application for obtaining a TIN, fill it out and send it to the Tax Office.

In addition, the site offers to register by entering a username and a password of at least 8 characters. The activation code will be sent to the mailbox specified during registration.

It should be noted that the site navigation leaves much to be desired, so be patient.

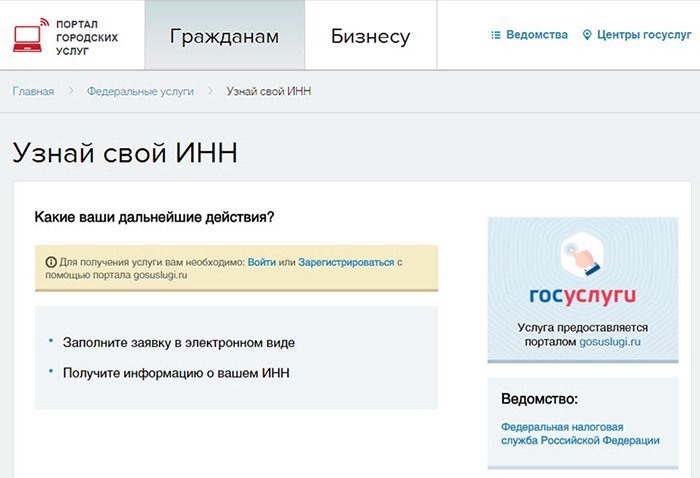

On the Gosulug website

In addition to the website of the Federal Tax Service of the Russian Federation, the TIN can be obtained on the website of public services (LINK). The portal was created for the convenience of citizens, but it requires prior registration with the introduction of their identification data, including the SNILS number.

After verifying the data (it takes some time), the user registers on the portal and submits an application. You need to go to the "individuals" section, and from it go to the "taxes and fees" section.

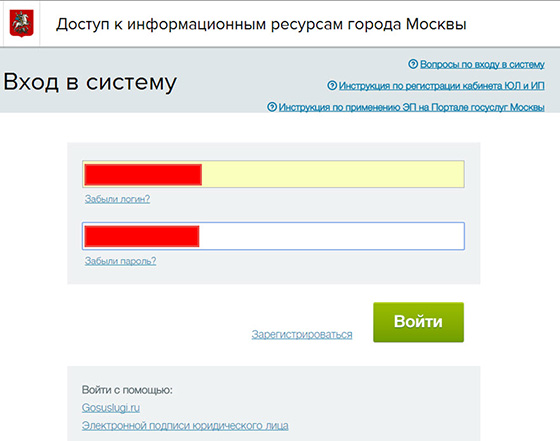

If the user has an account on the pgu.mos.ru website, you can use it as well.

You can enter through this site, or you can enter directly through the site of public services.

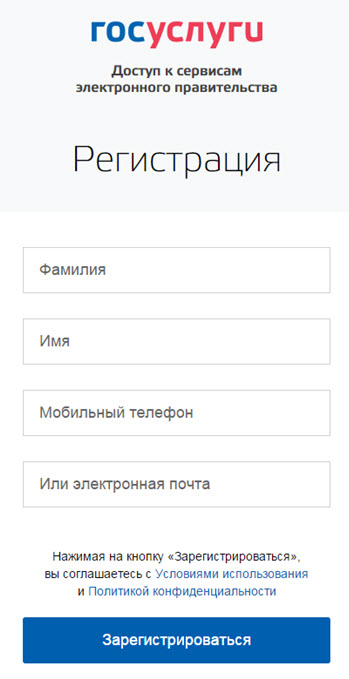

After that, Mosuslug redirects the user to the State Services portal. The system offers registration. It is simple, the activation code will be sent to the email address you specified.

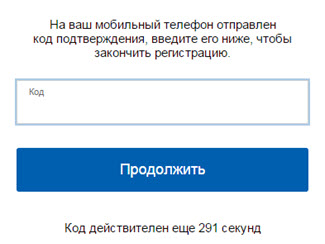

We confirm the phone number. It will come with a verification code.

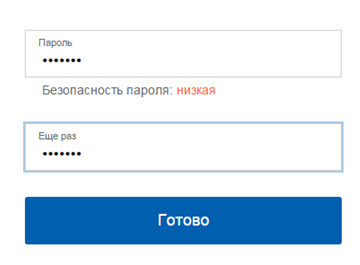

We come up with a password.

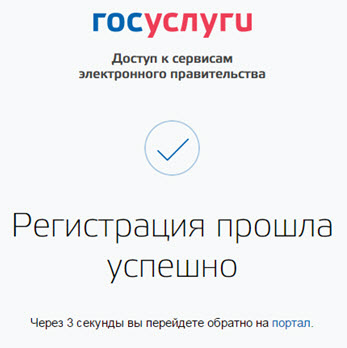

and complete the registration.

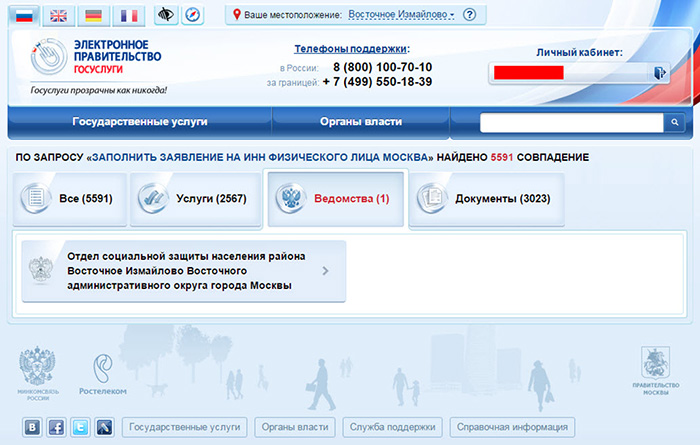

A user registered on the site can order various services. You need to enter in the search bar what the user needs. For convenience, you enter your city, district, district, etc.

Is it possible to get it not at the place of registration

Until the summer of 2012, a TIN was assigned to a citizen only in the Tax Office where the individual was permanently or temporarily registered. The document confirming the registration was a certificate.

This limited was a necessary measure, since the TIN is a unique value assigned once to a citizen. It was easier to control the taxpayer in this way.

In mid-summer 2012, a new, more simplified procedure was introduced. This became possible thanks to the new electronic rules, which exclude the possibility of assigning a TIN several times to one citizen. For several years, users have been able to receive a TIN:

- at the place of registration (permanent);

- if a citizen does not have a permanent place of residence in Russia, he can obtain a TIN at the place of residence;

- at the place of officially registered real estate of a citizen: a house, a plot of land, an apartment;

- at the place of registration of the car, if the citizen does not have a permanent place of residence in Russia.

Simplified Order Action

Citizens, when filing a tax return with a request for a tax deduction, do not indicate the TIN. It is enough to indicate the personal data of the passport - the main document.

Now citizens can indicate the TIN in the passport: it will be affixed by tax officials when registering on page 18 of the main document.

If a citizen remembers that he received a taxpayer identification number, but cannot find it, then he will be able to find it out on the tax website. After the death of a person, the TIN is not assigned to other citizens and remains with him forever.

The TIN certificate is a document that identifies a taxpayer as a subject of tax legal relations. A taxpayer identification number is necessary in many areas of a citizen's social life.

Video - how to get a TIN for an individual via the Internet or at a tax authority in the territory of the Russian Federation:

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work