Letter of guarantee example - sample documents

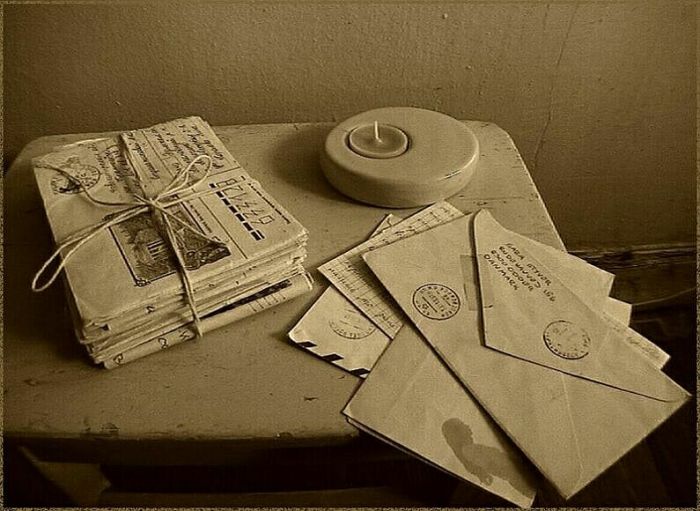

Correspondence is one of the forms of business relationships in modern business. Of course, the letters exchanged between organizations and individuals have nothing to do with the epistolary literary genre.

They are written on special forms and are drawn up according to certain rules. The content of such messages is exclusively official. One of the varieties of such correspondence is a letter of guarantee.

About what they are, how they are drawn up and used, we will consider in detail in the text below.

Purpose of the letter of guarantee

The main purpose of this business message is to additionally assure the addressee that the sender will definitely fulfill the obligations assumed earlier. For example, he will do some pre-agreed work, pay for products received or services rendered, and so on.

That is, in business language, such letters are a form of a way to ensure that one of the parties to the transaction takes on a list of conditions upon conclusion. Also, a message with a guarantee is drawn up as an official response of the organization to a written claim. The volume of such a business message, in most cases, does not exceed one sheet of A4 format.

It should be noted right away that the guarantee message is not considered by law as a legally binding document on the obligations assumed (although it is sealed by the signature of the head or chief accountant and the seal of the organization), but is simply a written confirmation of the seriousness of intentions to fulfill the terms of the previously agreed transaction.

It is most often used as an addition to an already concluded agreement, when one of the parties doubts the ability of the other party to fulfill its obligations.

On the other hand, this type of business correspondence has the legal status of a contractual document. For example, financial institutions consider letters of guarantee to be sufficient grounds for issuing a loan.

Thus, the legal status of letters of guarantee directly depends on the content of the text of the message and the method of its execution.

It should be added that both legal entities and individuals can be senders and recipients of messages with obligations. Such correspondence with the organization is mandatory recorded by the secretary as incoming correspondence and has an assigned registration number.

Components of a letter of guarantee

There are several types of such letters - each has its own purpose and features of compilation. True, the legislation does not give any instructions on the procedure for processing such messages - the drafting features were formed on the basis of existing customs of business correspondence.

Moreover, not even one, but two types of design are used:

- Starts right away with making promises, which are deciphered further in the text (usually, it begins with the phrase "We guarantee this letter ...").

- Starts with a list of conditions appeal and ends with an obligation (the phrases “I guarantee this, that, that ...” or “I guarantee the fulfillment of the conditions ...” are used).

The choice of the type of registration depends on the level of business relations of the participants in the transaction and the accepted conditions.

Regardless of the type of design, messages with obligations consist of two parts - introductory and main text.

Introduction

Regardless of the type of obligation, each letter has an introductory part, which informs personal information about the sender and addressee:

Regardless of the type of obligation, each letter has an introductory part, which informs personal information about the sender and addressee:

- the official name of the sender and recipient is indicated in the upper right corner(for organizations with the status of individuals and / or legal entities), form of economic activity and full name (for individuals);

- in the lower left corner of the paper carrier must be written- the current date, the outgoing number of correspondence (for organizations), the signature of the head (chief accountant) or the sender of the individual is put and a seal is made;

Main (the essence of the guarantee)

The main part of the text contains the obligation of the author of the letter to perform in the future any actions that are in the sphere of interests of the addressee or stipulated by the concluded transaction (perform some work, pay for products or services, and so on).

The style of writing such a message is purely businesslike and concise. Also, the text may additionally indicate the bank details of the sender or the amount of fines for failure to fulfill the obligations taken. The title of the appeal can be any subject, for example, "On payment for services received" and so on.

In addition, it is not at all necessary to use the word “I guarantee” itself or its single-root word forms when writing, such expressions can be replaced in meaning with synonyms - the legal status of the letter will not change.

If the essence of the message is promises to make some payments, the letter is signed not only by the head of the organization, but also by a financially responsible person, most often, the chief accountant.

It is worth adding that such business messages are drawn up on letterheads of organizations.

Also, additional documents may be attached to notifications of obligations (registration certificate of entrepreneurship, grounds for appointing a general director, certificate of tax registration, etc.).

Types of letters of guarantee

There are several varieties of such incoming correspondence, which are actively used by representatives of domestic business for official correspondence.

The main feature of such messages is the possibility of changing, depending on the specific situation and on the relationship of the participants in the transaction, the legal status of the message - from the usual assurance of the seriousness of intentions to a legally binding document of a contractual nature.

For business correspondence, the following types of messages with obligations can be used:

A sample of filling out this business message is quite easy to find on the Internet.

Representatives of modern Russian business actively use different types of letters of guarantee as a means of business communication. The type of document execution is not dictated by law, but is a consequence of existing business practices in the preparation of such messages.

The main feature of letters of guarantee is the ability, depending on the situation, to change the legal status - from a regular letter confirming the intention of any action to a document of a contractual nature, accepted as evidence in court when resolving economic disputes.

Noskova Elena

I have been in the accounting profession for 15 years. She worked as a chief accountant in a group of companies. I have experience in passing inspections, obtaining loans. Familiar with the areas of production, trade, services, construction.

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work