The formula for the turnover ratio of working capital

The success of any enterprise directly depends on how efficiently working capital is spent. It is very important to pay great attention to the economic side of the revolving fund.

It is not difficult to conduct such studies and it will help to determine whether there are problems in the enterprise and solve them, thereby preventing losses.

Plays a very important role turnover ratio. It can be used to characterize how effective the turnover of assets is.

The necessary data for calculating such a coefficient are taken from the balance sheet of the accounting department.

The concept of the turnover ratio of working capital is the ratio of the amount that was received from the sale of products.

Working capital is a certain amount of money that is invested in order to create production turnover funds. All this allows the firm or company to work without interruption.

Where to get indicators for calculation

Of course, it must be remembered that all these data must be used for the period for which the calculation is carried out. Usually, the calculation of all indicators is carried out for the year, so all the necessary information is taken from the annual report on accounting.

The volume of all products already sold is indicated in the RP formula. This volume is located in the 10th line of the report on losses and profits. It is in this answer that you can clearly see the entire net proceeds from the total sale for a certain period.

It is important to subtract the average cost of all means of circulation. To do this, it is necessary to divide all the amounts of the turnover value from the beginning to the end of the desired period.

The necessary data in order to make the calculation are taken from the balance sheet, exactly from line 290. It is in it that the totals of all current assets are indicated.

What do the coefficients depend on?

Each industry has its own indicator. Most of all indicator in trade branches. Other industries, such as cultural or scientific organizations, do not have a high coefficient level. Therefore, it is impossible to compare all enterprises, because they differ in their type of activity.

The coefficient depends on the following factors:

- A variety of raw materials that are used in the industry;

- Volume and rate of production;

- Cycle duration;

- Qualification of all employees of the enterprise;

- Type of activity of the enterprise;

Factor calculations

The coefficient allows you to find out how much revenue is obtained from the sale of all goods or products and how much comes from this per ruble of the working capital. This calculation uses the formula

Kob \u003d RP / CO

Here, the turnover ratio is defined as Cob.

RP is the volume of all products that were sold for the period, the report of which is carried out.

CO - denotes the average value of the means of circulation for the desired period.

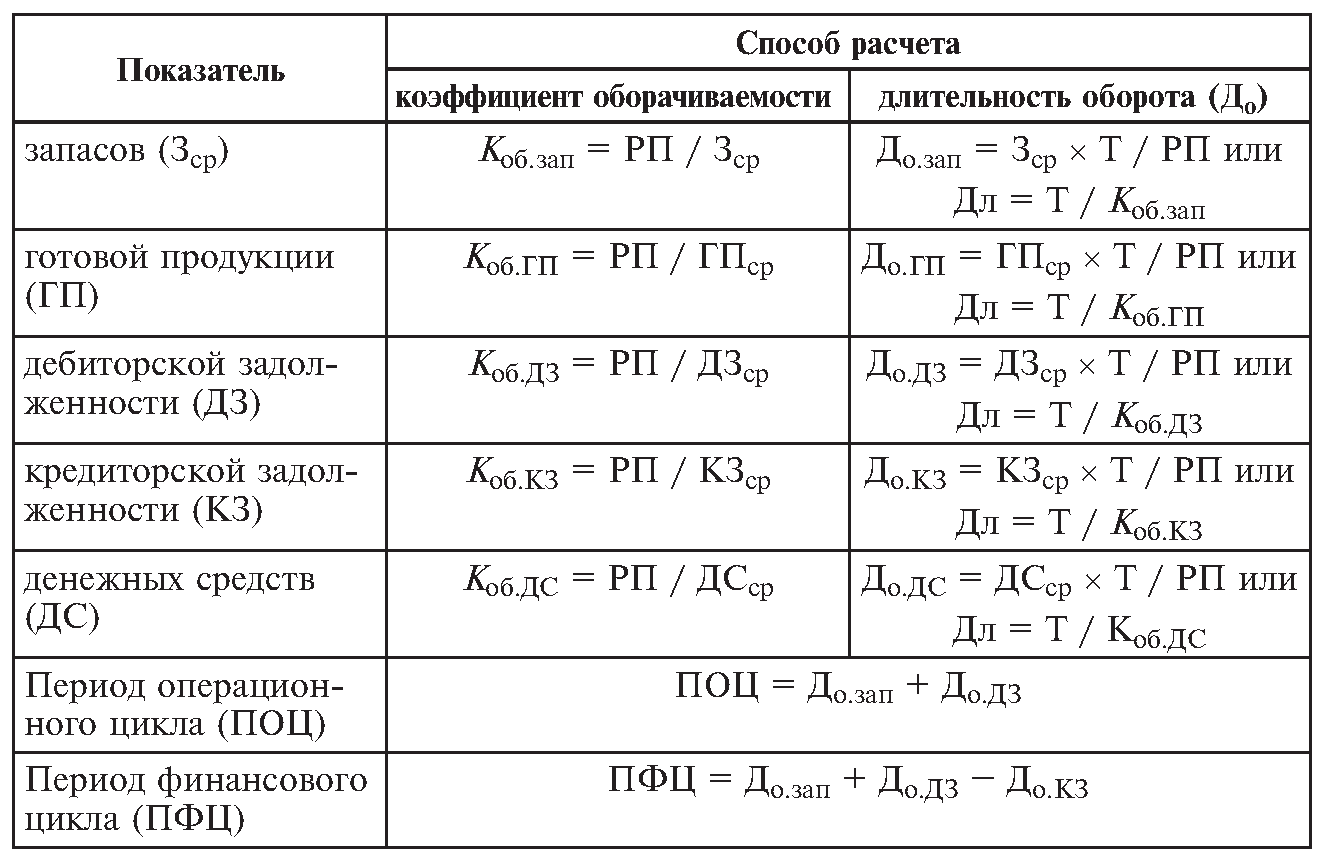

Analysis of current assets ratio

In the case when the asset ratio is greater than 1, this indicates that the company is generating income. If the coefficient exceeds 1.36, such an enterprise is extremely profitable and brings a very good profit.

It is also important to observe the dynamics of the coefficient changes. Everything looks more clearly in tables, according to which you can follow all the changes and draw the appropriate conclusions.

Possible reasons for lowering the turnover ratio

If the dynamics of the coefficient falls, this is an alarming sign, and the company's management should seriously think about how to increase it and what needs to be done for this.

Often the reason for the low rate is excessive accumulation of material values. In this case, you need to reduce the volume of goods, and all the savings should be invested in production.

An important point is the introduction of new equipment and technologies, the desire to improve all production and the work of the enterprise.

Reasons for a low ratio can be anything. For example, it is very important to monitor the qualifications of employees and their level of performance, for the condition of the equipment, so that there are no breakdowns and stagnation of production.

Calculation of the turnover ratio of working capital

It is impossible to imagine the effective and fruitful work of an enterprise without the correct use of working capital.

Working capital is always different, depending on the time of year, on the standard of living and activity. If resources are used wisely, then the activity of the enterprise will be successful and fruitful.

How competently and correctly the capital is used can be found with the help of coefficients. Some of them help to analyze the liquidity and speed of the organization. The turnover rate is very important. He designates as Cob.

Indicators required for calculation

The turnover ratio is determined using the data that is in the financial report of the enterprise, namely in the first two lines of the accounting report.

It is necessary to calculate the volume as revenue for a certain period, which is taken from the income statement.

We need numbers that are written in the line of the report, which indicates the amount that was received from all sales or sales of services and goods.

The average residual is subtracted from the amount located in the second column of the balance sheet for accounting using the formula:

F ob.sr \u003d F1 + F0 / 2

F0 and F1 are two values of the turnover of the enterprise's funds for the present and the past period.

Formula and calculation

The turnover ratio indicates the number of turnovers of working capital for a certain period of time. It can be calculated using the following formula:

Kob \u003d Qp / Fob.av.

That is, it turns out in such a way that all the funds that the organization invests in the development of its business are returned back after a certain time and in the form of a ready-made product, which is then sold and makes a monetary profit.

In addition to the coefficient denoting turnover in economic analysis, there are other designations:

- Duration of one revolution Tob;

- Profitability Rob.sr;

Turnover ratio analysis

Before analyzing the turnover ratio, it is necessary to understand what the working capital of an enterprise is. This is the amount of assets that have a useful life of less than a year.

These include:

- Production at an unfinished stage;

- Already finished product and goods;

- stock;

- Material resources;

- Accounts receivable;

It is possible to reduce stocks if it is more economical to use all resources and with an increase in losses in production.

Reasons for the decrease in the turnover ratio

The decrease in the coefficient can occur for several reasons, emanating from internal and external factors.

Let's say the economy has deteriorated in the country and people began to buy less certain goods, or when new models of equipment appear, the older ones will no longer be sold. This is an external reason.

Internal reasons:

- Improper management of funds;

- Erroneous actions in logistics and marketing;

- Debts of the organization;

- The use of old technologies in production;

The conclusion suggests that all these reasons appear due to errors within the company and insufficient qualifications of employees.

If the company has moved to a new, more modernized level and new methods, the coefficient may also decrease.

Calculations using the example

For example, there is an organization called Omega. Having made an analysis for 2012, the result showed that the income in that year was 100,000 rubles. and the value of all working capital is 35,000 rubles. and in 2013 45,000 rubles.

Let's look at the formula:

Cob \u003d 100,000 rubles / (35 + 45 / 2) \u003d 2.5

Using the result of this formula, we calculate the annual turnover cycle of the enterprise:

Tob \u003d 360 / 2.5 \u003d 144 days

It turns out that the production cycle of the Omega organization is 144 days.

Turnover of current assets

Definition

Using the indicator of current assets, you can find out how many times over a certain period the organization used the average balance of all available funds.

According to the balance sheet, current assets are:

- Stocks;

- Material resources;

- Short-term debt on debtors of purchased goods, together with VAT.

Formula (calculation)

Current assets are calculated by a special formula:

Turnover of turnover = Revenue / turnover assets

For the formula, current assets should be taken as the average annual balance.

Normal value

Turnover indicators do not have any general norms. They are analyzed in dynamics or in comparison with the same sectoral enterprises. A very low ratio indicates that a very large accumulation of stocks in the enterprise.

Asset turnover ratio on the example of OJSC Rostelecom

The asset turnover ratio is in the group of indicators of business activity and shows how intensively the organization's resources were used.

The economic meaning of the asset turnover ratio

The asset turnover ratio helps to determine how effective the organization's activities are not from the profit side, but from the use of assets in production.

What is an integral part of current assets?

Working capital is:

- Any stock;

- Material resources, namely cash;

- Investments for a short period;

- Short-term accounts receivable;

What factors determine the value of the turnover asset ratio?

The turnover asset ratio depends on several factors:

- duration of production;

- The level of qualification of the personnel of the organization;

- Organization's activities;

- production rates;

The largest coefficient in enterprises where they are engaged in trade. Its lowest level is in scientific enterprises. Therefore, it is necessary to compare organizations by their industry.

Synonyms for the value of the asset turnover ratio

Such a value as the asset turnover ratio has synonyms.

The turnover ratio can be functioning capital or mobile funds.

Knowing the synonyms of the coefficient is useful, since there are various literary sources, and everywhere the coefficient is called differently.

But due to the fact that many economists call coefficients in their own way, there is no one specific definition and term for coefficient.

Asset turnover ratio

The coefficient is never negative. Its low level indicates that the company has accumulated an excessive amount of working capital.

To make the coefficient higher, you need to sell what people need and at the same time the product must be quality and affordable. This raises the competitiveness. At the same time, the production cycle should be lower.

Analysis of the ratio using the dynamics will determine its level and find out whether the economics of the organization is progressing well.

Noskova Elena

I have been in the accounting profession for 15 years. She worked as a chief accountant in a group of companies. I have experience in passing inspections, obtaining loans. Familiar with the areas of production, trade, services, construction.

Popular

- How to get a TIN: possible ways

- What kind of business can you do?

- Written notice of termination of the lease

- Business from scratch. Things to do?

- Cost of goods sold: formula, methodology and calculation example

- How to write a vacation application - examples

- What kind of business can be opened in a small town or village?

- The formula for calculating the cost of services, products sold and total cost

- Sample memorandum: I bring to your attention

- Example of an explanatory note for being late for work